Immediate Annuity Medicaid is a strategy that combines the guaranteed income stream of an immediate annuity with the long-term care benefits provided by Medicaid. This approach can be a valuable tool for individuals seeking to protect their assets while securing a reliable source of income in their later years.

A three-year annuity provides a fixed stream of income for a specific period. If you’re looking for a short-term income solution, understanding how a 3-year annuity works in 2024 can be beneficial. This type of annuity might be suitable for specific financial goals, like covering temporary expenses or bridging a gap in your income.

The concept revolves around utilizing immediate annuities to generate a steady income stream while potentially qualifying for Medicaid benefits. Immediate annuities offer guaranteed payments, providing financial security and peace of mind. However, understanding how immediate annuities impact Medicaid eligibility is crucial to avoid potential complications.

Microsoft Excel is a powerful tool for financial planning, and it can be used to calculate the present value of an annuity. If you’re familiar with Excel, you can learn how to calculate the present value of an annuity in Excel in 2024.

This can help you make informed decisions about purchasing an annuity and understand its financial implications.

Immediate Annuities

Immediate annuities are financial products that provide a guaranteed stream of income for life. They are purchased with a lump sum payment, and the insurer then makes regular payments to the annuitant (the person who purchased the annuity) for the rest of their life.

Using a calculator can be helpful when planning for your retirement and considering annuities. There are various online tools that can help you calculate annuity savings in 2024. These calculators can help you estimate potential returns and understand how an annuity might impact your overall financial plan.

Immediate annuities can be a valuable tool for individuals seeking to secure a steady income stream during retirement, especially those who are concerned about outliving their savings.

Variable annuities offer potential growth, but their liquidity can be a concern. It’s important to understand the liquidity of variable annuities in 2024 to ensure they align with your financial needs. Accessing funds from a variable annuity may involve fees or limitations, so understanding these aspects is vital.

Types of Immediate Annuities

Immediate annuities are available in a variety of forms, each with its own set of features and benefits. The most common types of immediate annuities include:

- Fixed Annuities:These annuities provide a fixed payment amount for life. The payment amount is determined at the time of purchase and is not affected by market fluctuations. This makes fixed annuities a good option for individuals seeking a predictable income stream.

- Variable Annuities:Variable annuities offer a payment amount that fluctuates based on the performance of the underlying investment portfolio. This means that the payment amount can increase or decrease over time, depending on the performance of the investments. Variable annuities can be a good option for individuals who are comfortable with some investment risk and are seeking the potential for higher returns.

Chapter 9 of the Bankruptcy Code deals with specific aspects of annuities and how they’re treated during bankruptcy proceedings. If you’re facing financial difficulties and considering bankruptcy, understanding Chapter 9’s implications for annuities in 2024 is essential. This can help you protect your assets and navigate the legal process.

- Indexed Annuities:Indexed annuities offer a payment amount that is linked to the performance of a specific market index, such as the S&P 500. This means that the payment amount can increase over time, but it is capped at a certain rate.

Indexed annuities offer a balance between the potential for growth and the protection of a fixed payment amount.

Advantages and Disadvantages of Immediate Annuities

Immediate annuities offer several advantages, including:

- Guaranteed Income:Immediate annuities provide a guaranteed stream of income for life, regardless of market conditions. This can provide peace of mind and financial security during retirement.

- Longevity Protection:Immediate annuities can help protect against the risk of outliving your savings. The payments continue for life, even if you live longer than expected.

- Tax Advantages:The payments from an immediate annuity are generally taxed as ordinary income, but the growth of the annuity is tax-deferred. This can be a significant tax advantage, especially for individuals in high tax brackets.

However, immediate annuities also have some disadvantages, including:

- Irreversible:Once you purchase an immediate annuity, you cannot get your money back. This means that you need to be sure that you are comfortable with the terms of the annuity before you purchase it.

- Limited Flexibility:Immediate annuities generally offer limited flexibility in terms of how you can access your funds. The payments are typically fixed and cannot be withdrawn early without penalties.

- Potential for Lower Returns:Immediate annuities may not provide the same level of potential returns as other investments, such as stocks or bonds.

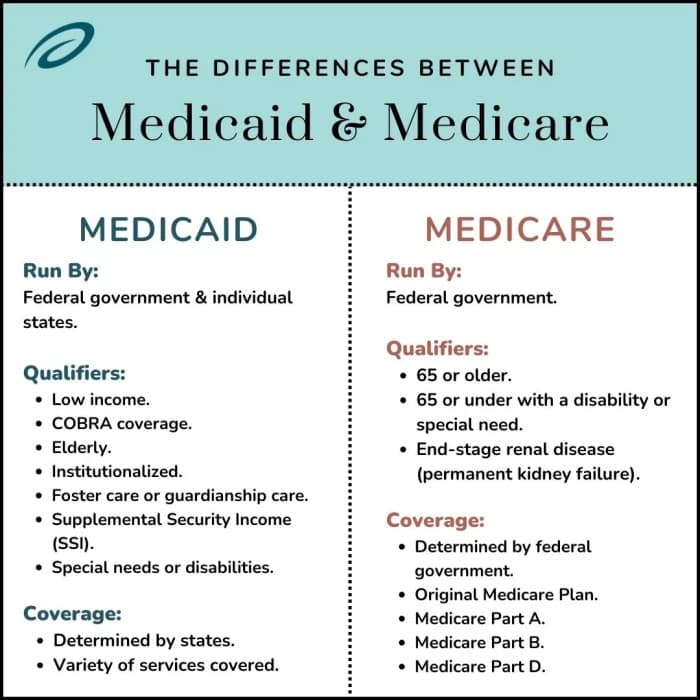

Medicaid Eligibility

Medicaid is a government-funded health insurance program that provides coverage for low-income individuals and families. Eligibility for Medicaid is based on a variety of factors, including income, assets, and family size.

While annuities are typically associated with retirement planning, they can also be beneficial for younger individuals. If you’re in your 30s and considering an annuity, learning more about immediate annuities for 30-year-olds can be helpful. This type of annuity can provide a guaranteed stream of income for a specific period, even at a younger age.

Medicaid Eligibility Criteria

The specific Medicaid eligibility criteria vary from state to state. However, in general, individuals must meet the following requirements to qualify for Medicaid:

- Income:Individuals must have an income that falls below a certain threshold, which varies based on family size and state.

- Assets:Individuals must have assets that fall below a certain threshold, which also varies based on state. These assets can include cash, savings accounts, real estate, and vehicles.

- Citizenship:Individuals must be U.S. citizens or legal residents.

- Residency:Individuals must reside in the state where they are applying for Medicaid.

Impact of Medicaid Eligibility on Immediate Annuities

The use of immediate annuities can have a significant impact on Medicaid eligibility. This is because Medicaid eligibility is based on both income and asset levels. The purchase of an immediate annuity can affect both of these factors.

John Hancock offers a variable annuity called Venture 3. If you’re interested in this particular product, it’s essential to understand the details of John Hancock Venture 3 Variable Annuity in 2024. This includes factors like investment options, fees, and potential risks associated with the product.

- Income:The payments from an immediate annuity are considered income for Medicaid purposes. This means that the payments can reduce an individual’s eligibility for Medicaid, especially if their income is already close to the eligibility threshold.

- Assets:The purchase of an immediate annuity is considered a transfer of assets for Medicaid purposes. This means that the value of the annuity can be counted towards an individual’s asset limit, which can reduce their eligibility for Medicaid.

Benefits and Drawbacks of Using Immediate Annuities with Medicaid, Immediate Annuity Medicaid

There are both potential benefits and drawbacks to using immediate annuities in conjunction with Medicaid.

- Benefits:

- Guaranteed Income:Immediate annuities can provide a guaranteed stream of income for life, which can help individuals maintain their standard of living while receiving Medicaid benefits.

- Asset Protection:The transfer of assets to an immediate annuity can help protect assets from Medicaid’s asset test. This can be beneficial for individuals who want to preserve their assets for their heirs.

- Long-Term Care Planning:Immediate annuities can be used as part of a long-term care planning strategy. The guaranteed income stream can help pay for long-term care expenses, while the transfer of assets to the annuity can help protect assets from Medicaid’s asset test.

- Drawbacks:

- Potential for Medicaid Ineligibility:The payments from an immediate annuity can reduce an individual’s eligibility for Medicaid, especially if their income is already close to the eligibility threshold.

- Limited Flexibility:Immediate annuities generally offer limited flexibility in terms of how you can access your funds. The payments are typically fixed and cannot be withdrawn early without penalties.

- Potential for Lower Returns:Immediate annuities may not provide the same level of potential returns as other investments, such as stocks or bonds.

Impact of Immediate Annuities on Medicaid Eligibility

The use of immediate annuities can have a significant impact on Medicaid eligibility. This is because Medicaid eligibility is based on both income and asset levels. The purchase of an immediate annuity can affect both of these factors.

Impact of Annuity Payments on Medicaid Eligibility

The payments from an immediate annuity are considered income for Medicaid purposes. This means that the payments can reduce an individual’s eligibility for Medicaid, especially if their income is already close to the eligibility threshold.

If you’re in the Sarasota area and considering an annuity, you might want to explore the services of Annuity King Sarasota in 2024. This local provider may offer specialized expertise and guidance tailored to your specific needs.

Impact of Asset Transfers on Medicaid Eligibility

The purchase of an immediate annuity is considered a transfer of assets for Medicaid purposes. This means that the value of the annuity can be counted towards an individual’s asset limit, which can reduce their eligibility for Medicaid. Medicaid rules have a look-back period, which means that transfers of assets within a certain period before applying for Medicaid can be reviewed and may affect eligibility.

Annuity 4 is a type of annuity that offers a fixed stream of income for a specific period. If you’re considering this option, researching Annuity 4 in 2024 is important. Understanding the terms, conditions, and potential benefits of this type of annuity can help you make an informed decision.

Implications of Annuity Payments on Income-Based Medicaid Eligibility

The payments from an immediate annuity can affect income-based Medicaid eligibility. The income from the annuity is considered countable income, and if it exceeds the state’s income limit, it could make the individual ineligible for Medicaid. However, some states have special rules for certain types of income, including annuity payments.

It is important to consult with a Medicaid expert to determine how annuity payments will affect eligibility in your specific situation.

Annuity rates fluctuate, and understanding current market trends is essential. Researching annuity rates from 2021 to 2024 can help you make informed decisions about purchasing an annuity. Comparing rates across different providers can also help you secure a better deal.

Strategies for Utilizing Immediate Annuities and Medicaid

There are several strategies that individuals can use to maximize the use of immediate annuities while maintaining Medicaid eligibility.

Choosing between an annuity and a 401(k) depends on your individual financial circumstances and goals. Learn more about whether an annuity is better than a 401(k) in 2024 to make an informed decision. Each option has its advantages and disadvantages, so careful consideration is essential.

Strategies for Maximizing Annuity Use

Here are some strategies for maximizing the use of immediate annuities while maintaining Medicaid eligibility:

- Purchase an Annuity with a Lower Payment Amount:Individuals can choose an annuity with a lower payment amount, which can reduce the impact on their income and make them more likely to qualify for Medicaid.

- Purchase an Annuity with a Longer Payment Period:Individuals can choose an annuity with a longer payment period, which can spread the payments over a longer time and reduce the impact on their monthly income.

- Consider a Spousal Annuity:In some cases, individuals may be able to purchase a spousal annuity, which provides payments to the surviving spouse after the primary annuitant dies. This can help protect the surviving spouse’s income and assets.

- Use an Annuity as a Supplement to Other Income:Individuals can use an annuity as a supplement to other income sources, such as Social Security or pensions. This can help ensure that they have enough income to meet their needs while still qualifying for Medicaid.

Scenarios for Utilizing Annuities and Medicaid

Here are some examples of scenarios where immediate annuities can be effectively utilized in conjunction with Medicaid:

- Long-Term Care Planning:Individuals who are concerned about the cost of long-term care can use an immediate annuity to provide a guaranteed stream of income to pay for these expenses. The transfer of assets to the annuity can also help protect assets from Medicaid’s asset test.

Calculating the annual payments from an annuity is crucial for budgeting and planning. You can use an online calculator or learn how to calculate annual annuity payments in 2024 manually. This knowledge will help you understand the potential income stream you can expect from your annuity.

- Asset Protection:Individuals who want to protect their assets for their heirs can use an immediate annuity to transfer assets out of their estate. This can help reduce the amount of assets that are subject to Medicaid’s asset test.

- Income Supplement:Individuals who are living on a fixed income can use an immediate annuity to supplement their income. This can help them maintain their standard of living while still qualifying for Medicaid.

Tax Implications of Using Annuities for Medicaid Planning

It is important to consider the tax implications of using immediate annuities for Medicaid planning. The payments from an immediate annuity are generally taxed as ordinary income, but the growth of the annuity is tax-deferred. This can be a significant tax advantage, especially for individuals in high tax brackets.

Deciding between an annuity and an IRA depends on your individual financial goals and risk tolerance. Learn more about whether an annuity or an IRA is better for you in 2024. Each option has its advantages and disadvantages, so careful consideration is crucial.

However, it is important to consult with a tax advisor to understand the specific tax implications of your situation.

Considerations for Immediate Annuities and Medicaid

Individuals seeking to utilize immediate annuities while qualifying for Medicaid should carefully consider the following factors:

Key Considerations

- Medicaid Eligibility Rules:It is important to understand the specific Medicaid eligibility rules in your state. These rules can vary significantly, and it is important to consult with a Medicaid expert to ensure that you are meeting all of the requirements.

- Annuity Contract Terms:It is important to carefully review the terms of the annuity contract before you purchase it. This includes the payment amount, the payment period, and any fees or penalties associated with the annuity.

- Financial Situation:It is important to consider your overall financial situation before purchasing an immediate annuity. You need to be sure that you can afford the purchase price and that the annuity will meet your income needs.

- Long-Term Care Planning:If you are using an immediate annuity as part of a long-term care planning strategy, it is important to consider the potential cost of long-term care and to ensure that the annuity will provide enough income to cover these expenses.

Importance of Consulting with Experts

It is essential to consult with a qualified financial advisor and a Medicaid expert before making any decisions about using immediate annuities for Medicaid planning. A financial advisor can help you understand the different types of annuities available and can help you choose an annuity that meets your specific needs.

A Medicaid expert can help you understand the Medicaid eligibility rules in your state and can help you develop a plan that will maximize your chances of qualifying for Medicaid.

Potential Risks and Limitations

There are several potential risks and limitations associated with using immediate annuities for Medicaid planning. These include:

- Loss of Principal:If you purchase a variable or indexed annuity, you could lose some or all of your principal if the underlying investments perform poorly.

- Limited Flexibility:Immediate annuities generally offer limited flexibility in terms of how you can access your funds. The payments are typically fixed and cannot be withdrawn early without penalties.

- Potential for Medicaid Ineligibility:The payments from an immediate annuity can reduce an individual’s eligibility for Medicaid, especially if their income is already close to the eligibility threshold.

Final Summary: Immediate Annuity Medicaid

Navigating the complexities of Immediate Annuity Medicaid requires careful planning and consultation with qualified professionals. By understanding the interplay between these financial tools and Medicaid eligibility, individuals can potentially maximize their financial resources while securing long-term care support.

While it’s generally recommended to wait until age 59 1/2 to access retirement funds, there are situations where an immediate annuity before age 59 1/2 might be an option. This could be relevant if you face unforeseen circumstances like a medical emergency or need to cover unexpected expenses.

It’s important to consult with a financial advisor to understand the potential implications and tax consequences.

Questions Often Asked

How do immediate annuities work?

An immediate annuity is a type of insurance contract where you make a lump-sum payment to an insurance company in exchange for guaranteed periodic payments for a specified period or for life.

Can I use an immediate annuity to qualify for Medicaid?

Annuity payments are considered taxable income, so it’s crucial to factor this into your financial planning. Learn more about how annuities are treated as income in 2024 to ensure you’re prepared for tax season. Understanding this aspect will help you make informed decisions about your annuity strategy.

The impact of an immediate annuity on Medicaid eligibility depends on several factors, including the type of annuity, the amount of the payment, and the state’s Medicaid rules. Consulting with a Medicaid expert is essential.

What are the potential benefits of using an immediate annuity for Medicaid planning?

Benefits can include guaranteed income, asset protection, and potentially qualifying for Medicaid benefits.

What are the potential risks of using an immediate annuity for Medicaid planning?

Risks include the potential for lower returns compared to other investments and the possibility of not qualifying for Medicaid due to specific state rules.