Immediate Annuity Loans offer a unique financial solution, providing a guaranteed stream of income in exchange for a lump sum payment. These loans can be a valuable tool for individuals seeking financial security, particularly in retirement or during times of unexpected financial need.

An immediate annuity loan essentially involves a lender providing a borrower with a fixed sum of money upfront, in exchange for regular payments over a predetermined period. The payments are typically made monthly and can be tailored to the borrower’s specific financial situation and goals.

This arrangement can provide a stable source of income, offering peace of mind and the ability to plan for future expenses.

Finding the right annuity can be a challenge, but there are resources available to help. Annuity Leads 2024 provides information on finding leads for annuities. Annuity Formula Half Yearly 2024 can help you understand the formulas used to calculate annuity payments.

Immediate Annuity Loans: A Comprehensive Guide

An immediate annuity loan, also known as a fixed-rate annuity loan, is a type of loan that provides a stream of regular payments to the borrower for a specified period. It’s a unique financial product that offers guaranteed income and can be a valuable tool for retirement planning or other financial needs.

If you’re using a financial calculator like the HP10bii, you can use it to calculate annuity payments. Calculate Annuity On Hp10bii 2024 provides guidance on using the HP10bii for annuity calculations.

This comprehensive guide will delve into the intricacies of immediate annuity loans, covering their definition, how they work, their benefits, risks, different types, and more.

Definition of an Immediate Annuity Loan

An immediate annuity loan is a loan that provides a fixed stream of regular payments to the borrower, typically for a specific term or until the borrower’s death. It’s a type of structured loan that’s distinct from traditional loans, such as mortgages or personal loans, where the borrower makes periodic payments to repay the principal and interest.

Here are some key characteristics of an immediate annuity loan:

- Guaranteed Income:Immediate annuity loans offer a guaranteed stream of income for a specified period, providing financial stability and predictability.

- Fixed Interest Rate:The interest rate on an immediate annuity loan is typically fixed for the duration of the loan, protecting the borrower from fluctuations in interest rates.

- Lump Sum Payment:The borrower typically receives a lump sum payment upfront, which is used to fund the annuity payments.

- Term Length:The loan term can be for a fixed period, such as 10 or 20 years, or it can continue until the borrower’s death.

It’s important to differentiate an immediate annuity loan from other types of annuities. Unlike traditional annuities, which involve an initial investment and subsequent payments, an immediate annuity loan involves borrowing money and receiving a guaranteed stream of payments in return.

Compound annuities are a powerful tool for growing your wealth. Compound Annuity Uses The Principles Of 2024 explains how compound annuities work. Annuity Is Primarily Used To Provide 2024 highlights the key benefits of using annuities.

The loan is repaid through the annuity payments, with interest accruing on the outstanding balance.

If you’re looking for a way to ensure a steady stream of income in retirement, a variable annuity might be a good option. Variable Annuity Tax Qualification 2024 provides some insight into the tax benefits of these annuities. To determine if a variable annuity is right for you, consider asking some key questions, as outlined in Variable Annuity Questions To Ask 2024.

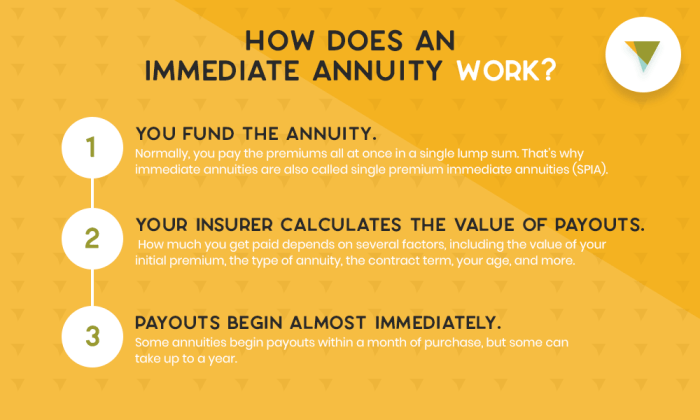

How Immediate Annuity Loans Work

The process of obtaining an immediate annuity loan typically involves the following steps:

- Application:The borrower applies for the loan with a reputable lender, providing necessary financial information and documentation.

- Underwriting:The lender assesses the borrower’s creditworthiness, income, and other factors to determine loan eligibility and terms.

- Loan Approval:If approved, the lender issues a loan agreement outlining the terms, including the loan amount, interest rate, and payment schedule.

- Lump Sum Payment:The borrower receives a lump sum payment upfront, which is used to fund the annuity payments.

- Annuity Payments:The borrower receives regular annuity payments according to the agreed-upon schedule, typically monthly or quarterly.

In an immediate annuity loan transaction, the lender plays the role of providing the loan and receiving the annuity payments, while the borrower receives the lump sum payment and the regular income stream. The loan amount and interest rate are determined by several factors, including the borrower’s age, health, creditworthiness, and the chosen annuity term.

Benefits of Immediate Annuity Loans

Immediate annuity loans offer several benefits for borrowers, including:

- Guaranteed Income:Provides a reliable and predictable source of income, especially during retirement or other periods of financial need.

- Financial Security:Offers peace of mind knowing that a guaranteed income stream is available for a specific period.

- Tax Advantages:In some cases, the interest paid on immediate annuity loans may be tax-deductible, reducing the overall tax burden.

- Flexibility:The lump sum payment can be used for various purposes, such as paying off debt, investing, or covering unexpected expenses.

Risks and Considerations, Immediate Annuity Loan

While immediate annuity loans offer benefits, they also come with potential risks and considerations:

- Interest Rates:The interest rate on an immediate annuity loan can be higher than traditional loans, potentially leading to a larger overall cost.

- Market Fluctuations:Changes in interest rates or market conditions can affect the value of the annuity payments.

- Loan Term:The loan term can be lengthy, potentially exceeding the borrower’s lifespan, which may not be desirable in all cases.

- Creditworthiness:Borrowers with poor credit may face higher interest rates or may not be eligible for an immediate annuity loan.

It’s crucial to carefully evaluate the terms and conditions of an immediate annuity loan before making a decision. Consulting with a financial advisor can help assess the suitability of this loan type for individual financial needs and circumstances.

Different Types of Immediate Annuity Loans

The market offers various types of immediate annuity loans, each with unique features and benefits. Here are some common types:

- Fixed-Rate Annuity Loan:Offers a fixed interest rate for the duration of the loan, providing predictable payments.

- Variable-Rate Annuity Loan:The interest rate can fluctuate based on market conditions, potentially resulting in varying payments.

- Indexed Annuity Loan:The interest rate is linked to a specific index, such as the S&P 500, offering potential for higher returns but also exposing the borrower to market volatility.

- Lifetime Annuity Loan:Payments continue until the borrower’s death, providing lifelong income security.

The suitability of each type of immediate annuity loan depends on the borrower’s financial goals, risk tolerance, and overall financial situation.

Deciding between an annuity and drawdown can be a tough choice. Is Annuity Better Than Drawdown 2024 explores the pros and cons of each option. It’s also important to understand the licensing requirements for annuities, which you can find in Is Annuity Lic 2024.

Finding the Right Immediate Annuity Loan

Finding the right immediate annuity loan involves careful research and comparison. Here are some tips:

- Research Reputable Lenders:Look for lenders with a strong track record and positive customer reviews.

- Compare Loan Terms:Compare interest rates, fees, payment schedules, and loan terms from different lenders.

- Consult a Financial Advisor:A financial advisor can help assess your financial needs and recommend the most suitable immediate annuity loan for your situation.

Case Studies and Examples

| Borrower’s Situation | Loan Amount | Interest Rate | Annuity Term | Outcome |

|---|---|---|---|---|

| Retired couple seeking guaranteed income | $200,000 | 4.5% | 20 years | Received monthly payments of $1,200 for 20 years, providing a stable income stream for retirement. |

| Individual with medical expenses | $50,000 | 5.0% | 10 years | Received monthly payments of $500 for 10 years, helping cover medical expenses and reducing financial stress. |

These examples illustrate how immediate annuity loans can be used to address various financial needs and provide financial security.

Future Trends and Developments

The immediate annuity loan market is expected to evolve in the coming years, driven by factors such as:

- Regulatory Changes:New regulations and policies may impact the availability and terms of immediate annuity loans.

- Technological Advancements:The use of technology, such as online platforms and AI-powered tools, may streamline the loan application and underwriting processes.

- Shifting Demographics:An aging population and increased demand for retirement income security may drive growth in the immediate annuity loan market.

Immediate annuity loans are likely to play an increasingly significant role in retirement planning and other financial strategies in the future.

Last Recap

Immediate annuity loans can be a powerful financial tool for individuals seeking guaranteed income and financial stability. However, it’s crucial to carefully evaluate the terms and conditions, understand the associated risks, and consult with a financial advisor to determine if this type of loan is right for your specific circumstances.

If you’re looking for an immediate annuity in Hong Kong, there are a few options available. Immediate Annuity Hong Kong provides a starting point for your research. Annuity 4 2024 might also provide helpful information on the different types of annuities available.

By carefully weighing the benefits and drawbacks, you can make an informed decision that aligns with your financial goals and objectives.

There are many different types of annuities available, and each one has its own set of features and benefits. 6 Annuity 2024 provides a good overview of some popular types. Annuity Date Is 2024 can help you understand the specific dates associated with your annuity.

Quick FAQs: Immediate Annuity Loan

How do immediate annuity loans differ from traditional loans?

Unlike traditional loans, immediate annuity loans provide a guaranteed stream of income rather than a lump sum payment. This income stream is typically fixed and guaranteed for a set period, making it a more predictable and reliable source of funds.

What are the potential risks associated with immediate annuity loans?

The main risk with immediate annuity loans is the potential for interest rates to rise after the loan is taken out. If rates increase, the borrower may end up paying more in interest over the life of the loan. It’s important to carefully consider the potential impact of interest rate fluctuations before taking out an immediate annuity loan.

Are immediate annuity loans suitable for everyone?

Variable annuities have been around for a while, with the first one introduced in 1952. First Variable Annuity In 1952 2024 provides more information on this historical event. Today, variable annuity rates fluctuate based on market performance, which you can learn more about in Variable Annuity Rates Today 2024.

Immediate annuity loans may not be suitable for everyone. It’s essential to consider your individual financial situation, risk tolerance, and long-term goals before deciding if this type of loan is right for you. Consulting with a financial advisor can help you determine the best course of action.