Immediate Annuity Premium, a financial product designed to provide a steady stream of income during retirement, offers a unique approach to securing your financial future. This type of annuity allows you to convert a lump sum of money into guaranteed, regular payments that begin immediately, providing a reliable source of income for life.

Variable annuities can be a good option for those seeking growth potential, but they come with their own set of terms and conditions. To understand these nuances, it’s helpful to familiarize yourself with the Variable Annuity Terminology 2024. This will allow you to make informed choices about the best variable annuity products for your individual needs.

You can explore the Best Variable Annuity Products 2024 and compare their features and performance.

Whether you’re nearing retirement and seeking a predictable income stream or aiming to supplement your existing retirement savings, an immediate annuity can play a significant role in your financial plan. Understanding the intricacies of immediate annuities, including the factors that influence premium calculations and the various types available, can help you make informed decisions about your retirement income strategy.

Immediate Annuity Premium: Definition and Purpose

An immediate annuity is a type of insurance product that provides a guaranteed stream of income payments starting immediately after the purchase. This means you receive your first payment within a short period, typically within a month, after you buy the annuity.

Variable annuities can have different share classes, and the O Share Variable Annuity 2024 is one example. This type of share class may have specific features, fees, and performance characteristics. It’s important to understand the nuances of each share class before making a decision about your investment strategy.

Understanding Immediate Annuity Premiums

An immediate annuity premium is the lump sum payment you make to an insurance company in exchange for the guaranteed income stream. The premium amount determines the size of your monthly payments. In essence, you’re essentially trading a lump sum of money for a steady stream of income for life.

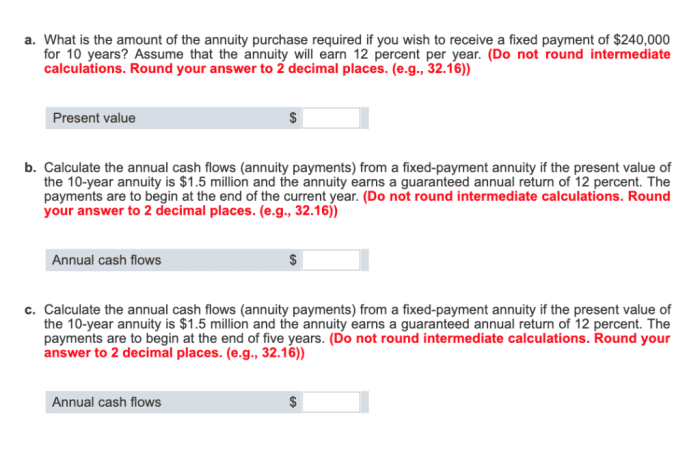

Some variable annuities offer a Variable Annuity Guaranteed Minimum Income Benefit 2024 , which can provide peace of mind about your retirement income. This feature guarantees a minimum income stream, even if the market performance is unfavorable. To calculate annuity payments, you can use a financial calculator.

Learn more about How To Calculate Annuity Using Financial Calculator 2024 to understand the process and make accurate projections.

Purpose of Immediate Annuities

Immediate annuities are primarily designed to provide a reliable and predictable income stream for retirement. They are particularly useful for individuals who:

- Want to eliminate the risk of outliving their savings

- Desire a guaranteed income stream that won’t be affected by market fluctuations

- Seek to simplify their retirement planning by eliminating the need to manage investments

Examples of Beneficial Scenarios

- Retirement Income:A retiree with a lump sum of savings can purchase an immediate annuity to secure a guaranteed income stream for life, eliminating the need to manage investments and worry about outliving their savings.

- Longevity Protection:Individuals concerned about living a long life can use an immediate annuity to ensure a steady income stream throughout their retirement years.

- Estate Planning:An immediate annuity can provide a guaranteed income stream to a beneficiary, ensuring their financial security after the annuitant’s passing.

Factors Influencing Immediate Annuity Premiums

Several factors influence the calculation of immediate annuity premiums, determining the amount of monthly payments you’ll receive.

Key Factors Affecting Premiums

- Age:The older you are, the higher your premium will be because you’re expected to live longer, requiring more payments from the insurance company.

- Gender:Women generally live longer than men, so their premiums tend to be slightly higher.

- Health:Individuals with excellent health are expected to live longer, leading to higher premiums. Conversely, those with pre-existing conditions may receive lower premiums due to a shorter life expectancy.

- Interest Rates:Higher interest rates generally result in higher annuity premiums because the insurance company can earn more on its investments.

- Annuity Payout Options:The type of annuity payout you choose also affects the premium. For instance, a lifetime annuity that guarantees payments for your entire life will have a higher premium than a fixed-term annuity with a specific payout period.

Impact of Annuity Payout Options

- Lifetime Annuity:This option provides a guaranteed income stream for your entire life, regardless of how long you live. It offers the highest level of longevity protection but comes with the highest premium.

- Fixed-Term Annuity:This option guarantees payments for a specific period, such as 10 or 20 years. It offers a lower premium than a lifetime annuity but may not provide sufficient income if you live longer than the fixed term.

- Joint Life Annuity:This option provides payments for as long as either you or your spouse is alive. It’s a suitable option for couples who want to ensure a steady income stream for both of them.

Types of Immediate Annuities

Immediate annuities are available in various forms, each offering different features and benefits.

Variable annuities can come with different terms and conditions, including the duration of the contract. A 7 Year Variable Annuity 2024 might offer a specific set of benefits and guarantees. To understand the potential returns associated with a variable annuity, it’s important to consider the 7 Annuity Return 2024 expectations and historical performance data.

Common Types of Immediate Annuities

- Fixed Annuities:These annuities provide a guaranteed fixed income stream for life. The monthly payments remain the same, regardless of market fluctuations. They offer predictability and stability but may not keep pace with inflation.

- Variable Annuities:These annuities offer the potential for higher returns but also carry greater risk. The monthly payments vary depending on the performance of the underlying investment portfolio. They may provide inflation protection but are subject to market volatility.

- Indexed Annuities:These annuities link their growth potential to a specific market index, such as the S&P 500. They offer the potential for higher returns than fixed annuities but with less risk than variable annuities. The payments may be capped or subject to certain limitations.

Specific Annuity Products

- XYZ Insurance Company:XYZ offers a fixed immediate annuity with a guaranteed lifetime income stream and a competitive interest rate.

- ABC Insurance Company:ABC offers a variable immediate annuity with a wide range of investment options and the potential for higher returns.

- DEF Insurance Company:DEF offers an indexed immediate annuity linked to the S&P 500, providing potential growth with some downside protection.

Advantages and Disadvantages of Immediate Annuities

Immediate annuities offer several advantages, but it’s crucial to consider their potential drawbacks before making a purchase.

Annuity payments can be a source of income during retirement, but it’s important to understand how they are treated for tax purposes. Find out if Is Annuity Counted As Income 2024 to make accurate tax projections and plan for your financial future.

Transamerica offers a variety of variable annuity options, including the Transamerica B Share Variable Annuity 2024. This specific annuity has its own set of features and benefits that you can explore further.

Benefits of Immediate Annuities

- Guaranteed Income:Immediate annuities provide a guaranteed stream of income for life, eliminating the risk of outliving your savings.

- Longevity Protection:They ensure a steady income stream throughout your retirement years, even if you live longer than expected.

- Simplicity:They simplify retirement planning by eliminating the need to manage investments and worry about market fluctuations.

- Tax Advantages:Annuity payments are typically taxed as ordinary income, but the principal amount may be tax-deferred.

Potential Drawbacks

- Limited Flexibility:Once you purchase an immediate annuity, you generally cannot access the principal amount. This limits your flexibility to adjust your retirement income strategy.

- Risk of Outliving Your Payments:If you live longer than expected, you may outlive your annuity payments, leaving you with no income in your later years.

- Lower Returns:Immediate annuities typically offer lower returns than other investment options, such as stocks or bonds.

Comparison with Other Retirement Income Strategies, Immediate Annuity Premium

Immediate annuities are just one of many retirement income strategies. It’s essential to compare them with other options, such as:

- Traditional Retirement Accounts (IRAs and 401(k)s):These accounts offer tax-deferred growth and potential for higher returns, but they require you to manage investments and may be subject to market fluctuations.

- Annuities with a Guaranteed Minimum Income:These annuities offer a guaranteed minimum income stream, even if the underlying investments perform poorly.

- Reverse Mortgages:These loans allow homeowners to tap into their home equity for retirement income but may carry higher interest rates and could lead to foreclosure if not managed carefully.

Purchasing an Immediate Annuity

Purchasing an immediate annuity involves several steps and requires careful consideration.

Steps Involved in Purchasing an Annuity

- Consult with a Financial Advisor:Seek professional advice from a qualified financial advisor to determine if an immediate annuity is suitable for your specific financial situation and retirement goals.

- Research Annuity Providers:Compare different insurance companies, their annuity products, and their fees to find the best option for you.

- Choose an Annuity Type:Decide on the type of annuity that best meets your needs, considering factors such as your risk tolerance, income requirements, and longevity expectations.

- Select a Payout Option:Choose the payout option that aligns with your income goals and financial needs. Consider lifetime annuities, fixed-term annuities, and joint life annuities.

- Purchase the Annuity:Once you’ve chosen an annuity provider, product, and payout option, complete the purchase process and make the premium payment.

Importance of Professional Advice

Consulting with a financial advisor is essential before purchasing an immediate annuity. They can help you:

- Assess your financial situation and retirement goals

- Determine if an immediate annuity is suitable for you

- Compare different annuity products and providers

- Choose the appropriate payout option

- Understand the risks and benefits of annuity ownership

Essential Considerations for Prospective Buyers

- Your Financial Situation:Consider your current savings, income, expenses, and retirement goals.

- Risk Tolerance:Determine your comfort level with risk and whether you prefer guaranteed income or potential for higher returns.

- Longevity Expectations:Consider your health and family history to estimate your potential lifespan and the need for longevity protection.

- Tax Implications:Understand the tax consequences of annuity payments and how they will affect your overall tax liability.

- Fees and Charges:Compare the fees and charges associated with different annuity products to ensure you’re getting a fair deal.

Immediate Annuity Premium Illustrations

Here are some examples illustrating the relationship between age, premium amount, and monthly annuity payments.

If you’re considering an annuity, you might be interested in the Annuity 200k 2024 option. This type of annuity provides a guaranteed income stream, but it’s important to understand how to calculate the payments and what factors can influence your returns.

You can learn more about How To Calculate An Annuity Payment 2024 to make informed decisions about your retirement planning.

Age, Premium, and Monthly Payments

| Age | Premium Amount | Monthly Payment |

|---|---|---|

| 65 | $100,000 | $600 |

| 70 | $100,000 | $750 |

| 75 | $100,000 | $900 |

Annuity Premium Variation by Payout Option

Scenario:A 65-year-old individual with a $100,000 premium can choose from different payout options, each affecting the monthly payment amount.

- Lifetime Annuity:Monthly payment of $600 for life, with the highest premium.

- Fixed-Term Annuity (20 years):Monthly payment of $500 for 20 years, with a lower premium than the lifetime annuity.

- Joint Life Annuity (with spouse, age 63):Monthly payment of $700 for as long as either the individual or their spouse is alive, with a higher premium than the lifetime annuity.

Hypothetical Scenario

Scenario:A 65-year-old retiree with $200,000 in savings is concerned about outliving their money. They decide to purchase a lifetime immediate annuity with a premium of $100,000, guaranteeing a monthly income stream of $600 for life. This provides them with a reliable income source and eliminates the risk of outliving their savings.

When it comes to variable annuities, understanding the Required Minimum Distribution (RMD) rules is crucial. Learn more about the Variable Annuity Rmd 2024 regulations to ensure you’re in compliance and maximizing your retirement income. You can also utilize Excel to model and analyze annuity scenarios.

Explore Annuity Is Excel 2024 for insights into how to leverage this powerful tool for retirement planning.

They can use the remaining $100,000 for other expenses or investments.

Final Review

Immediate annuities, with their guaranteed income and longevity protection, can be a valuable addition to your retirement portfolio. However, it’s crucial to carefully consider the advantages and disadvantages, the impact of various factors on premium costs, and the potential risks before making a decision.

Consulting with a financial advisor can help you determine if an immediate annuity aligns with your individual financial goals and risk tolerance, ensuring a secure and fulfilling retirement.

The variable annuity market is dynamic, with mergers and acquisitions shaping the landscape. Understanding the Variable Annuity M&A 2024 trends can help you make informed decisions about your investments. It’s also important to compare variable annuities with fixed annuities, as they offer different risk and reward profiles.

You can find more information on Variable Annuity Versus Fixed Annuity 2024 to make the best choice for your retirement goals.

Commonly Asked Questions: Immediate Annuity Premium

How do immediate annuity premiums work?

Immediate annuity premiums are calculated based on factors like your age, gender, health, and the chosen payout option. The higher the premium, the larger your monthly annuity payments will be.

What are the risks associated with immediate annuities?

One risk is the possibility of outliving your annuity payments. If you live longer than expected, your payments may cease before you’ve exhausted your savings. Additionally, some annuity types, like variable annuities, carry investment risk, meaning your payments could fluctuate depending on market performance.

Can I withdraw my premium from an immediate annuity?

Typically, you cannot withdraw your premium from an immediate annuity after purchasing it. This is because the premium is used to purchase a guaranteed stream of income for life.

Are immediate annuities suitable for everyone?

Immediate annuities may not be suitable for everyone. They are generally best suited for individuals with a stable income and a long-term need for guaranteed income. If you’re seeking flexibility or prefer to manage your investments independently, an immediate annuity may not be the right choice.