Immediate Annuity Historical Interest Rates provide a valuable lens into the financial landscape of retirement planning. Understanding how interest rates have historically impacted immediate annuities can help individuals make informed decisions about their retirement income strategy. This article delves into the historical trends, key factors influencing interest rates, and their implications for annuity buyers.

Class C variable annuities typically have higher fees, which can impact your returns. Class C Variable Annuity 2024 is a topic to consider. It’s important to carefully evaluate the fees associated with any variable annuity before making a decision.

The historical data on interest rates for immediate annuities reveals a dynamic relationship between economic conditions and annuity payouts. Examining these trends can shed light on the potential risks and opportunities associated with different types of annuities, such as fixed, variable, and indexed annuities.

The interest rates offered on variable annuities can fluctuate, so it’s important to stay informed. Variable Annuity Rates Today 2024 can give you a sense of the current market. Remember that these rates are subject to change, so it’s always a good idea to check for updates.

Understanding Immediate Annuities

Immediate annuities are financial products that provide a stream of guaranteed income payments for life. They are popular among retirees looking for a reliable source of income, as they offer a predictable and consistent cash flow. Unlike other investments, immediate annuities provide a fixed income stream, regardless of market fluctuations.

One of the main benefits of an annuity is that it provides a steady stream of income in retirement. Is Annuity Income 2024 is a common question. It’s important to understand how annuity payments are taxed and how they can impact your overall income.

This makes them a valuable tool for managing retirement income and mitigating longevity risk.

Key Features of Immediate Annuities

- Guaranteed Income Payments:Immediate annuities provide a guaranteed stream of income for life, regardless of market conditions. This means you can count on receiving regular payments, even if your investments experience losses.

- Longevity Protection:Immediate annuities help mitigate longevity risk, ensuring you have a source of income for the duration of your life. This is particularly important for individuals concerned about outliving their savings.

- Tax-Deferred Growth:The income generated from an immediate annuity is tax-deferred, meaning you won’t have to pay taxes on the earnings until you receive the payments.

- Flexibility:Immediate annuities offer various payout options, allowing you to choose a payment schedule that best suits your needs. You can opt for monthly, quarterly, or annual payments, and you can even select a payment period that extends beyond your lifetime.

With so many financial products available, it can be difficult to know where to start. Annuity Uncertain 2024 is a common question, and there’s no one-size-fits-all answer. The best approach depends on your individual needs and goals. Factors like your risk tolerance, time horizon, and financial situation all play a role.

Immediate vs. Deferred Annuities

Immediate annuities differ from deferred annuities in terms of the timing of income payments. As the name suggests, immediate annuities begin making payments immediately after the purchase, while deferred annuities provide income payments at a later date. Deferred annuities allow you to grow your savings over time, while immediate annuities provide immediate income.

Before investing in any annuity, it’s wise to read reviews from others who have used the product. Jackson Variable Annuity Reviews 2024 can provide insights into the pros and cons of this particular product. It’s always good to have multiple perspectives to make an informed decision.

Types of Immediate Annuities

- Fixed Annuities:Fixed annuities provide a guaranteed interest rate, ensuring a predictable income stream. The interest rate is fixed for the duration of the annuity, providing stability and security.

- Variable Annuities:Variable annuities offer the potential for higher returns, but they also carry more risk. The income payments are tied to the performance of underlying investments, so the amount you receive can fluctuate.

- Indexed Annuities:Indexed annuities provide a minimum guaranteed return, but they also have the potential to participate in market gains. The interest rate is linked to the performance of a specific index, such as the S&P 500.

Historical Interest Rates and Their Impact

Interest rates play a crucial role in determining the payouts of immediate annuities. When interest rates are high, annuities offer higher income payments, while low interest rates result in lower payouts. Understanding the historical trend of interest rates is essential for annuity buyers, as it provides insights into potential future returns.

If you’re looking for a way to grow your retirement savings, you might consider a variable annuity. T Rowe Price Variable Annuity is one option to explore. However, it’s important to be aware of the risks involved. The market can fluctuate, and your investment could lose value.

It’s crucial to do your research and consult with a financial advisor before making any decisions.

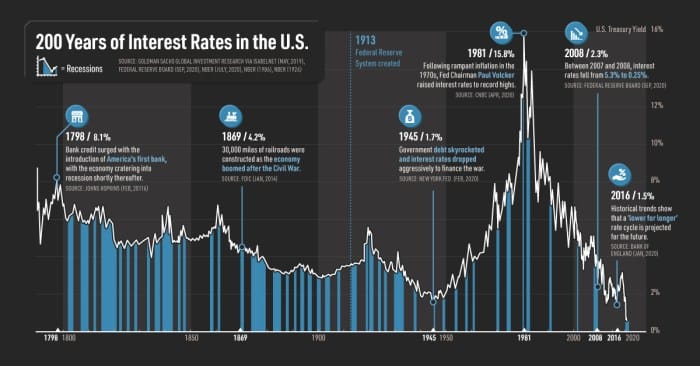

Historical Trend of Interest Rates

Historically, interest rates have fluctuated significantly, influenced by various economic factors. During periods of economic growth and inflation, interest rates tend to rise, while they decline during recessions and periods of low inflation. This trend is reflected in the historical interest rates for immediate annuities, which have shown periods of both growth and decline.

Want to see how much your annuity might be worth in the future? You can use an Annuity Calculator Lottery 2024 to estimate your potential returns. However, keep in mind that these are just estimates and your actual results may vary.

Impact of Interest Rate Fluctuations on Annuity Payouts

Fluctuations in interest rates have a direct impact on annuity payouts. When interest rates rise, the present value of future income payments increases, leading to higher payouts. Conversely, when interest rates fall, the present value of future income payments decreases, resulting in lower payouts.

Bogleheads are known for their focus on low-cost index funds. Variable Annuity Bogleheads 2024 is a relevant topic as it explores whether variable annuities align with the Boglehead philosophy. It’s essential to consider your investment approach and choose products that fit your strategy.

Historical Examples of Interest Rate Impact

The historical record provides numerous examples of how interest rate changes have impacted annuity returns. For instance, during the 1980s, interest rates rose significantly, leading to higher annuity payouts. Conversely, in the aftermath of the 2008 financial crisis, interest rates fell dramatically, resulting in lower annuity payouts.

Need help calculating your annuity payments? An Annuity Calculator Soup 2024 can provide a useful tool for estimating your future income. However, remember that these are just estimates, and your actual results may vary.

These examples highlight the importance of understanding the relationship between interest rates and annuity payouts.

A Series 7 license allows financial professionals to sell various securities, including variable annuities. Series 7 Variable Annuity 2024 is a relevant topic for anyone considering purchasing a variable annuity. Make sure to work with a qualified professional who has the necessary licenses and expertise.

Factors Influencing Interest Rates

Several economic factors influence interest rates for immediate annuities. These factors interact in complex ways, making it challenging to predict future interest rate movements.

Inflation

Inflation is a key driver of interest rates. When inflation is high, lenders demand higher interest rates to compensate for the erosion of their purchasing power. This is because the real return on their investment decreases due to inflation. As a result, higher inflation typically leads to higher interest rates for annuities.

If you’re a federal employee, you may be eligible for a TSP annuity. Calculating Tsp Annuity 2024 can help you determine your potential retirement income. Understanding how your TSP annuity works is essential for planning your financial future.

Monetary Policy

Central banks, such as the Federal Reserve in the United States, play a significant role in setting interest rates through monetary policy. They use tools like adjusting the federal funds rate and buying or selling government bonds to influence the overall cost of borrowing in the economy.

It’s important to be aware of the tax implications of variable annuities. Variable Annuity Taxable 2024 helps you understand how annuity payments are taxed. Consult with a tax professional for personalized advice.

When the central bank aims to stimulate economic growth, it may lower interest rates, while it may raise rates to curb inflation.

If you’re considering a variable annuity, it’s helpful to understand the basics. Variable Annuity Overview 2024 provides a comprehensive overview of this type of investment. It’s essential to know the potential risks and rewards before making a decision.

Market Conditions

Market conditions, such as investor confidence, economic growth, and global events, also influence interest rates. When investors are optimistic about the economy, they are more willing to lend money at lower rates. Conversely, during periods of economic uncertainty, investors demand higher interest rates to compensate for the increased risk.

When choosing between a variable annuity and a mutual fund, it’s essential to consider your investment goals. Variable Annuity Or Mutual Fund 2024 helps you understand the key differences between these two options. It’s important to choose the investment that best aligns with your needs and risk tolerance.

Analyzing Historical Interest Rate Data

Analyzing historical interest rate data for immediate annuities can provide valuable insights into potential future trends. This data can help annuity buyers understand the relationship between interest rates and annuity payouts and make informed decisions about their investment.

Many insurance companies offer variable annuities. Variable Annuity Life Ins Co 2024 is a topic worth exploring. It’s essential to compare different insurance companies and their offerings to find the best fit for your needs.

Table of Historical Interest Rates

| Year | Average Interest Rate | Notable Events Affecting Rates |

|---|---|---|

| 1980 | 11.50% | High inflation, Federal Reserve tightens monetary policy |

| 1990 | 7.50% | Recession, Federal Reserve eases monetary policy |

| 2000 | 6.50% | Dot-com bubble burst, Federal Reserve lowers interest rates |

| 2010 | 2.50% | Financial crisis, Federal Reserve implements quantitative easing |

| 2020 | 0.50% | COVID-19 pandemic, Federal Reserve cuts interest rates to near zero |

Visual Representation of Historical Trend

A chart or graph can visually illustrate the historical trend of interest rates for immediate annuities. This visual representation can provide a clear picture of how interest rates have fluctuated over time, allowing annuity buyers to identify patterns and trends.

Implications for Annuity Buyers

Understanding historical interest rate trends is crucial for annuity buyers, as it provides insights into potential future returns. By analyzing historical data, annuity buyers can make informed decisions about their annuity purchase and navigate interest rate fluctuations.

Informed Decision-Making

Historical data can help annuity buyers assess the potential for future income payments. By understanding the relationship between interest rates and annuity payouts, buyers can choose an annuity that aligns with their financial goals and risk tolerance.

Strategies for Navigating Interest Rate Fluctuations

Annuity buyers can adopt strategies to mitigate the impact of interest rate fluctuations. For instance, they can consider purchasing a fixed annuity during periods of high interest rates to lock in a guaranteed return. Alternatively, they may opt for a variable or indexed annuity during periods of low interest rates, seeking potential for higher returns.

Future Interest Rate Projections

Predicting future interest rate trends is challenging, as it involves a complex interplay of economic factors. However, experts and market forecasts can provide insights into potential future movements.

Expert Opinions and Market Forecasts

Experts and market analysts often provide forecasts on future interest rate trends, based on their analysis of economic indicators and policy expectations. These forecasts can provide valuable guidance for annuity buyers, but it’s essential to consider the uncertainties inherent in these projections.

Implications of Future Interest Rate Changes, Immediate Annuity Historical Interest Rates

Future interest rate changes can have significant implications for annuity payouts. If interest rates rise, annuity payouts may increase, while falling interest rates may lead to lower payouts. Annuity buyers should carefully consider the potential impact of future interest rate movements on their income stream.

Closing Notes

By analyzing historical interest rate data, individuals can gain a deeper understanding of the potential impact of interest rate fluctuations on their annuity income. This knowledge empowers them to make informed decisions about the type of annuity that best aligns with their risk tolerance and financial goals.

Understanding historical trends and the factors that influence interest rates can help individuals navigate the complexities of retirement planning and make informed decisions that contribute to a secure and fulfilling retirement.

Top FAQs: Immediate Annuity Historical Interest Rates

What are the main factors that influence interest rates for immediate annuities?

Key factors include inflation, monetary policy, and market conditions. These factors can significantly impact the interest rates offered on immediate annuities, ultimately affecting annuity payouts.

How can I use historical interest rate data to make informed decisions about annuity purchase?

By analyzing historical trends, you can gain insight into the potential risks and opportunities associated with different types of annuities. This information can help you determine the best type of annuity for your needs and risk tolerance.

What are the potential implications of future interest rate changes on annuity payouts?

Future interest rate changes can have a significant impact on annuity payouts, depending on the type of annuity. It’s important to stay informed about potential trends and their implications for your retirement income.