7 Annuity Return 2024: A Guide to Potential Gains – In the ever-changing landscape of retirement planning, annuities have emerged as a popular investment option. While many seek a guaranteed stream of income, others aim for higher returns to secure their future.

Want to calculate the annuity payments you’ll receive from your National Pension System (NPS) account in India? Calculate Annuity Nps 2024 provides you with a useful calculator for this purpose.

In 2024, the pursuit of a 7% annuity return has become a topic of interest for those seeking to maximize their retirement savings. This guide delves into the factors influencing annuity returns in 2024, explores strategies to achieve a 7% return, and provides insights into the current annuity market outlook.

Looking for an annuity calculator tailored to Singapore’s financial landscape? Annuity Calculator Singapore 2024 provides a convenient tool for exploring your annuity options.

This exploration will cover a wide range of aspects, including the current economic climate, interest rates, inflation, and the various annuity products available. We will analyze the potential for achieving a 7% return, weigh the risks involved, and compare annuities with other investment options like stocks, bonds, and mutual funds.

Annuity Basics

An annuity is a financial product that provides a stream of regular payments, typically for a fixed period or for the lifetime of the annuitant. Annuities are designed to provide a steady income stream during retirement, helping individuals to manage their finances and ensure financial security in their later years.

If you’re familiar with the R programming language, you can use it to calculate annuities. R Calculate Annuity 2024 offers a guide on how to perform annuity calculations using R.

Types of Annuities

There are various types of annuities available, each with its own features and benefits. Some common types include:

- Fixed Annuities:These annuities offer a guaranteed rate of return, providing a predictable income stream. The payments are typically fixed for the life of the annuity, offering stability and protection against market volatility.

- Variable Annuities:These annuities offer a potential for higher returns, but they also carry a higher level of risk. The payments are linked to the performance of underlying investments, such as mutual funds or stocks, making them subject to market fluctuations.

- Immediate Annuities:These annuities begin making payments immediately after the initial premium is paid. They are suitable for individuals who need immediate income, such as those who have recently retired or are facing unexpected financial needs.

- Deferred Annuities:These annuities start making payments at a future date, allowing individuals to accumulate funds and potentially earn higher returns before receiving payments. They are suitable for individuals who are planning for retirement in the future.

Advantages and Disadvantages of Annuities

Annuities offer both advantages and disadvantages, which individuals should carefully consider before making an investment decision.

It’s important to understand whether an annuity is a single sum or a series of payments. Annuity Is A Single Sum 2024 clarifies this concept.

- Advantages:

- Guaranteed Income:Fixed annuities provide a guaranteed income stream, offering peace of mind and financial security.

- Protection Against Market Volatility:Fixed annuities protect against market downturns, providing stability and preserving principal.

- Tax Deferral:Annuity earnings grow tax-deferred, potentially reducing overall tax liability.

- Longevity Protection:Some annuities provide lifetime income, ensuring a stream of payments even if the annuitant lives longer than expected.

- Disadvantages:

- Limited Growth Potential:Fixed annuities typically offer lower returns compared to other investment options.

- Fees and Expenses:Annuities often involve fees and expenses, which can reduce overall returns.

- Liquidity Constraints:Annuities can have restrictions on withdrawals, limiting access to funds.

- Inflation Risk:Fixed annuities may not keep pace with inflation, reducing the purchasing power of payments over time.

7% Annuity Return in 2024: 7 Annuity Return 2024

Achieving a 7% return on an annuity in 2024 is a challenging goal, considering the current economic climate and market conditions. However, it is not entirely impossible. Several factors influence annuity returns, and understanding these factors can help individuals make informed decisions.

The tax implications of annuities vary from country to country. If you’re wondering about the taxability of annuities in the UK, Is Annuity Income Taxable In Uk 2024 provides a comprehensive overview of the relevant tax rules.

Factors Influencing Annuity Returns

The return on an annuity is influenced by a combination of factors, including:

- Interest Rates:Interest rates play a crucial role in determining annuity returns. Higher interest rates generally lead to higher annuity payouts, as insurers can earn more on their investments.

- Inflation:Inflation erodes the purchasing power of money, making it essential to consider inflation when assessing annuity returns. Higher inflation rates can reduce the real value of annuity payments.

- Economic Growth:Strong economic growth can support higher interest rates and potentially lead to higher annuity returns. Conversely, economic slowdowns or recessions can negatively impact annuity rates.

- Competition:Competition among annuity providers can influence returns. When competition is fierce, insurers may offer more attractive rates to attract customers.

- Market Volatility:Market volatility can impact returns on variable annuities, as the value of underlying investments fluctuates. During periods of high volatility, returns may be more unpredictable.

Current Economic Climate and Its Impact

The current economic climate is characterized by rising inflation and interest rates. The Federal Reserve has been raising interest rates to combat inflation, which could potentially benefit annuity returns. However, the impact of rising interest rates on annuity rates is not always straightforward, as insurers may adjust their rates to reflect the changing economic environment.

Calculating your annuity payments based on your life expectancy can help you make more informed financial decisions. Annuity Calculator Based On Life Expectancy 2024 can help you determine how long your annuity payments will last.

Achieving a 7% Annuity Return

While achieving a 7% return on an annuity in 2024 is not guaranteed, individuals can explore strategies and investment options that could potentially increase their chances of achieving this goal.

Annuity numbers can be confusing. If you’re looking for a comprehensive guide to annuity numbers, Annuity Number 2024 can help you understand this concept.

Strategies and Investment Options

Here are some strategies and investment options that individuals can consider:

- Variable Annuities:Variable annuities offer the potential for higher returns, but they also carry a higher level of risk. By carefully selecting underlying investments with growth potential, individuals may be able to achieve a 7% return.

- Index-Linked Annuities:These annuities link their returns to the performance of a specific index, such as the S&P 500. If the index performs well, the annuity payments may increase.

- Deferred Annuities:Deferred annuities allow individuals to accumulate funds and potentially earn higher returns before receiving payments. By investing in a deferred annuity for a longer period, individuals may have a greater chance of achieving a 7% return.

- Annuity Riders:Some annuities offer riders that can enhance returns, such as guaranteed minimum income benefits or death benefit guarantees.

Risks Associated with Higher Returns

It is important to acknowledge that pursuing higher returns also comes with higher risks. Individuals should carefully consider their risk tolerance and financial goals before investing in annuities with the potential for higher returns.

If you’re in Canada and considering an annuity, it’s a good idea to get quotes from different providers. Annuity Quotes Canada 2024 can help you compare options and find the best deal.

- Market Risk:Variable annuities are subject to market risk, meaning that the value of underlying investments can fluctuate, potentially reducing returns.

- Inflation Risk:Even if an annuity provides a 7% return, inflation can erode the purchasing power of payments over time.

- Interest Rate Risk:Rising interest rates can impact the value of annuities, particularly those with fixed payments.

Importance of Diversification

Diversification is crucial for managing risk and maximizing returns. By diversifying investments across different asset classes, individuals can reduce their exposure to specific risks.

Annuity calculations often involve spreadsheets. Pv Annuity Sheet 2024 provides you with a helpful spreadsheet template to simplify your calculations.

Annuity Market Outlook

The annuity market is expected to continue growing in 2024, driven by an aging population and increasing demand for retirement income solutions. Technological advancements and innovation are shaping the industry, offering new and innovative products to meet evolving customer needs.

Want to figure out how many periods your annuity will last? Annuity Number Of Periods Calculator 2024 can help you calculate the total number of payments you’ll receive.

Current State and Potential for Growth

The annuity market is experiencing a period of growth, fueled by factors such as:

- Aging Population:As the baby boomer generation continues to retire, demand for retirement income products, including annuities, is expected to increase.

- Low Interest Rates:Historically low interest rates have made it challenging for individuals to generate income from traditional savings accounts and bonds, making annuities more attractive.

- Market Volatility:The recent market volatility has led some investors to seek out products that offer stability and protection against market downturns, such as fixed annuities.

Trends and Innovations

The annuity industry is evolving, with new trends and innovations emerging:

- Personalized Products:Annuity providers are developing more personalized products tailored to specific customer needs and financial goals.

- Technology Integration:Technology is playing a growing role in the annuity industry, with online platforms and mobile apps making it easier for individuals to purchase and manage annuities.

- Hybrid Products:Hybrid annuities combine features of fixed and variable annuities, offering flexibility and potential for higher returns.

Future of Annuity Returns

The future of annuity returns is uncertain, but several factors suggest that they may remain attractive for retirement planning.

Need to estimate your potential annuity payments? You can use a calculator to get an idea of what your monthly income could be. If you’re in New Zealand, Annuity Calculator Nz 2024 is a great resource for getting started.

- Rising Interest Rates:As interest rates rise, annuity providers may be able to offer higher returns to attract customers.

- Growing Demand:The increasing demand for retirement income solutions is likely to support annuity growth and potentially lead to higher returns.

- Innovation:Continued innovation in the annuity industry may lead to new products and features that enhance returns and meet evolving customer needs.

Annuity vs. Other Investment Options

Annuities are just one of many investment options available for retirement planning. Comparing annuities to other options can help individuals make informed decisions based on their individual circumstances and financial goals.

Comparison with Stocks, Bonds, and Mutual Funds

Here is a comparison of annuities with other popular retirement investment options:

| Investment Option | Risk | Return Potential | Suitability |

|---|---|---|---|

| Annuities (Fixed) | Low | Moderate | Suitable for individuals seeking guaranteed income and protection against market volatility. |

| Annuities (Variable) | High | High | Suitable for individuals with a higher risk tolerance and seeking potential for higher returns. |

| Stocks | High | High | Suitable for long-term investors with a high risk tolerance and seeking potential for significant growth. |

| Bonds | Moderate | Moderate | Suitable for investors seeking a balance of risk and return, providing income and diversification. |

| Mutual Funds | Moderate | Moderate | Suitable for investors seeking professional management and diversification across a range of assets. |

Pros and Cons of Each Option, 7 Annuity Return 2024

- Annuities:

- Pros:Guaranteed income, protection against market volatility, tax deferral, longevity protection.

- Cons:Limited growth potential, fees and expenses, liquidity constraints, inflation risk.

- Stocks:

- Pros:High potential for growth, potential for dividend income, liquidity.

- Cons:High risk, volatility, potential for capital losses.

- Bonds:

- Pros:Lower risk than stocks, regular interest payments, diversification benefits.

- Cons:Lower potential for growth than stocks, interest rate risk, inflation risk.

- Mutual Funds:

- Pros:Professional management, diversification, access to a wide range of asset classes.

- Cons:Fees and expenses, potential for underperformance, lack of control over individual investments.

Considerations for Annuity Investment

Before investing in an annuity, individuals should carefully consider several factors to ensure that the product aligns with their financial goals and circumstances.

Your age plays a crucial role in annuity calculations. Annuity Calculator By Age 2024 can help you estimate your potential annuity payments based on your age.

Important Factors to Consider

- Age:Younger individuals may have a longer time horizon and can afford to take on more risk, making variable annuities a potential option. Older individuals may prioritize guaranteed income and stability, making fixed annuities more suitable.

- Risk Tolerance:Risk tolerance refers to an individual’s willingness to accept potential losses in exchange for the possibility of higher returns. Individuals with a low risk tolerance may prefer fixed annuities, while those with a higher risk tolerance may consider variable annuities.

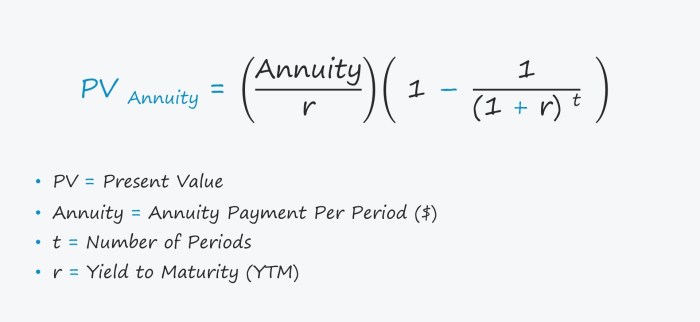

There’s a specific formula used to calculate annuity payments. Formula For Calculating The Annuity Payment 2024 provides you with the details of this formula.

- Financial Goals:Individuals should define their financial goals, such as retirement income, legacy planning, or protecting against long-term care expenses. Annuities can be tailored to meet specific financial goals.

- Time Horizon:The time horizon refers to the length of time an individual plans to invest. Longer time horizons allow for greater potential for growth, making variable annuities a potential option. Shorter time horizons may favor fixed annuities.

- Health:Health status can influence the choice of an annuity. Individuals with health concerns may consider annuities that provide longevity protection, ensuring income even if they live longer than expected.

Checklist of Questions to Ask Annuity Providers

When considering an annuity, individuals should ask potential providers the following questions:

- What are the fees and expenses associated with the annuity?

- What is the guaranteed rate of return, if applicable?

- What are the withdrawal restrictions and penalties?

- What are the death benefit provisions?

- What are the surrender charges?

- What is the financial strength of the annuity provider?

Assessing Suitability Based on Individual Circumstances

Individuals should carefully assess the suitability of an annuity product based on their specific circumstances and financial goals. It is essential to consult with a qualified financial advisor to obtain personalized advice and ensure that the annuity product meets their needs.

Are you looking for a way to secure your financial future? Annuity products can provide you with a steady stream of income throughout your retirement years. If you’re considering a 500k annuity, Annuity 500k 2024 can provide you with valuable insights into this type of investment.

End of Discussion

As you embark on your retirement planning journey, understanding the potential for a 7% annuity return in 2024 is crucial. This guide has provided insights into the factors influencing annuity returns, strategies to achieve higher returns, and a comprehensive overview of the annuity market.

While there are no guarantees in investing, by carefully considering your risk tolerance, financial goals, and the various annuity options available, you can make informed decisions that align with your individual circumstances. Remember to seek professional financial advice to tailor your investment strategy to your specific needs and objectives.

Clarifying Questions

What are the risks associated with pursuing a 7% annuity return?

Higher returns often come with higher risks. Investing in products that aim for a 7% return may expose you to market volatility, inflation, and potential loss of principal. It’s crucial to understand and assess your risk tolerance before pursuing such strategies.

How do I choose the right annuity product for me?

Consider your age, risk tolerance, financial goals, and time horizon. Seek professional advice to determine the best annuity product that aligns with your individual needs and circumstances.

Are annuities suitable for everyone?

Understanding the ins and outs of annuity calculations can be confusing. If you have questions about annuity calculations, Annuity Calculation Questions And Answers 2024 can provide you with helpful answers and explanations.

Annuities are not a one-size-fits-all solution. They may be suitable for individuals seeking guaranteed income, but they may not be the best choice for those with a higher risk tolerance and longer investment horizons.