401k contribution limits for 2024 for self-employed individuals provide a valuable opportunity to secure a comfortable retirement. Whether you’re a freelancer, independent contractor, or small business owner, understanding the rules and maximizing your contributions can make a significant difference in your long-term financial well-being.

This guide delves into the specifics of 401(k) contributions for self-employed individuals, exploring the limits, catch-up provisions, and strategies for maximizing your retirement savings.

The self-employed 401(k) plan, also known as a solo 401(k) or individual 401(k), offers a unique way for self-employed individuals to save for retirement. This plan allows you to contribute as both an employee and an employer, giving you the potential to save significantly more than traditional retirement plans.

The 2024 contribution limits for self-employed 401(k) plans offer valuable insights into how much you can contribute and how to optimize your savings strategy.

Understanding Self-Employed 401(k) Contribution Limits

The self-employed 401(k) is a powerful retirement savings tool, allowing you to contribute as both an employee and an employer. However, it’s important to understand the contribution limits to maximize your savings while staying within IRS guidelines.

If you’re self-employed, you might be considering a Solo 401k. The Ira contribution limits for solo 401k in 2024 will help you understand how much you can contribute.

Traditional vs. Roth 401(k) Contributions

There are two main types of 401(k) contributions: traditional and Roth. The main difference lies in when you pay taxes:* Traditional 401(k):Contributions are pre-tax, meaning you deduct them from your taxable income. You won’t pay taxes until you withdraw the money in retirement.

For those looking to contribute to a traditional IRA, the limits change every year. The Ira contribution limits for traditional IRA in 2024 will guide you on how much you can contribute.

Roth 401(k)

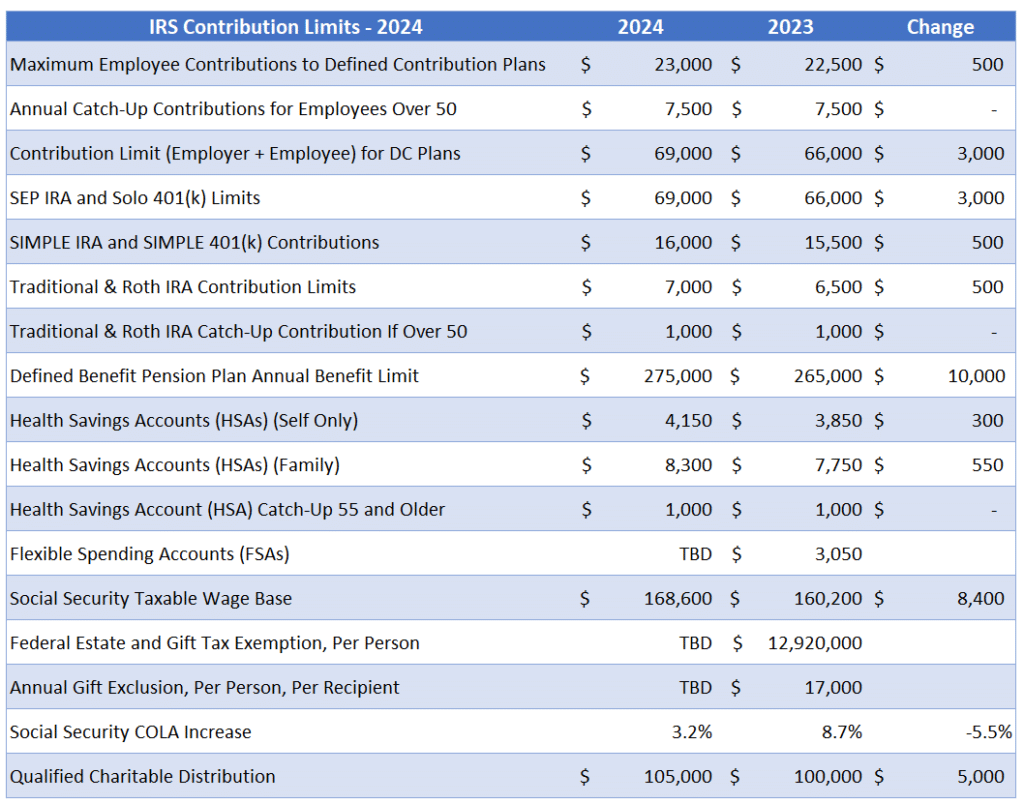

It’s always a good idea to compare the limits year-over-year to see any changes. The Ira contribution limits for 2024 vs 2023 page will provide a clear comparison.

Contributions are made with after-tax dollars. This means you pay taxes now, but your withdrawals in retirement are tax-free.The best choice for you depends on your individual financial situation and tax bracket.

Non-profit organizations also need to file W9 forms. The W9 Form October 2024 for non-profit organizations provides the necessary details for reporting income to the IRS.

2024 Contribution Limits, 401k contribution limits for 2024 for self-employed

Here’s a breakdown of the contribution limits for both employee and employer contributions in 2024:

Employee Contributions

- Traditional or Roth 401(k):$22,500

Employer Contributions

- Traditional or Roth 401(k):25% of your net adjusted self-employed income

Note:Your total contributions (employee + employer) cannot exceed $66,000 in 2024.

If you’re dealing with an estate, you might need to fill out a W9 form. The W9 Form October 2024 for estates is specifically designed for these situations and provides the necessary details for reporting income to the IRS.

Maximum Total Contribution

The maximum total contribution you can make to a self-employed 401(k) in 2024 is $66,000. This includes both employee and employer contributions.

The mileage rate can change throughout the year, so it’s important to stay updated. Check out the October 2024 mileage rate changes to see if there are any adjustments you need to make.

Example:If your net adjusted self-employed income is $100,000 in 2024, you could contribute a maximum of $25,000 as an employer (25% of $100,000). Since the employee contribution limit is $22,500, you could contribute a total of $47,500 ($25,000 + $22,500).

If you’re over 50, you have the opportunity to contribute a little more to your 401k. Find out the exact limits by visiting the What are the 401k limits for 2024 for over 50 page and make the most of your retirement savings.

Factors Affecting 401(k) Contribution Limits

The maximum amount you can contribute to your self-employed 401(k) is influenced by a few key factors. These factors determine how much you can save for retirement each year, impacting your long-term financial security.

There are various tax credits available, and some might apply to your situation. Make sure to check the Tax credits for the October 2024 deadline to see if you qualify for any benefits.

Income Level

Your income level directly impacts the maximum contribution you can make to your self-employed 401(k). The IRS sets annual contribution limits for both employee and employer contributions.

Students often have different tax deadlines, so it’s crucial to be aware of the specifics. The October 2024 tax deadline for students might be different from the general deadline, so make sure to check the details.

For 2024, the maximum employee contribution limit is $22,500, while the maximum employer contribution limit is 25% of your net adjusted self-employed income.

When it comes to medical expenses, the mileage rate is used for calculating deductions. Make sure you’re using the correct rate by checking the October 2024 mileage rate for medical expenses information.

This means that if your net adjusted self-employed income is $100,000, you can contribute up to $25,000 as an employer. This limit is separate from the $22,500 employee contribution limit. However, if your income is lower, your employer contribution limit will be lower as well.

Curious about how the mileage rate is calculated for October 2024? You can find all the details on the official IRS website, which explains the how the mileage rate is calculated for October 2024. It’s a good idea to check this information periodically as rates can change.

Business Structure

The structure of your business also plays a role in your 401(k) contribution limits.

If you’re using a SIMPLE IRA, there are specific contribution limits to be aware of. The Ira contribution limits for SIMPLE IRA in 2024 will give you a clear picture of how much you can save.

- Sole proprietorships and single-member LLCs are treated as one entity for tax purposes, meaning you are both the employee and employer. This allows you to contribute both as an employee and an employer.

- Partnerships and multi-member LLCs have slightly different rules. Each partner or member is considered both an employee and an employer, and they have individual contribution limits based on their income.

It is important to consult with a financial advisor or tax professional to understand how your specific business structure affects your 401(k) contribution limits.

If you’re an employee, you’ll have a specific limit on how much you can contribute to your 401k. Learn about the 2024 401k contribution limits for employees to maximize your retirement savings.

Tax Implications of 401(k) Contributions: 401k Contribution Limits For 2024 For Self-employed

Self-employed individuals have the advantage of contributing to a 401(k) plan, which offers significant tax benefits. These benefits can significantly reduce your tax liability and help you save for retirement.The primary tax advantage of contributing to a 401(k) is the ability to defer taxes on your contributions and earnings until retirement.

This means that you don’t have to pay taxes on the money you contribute to your 401(k) until you withdraw it in retirement. This can be a significant savings, especially if you are in a high tax bracket.

Traditional vs. Roth 401(k) Contributions

The tax implications of 401(k) contributions depend on whether you choose a traditional or Roth 401(k).

- Traditional 401(k):With a traditional 401(k), your contributions are pre-tax, meaning you deduct them from your taxable income. This lowers your current tax liability. However, you will have to pay taxes on the money you withdraw in retirement.

- Roth 401(k):With a Roth 401(k), your contributions are made with after-tax dollars. This means you don’t get a tax deduction for your contributions, but you won’t have to pay taxes on the money you withdraw in retirement.

How 401(k) Contributions Reduce Taxable Income

When you contribute to a traditional 401(k), the amount you contribute is deducted from your adjusted gross income (AGI) before calculating your taxable income. This reduces your taxable income, leading to lower taxes in the current year.For example, if you have a taxable income of $100,000 and contribute $20,000 to a traditional 401(k), your taxable income will be reduced to $80,000.

This means you will pay taxes on a lower income, potentially saving you a significant amount in taxes.

Example:If your marginal tax rate is 25%, contributing $20,000 to a traditional 401(k) will save you $5,000 in taxes ($20,000 x 0.25).

Wrap-Up

Navigating the world of self-employed 401(k) contributions can feel overwhelming, but with careful planning and a thorough understanding of the rules, you can create a robust retirement savings strategy. By maximizing your contributions, taking advantage of catch-up provisions, and staying informed about tax implications, you can set yourself up for a secure financial future.

Remember, your retirement is an investment worth prioritizing, and a self-employed 401(k) plan offers a powerful tool to achieve your financial goals.

FAQs

What is the difference between a traditional and Roth 401(k)?

A traditional 401(k) allows you to contribute pre-tax dollars, reducing your current taxable income. Your contributions grow tax-deferred, and you pay taxes on withdrawals in retirement. A Roth 401(k) uses after-tax contributions, meaning you don’t receive a tax deduction upfront.

However, your withdrawals in retirement are tax-free.

How do I choose between a traditional and Roth 401(k)?

The best choice depends on your individual tax situation and future income expectations. If you expect to be in a lower tax bracket in retirement, a traditional 401(k) might be advantageous. If you expect to be in a higher tax bracket in retirement, a Roth 401(k) could be more beneficial.

Can I withdraw from my self-employed 401(k) before retirement?

You can withdraw from your self-employed 401(k) before retirement, but you may face penalties and taxes. Early withdrawals are generally allowed for certain situations, such as buying a first home, paying for education, or experiencing a hardship. It’s crucial to consult with a financial advisor before making any withdrawals.

How often can I contribute to my self-employed 401(k)?

You can contribute to your self-employed 401(k) as often as you’d like, as long as you don’t exceed the annual contribution limits. Many individuals choose to make contributions on a regular schedule, such as monthly or quarterly, to ensure they meet their savings goals.

The IRA contribution limits can vary based on your age. Check out the Ira contribution limits for 2024 by age page to see what applies to you.

If you’re self-employed, there are specific IRA contribution limits you need to be aware of. The Ira contribution limits for self-employed in 2024 will provide all the necessary information.