401k contribution limits for 2024 by age are a crucial factor in maximizing your retirement savings. As you navigate the complexities of retirement planning, understanding these limits and how they apply to you is essential. The annual contribution limit sets the maximum amount you can contribute to your 401k plan each year, while the catch-up contribution limit allows those 50 and older to contribute even more to their retirement nest egg.

This guide explores the intricacies of these limits, shedding light on how age plays a significant role in shaping your retirement savings journey.

Whether you’re just starting your career or approaching retirement, knowing the 401k contribution limits for your age group can empower you to make informed decisions about your financial future. We’ll delve into the specific limits for different age groups, providing a clear understanding of the maximum contributions you can make.

This information will empower you to make strategic decisions that can significantly impact your retirement security.

Retirement Planning Strategies: 401k Contribution Limits For 2024 By Age

Retirement planning is crucial for securing your financial future and ensuring a comfortable lifestyle during your golden years. A well-crafted retirement savings plan can help you achieve your financial goals and live a fulfilling life after you stop working.

Are you eligible for any tax credits? Many credits are available, and knowing which ones you qualify for can significantly reduce your tax bill. Learn about the different tax credits for the October 2024 deadline and see how they can benefit you.

Retirement Savings Plan Development

Developing a retirement savings plan requires careful consideration of your financial goals, time horizon, and risk tolerance. The following steps can help you create a comprehensive plan:

- Determine Your Retirement Goals:Start by defining your desired retirement lifestyle. Consider your desired income, expenses, and travel plans.

- Estimate Your Retirement Expenses:Research average retirement expenses in your area. Factor in housing costs, healthcare, travel, and entertainment.

- Calculate Your Savings Needs:Use online calculators or consult with a financial advisor to determine how much you need to save for retirement.

- Choose a Retirement Savings Strategy:Decide on a mix of retirement savings vehicles, such as 401(k)s, IRAs, and Roth IRAs, that best suit your needs.

- Set Realistic Savings Goals:Break down your overall savings goal into smaller, achievable targets.

- Monitor and Adjust Your Plan:Regularly review your progress and make adjustments as needed to ensure you stay on track.

Contribution Limits in Retirement Planning

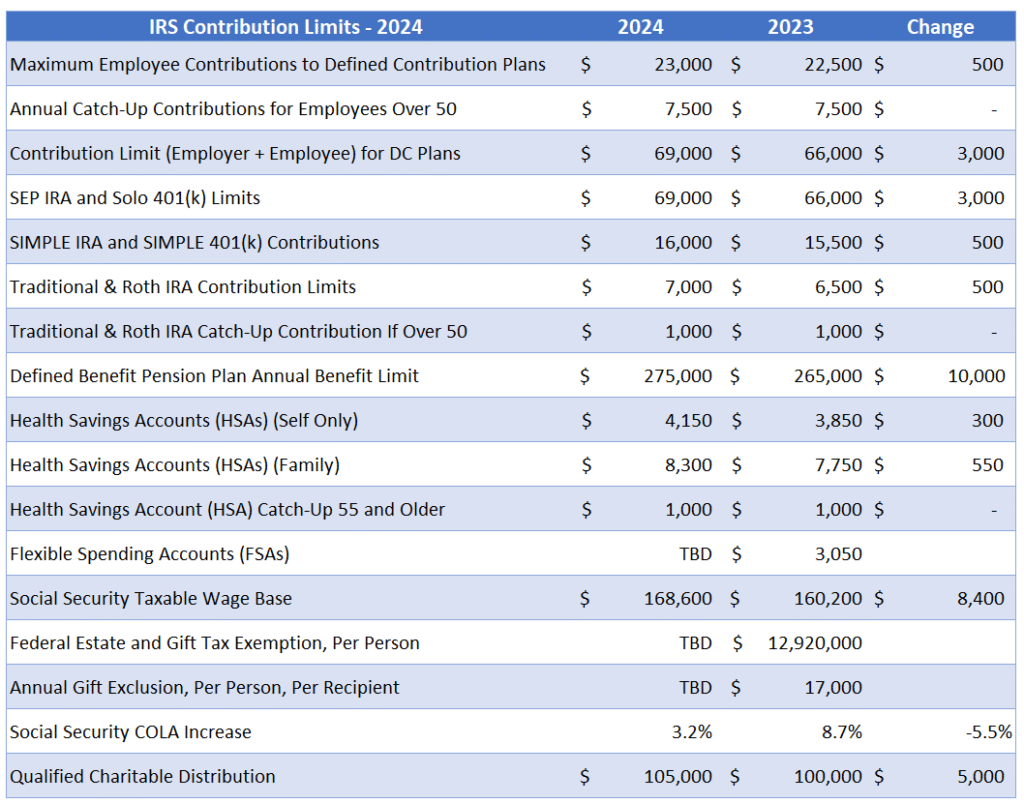

Contribution limits play a significant role in retirement planning. Understanding and utilizing these limits can maximize your savings potential.

Planning to contribute to your IRA this year? It’s helpful to know the contribution limits for both 2023 and 2024. Check out this article for a breakdown of IRA contribution limits for 2024 vs 2023. It will give you a clear picture of how much you can contribute to your IRA.

Contribution limits represent the maximum amount you can contribute to a specific retirement account annually.

The tax deadline for retirees in October 2024 might be different from the usual April deadline. It’s crucial to be aware of the specific deadline for your situation. Find out more about the October 2024 tax deadline for retirees and avoid any penalties.

- Maximize Your Contributions:Aim to contribute the maximum allowed to your retirement accounts each year. This will accelerate your savings growth.

- Consider Catch-Up Contributions:Individuals aged 50 and older are eligible for catch-up contributions, which allow them to contribute additional amounts beyond the regular limit.

- Stay Informed About Limit Changes:Contribution limits are adjusted annually, so it’s essential to stay updated on any changes.

Maximizing Retirement Savings through 401(k) Contributions, 401k contribution limits for 2024 by age

(k) plans offer tax advantages and employer matching contributions, making them a powerful tool for retirement savings.

If you’re planning a long road trip this October, it’s good to know the current mileage reimbursement rate. You can find the latest information on what is the mileage reimbursement rate for October 2024. This will help you determine how much you can claim back for your travel expenses.

- Take Advantage of Employer Matching:Always contribute enough to your 401(k) to receive the full employer match. This is free money that boosts your retirement savings.

- Consider Automatic Increases:Set up automatic contribution increases to your 401(k) over time. This helps you gradually increase your savings without having to manually adjust them.

- Allocate Funds Wisely:Diversify your 401(k) investments across different asset classes, such as stocks, bonds, and real estate.

- Review Investment Options:Periodically review your 401(k) investment options to ensure they align with your risk tolerance and retirement goals.

Last Point

Navigating the world of 401k contribution limits can seem daunting, but understanding the nuances can be empowering. By understanding the age-based limits, catch-up contribution options, and the tax advantages of contributing to a 401k plan, you can make informed decisions that can significantly impact your financial future.

Remember, maximizing your contributions, especially with the help of catch-up contributions, can accelerate your journey towards a comfortable and secure retirement. Take the time to explore your options and work with a financial advisor to develop a personalized retirement savings plan that aligns with your goals and aspirations.

FAQs

What happens if I contribute more than the 401k contribution limit?

If you exceed the annual contribution limit, you may be subject to penalties and taxes. It’s essential to stay within the limits to avoid any unexpected financial repercussions.

Can I withdraw money from my 401k before retirement?

While you can generally withdraw money from your 401k before retirement, you may be subject to taxes and penalties. It’s best to consult with a financial advisor to understand the potential implications before making any withdrawals.

How do I know if my employer offers a 401k plan?

You can contact your Human Resources department or review your employee benefits package to determine if your employer offers a 401k plan. Many employers offer 401k plans as a valuable employee benefit.

If you’re receiving payments from a business, you’ll need to fill out a W9 form. This form provides the business with your tax information. To ensure you complete it correctly, refer to this guide on how to fill out W9 form for October 2024.

It will help you avoid any errors.

If you’re considering a Roth IRA, it’s important to understand the contribution limits for 2024. These limits can vary depending on your age and income. Get the details on IRA contribution limits for Roth IRA in 2024 to make informed decisions about your retirement savings.

Students have different tax deadlines compared to others. Make sure you’re aware of the specific deadline for filing your taxes in October 2024. Find out the October 2024 tax deadline for students and avoid any late filing penalties.

Tax season can be stressful, but with proper preparation, you can navigate it smoothly. There are many helpful tips and resources available. Check out these tax preparation tips for the October 2024 deadline to make the process easier.

Knowing your tax bracket is crucial for understanding your tax obligations. These brackets change from year to year. Learn about the tax bracket thresholds for 2024 and how they impact your tax liability.

If you’re a foreign national, you might have different tax rules and deadlines. It’s important to be aware of the specific requirements for filing your taxes in October 2024. Find out more about the October 2024 tax deadline for foreign nationals to ensure you comply with all regulations.

If you’re claiming medical expenses on your taxes, you’ll need to know the mileage rate for October 2024. This rate can be used to calculate the deductible expenses for your travel. Get the latest information on the October 2024 mileage rate for medical expenses and ensure your claim is accurate.

If you’re moving, you might be able to deduct some of your moving expenses. Knowing the mileage rate for October 2024 is crucial for calculating these expenses. Find out the October 2024 mileage rate for moving expenses and maximize your deductions.

IRA contribution limits are subject to change each year. Make sure you’re aware of the latest limits for 2024. Find out the IRA contribution limits for 2024 to make the most of your retirement savings.

If you’re self-employed, you can contribute to a solo 401(k) plan. These plans have specific contribution limits. Check out the IRA contribution limits for solo 401(k) in 2024 to ensure you’re maximizing your contributions.

Individuals over 50 have a higher contribution limit for their IRAs. This allows them to catch up on their retirement savings. Find out the IRA contribution limits for people over 50 in 2024 to see how much you can contribute.