401k contribution limits 2024 vs 2023 are a hot topic for anyone saving for retirement. The annual adjustments to these limits can significantly impact your retirement savings strategy, especially if you’re close to retirement or have a high income.

Understanding these changes is crucial for maximizing your contributions and building a secure financial future. This article will break down the new limits, explain their impact, and provide tips for maximizing your contributions in 2024.

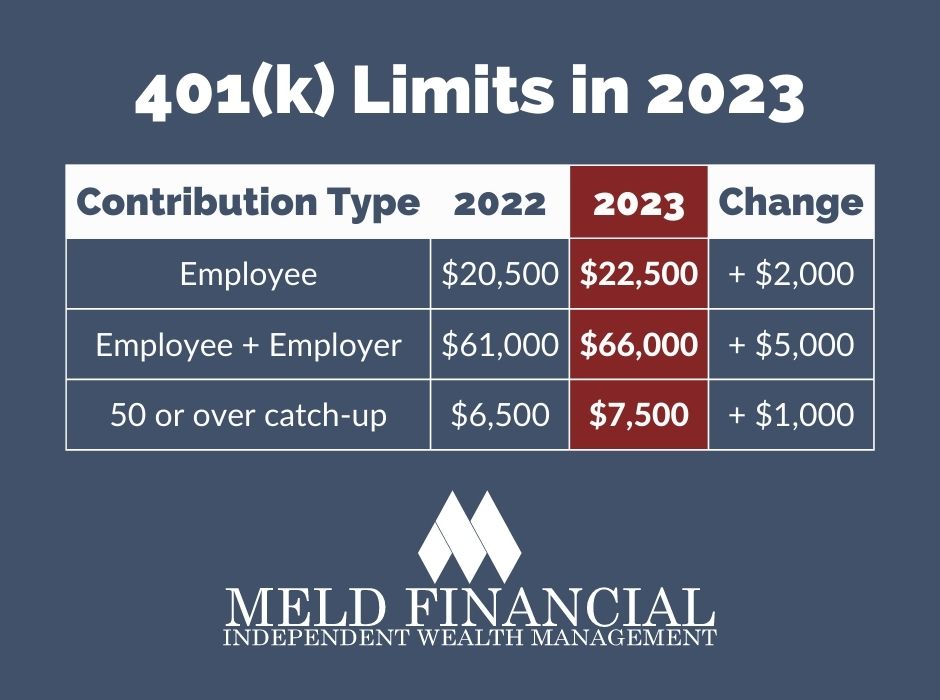

The 2024 contribution limit for 401(k) plans is set at $22,500, a slight increase from the 2023 limit of $22,500. For those aged 50 and over, the catch-up contribution limit is $7,500, remaining unchanged from 2023. These adjustments reflect the ongoing need to adjust for inflation and ensure retirement savings keep pace with rising costs.

However, the impact of these changes can vary depending on your individual circumstances and financial goals.

Impact of Contribution Limit Changes: 401k Contribution Limits 2024 Vs 2023

The increase in the 401(k) contribution limit for 2024 presents both opportunities and challenges for individuals and employers. While the higher limit allows for more substantial retirement savings, it also requires careful planning and consideration of individual circumstances.

The tax brackets for head of household can be significantly different from other filing statuses, so make sure you’re familiar with them.

Impact on Individuals’ Retirement Savings Strategies, 401k contribution limits 2024 vs 2023

The increased contribution limit provides individuals with a greater opportunity to save for retirement. This can be particularly beneficial for those who are early in their careers and have a longer time horizon to benefit from compound growth. By contributing the maximum amount, individuals can potentially accelerate their savings and reach their retirement goals sooner.

The IRS has a wealth of resources available to help you navigate the tax process, especially during the busy October 2024 deadline. This link will guide you to some of the most helpful tools and information.

Impact on Individuals Nearing Retirement or with a High Income

Individuals nearing retirement may find the increased limit particularly helpful as they strive to accumulate a larger nest egg. However, they may also face limitations due to income thresholds for catch-up contributions. For those with high incomes, the higher contribution limit can help them maximize their retirement savings, but it’s important to note that the amount of contributions that can be deducted for tax purposes is capped.

Are you looking to take advantage of any tax credits before the October 2024 deadline? This article outlines some of the most common credits available to taxpayers.

Impact on Employers Who Contribute to 401(k) Plans

Employers who match employee contributions may need to adjust their matching formulas to accommodate the higher contribution limit. This could potentially increase their overall costs associated with the 401(k) plan. However, it can also serve as a valuable tool to attract and retain talent, as employees appreciate employer contributions to their retirement savings.

If you’re filing as married filing separately, you’ll want to check out the tax brackets for 2024 to see how your income will be taxed.

Final Review

Navigating 401k contribution limits in 2024 requires careful planning and consideration. Understanding the new limits, their potential impact, and available strategies can help you make informed decisions about your retirement savings. Whether you’re just starting out or nearing retirement, it’s essential to stay informed and make the most of these valuable tools to build a secure financial future.

Remember, your retirement is a journey, and the choices you make today will have a lasting impact on your future.

FAQ Resource

What are the penalties for exceeding the 401(k) contribution limit?

If you exceed the 401(k) contribution limit, you may face a 10% penalty on the excess contribution. Additionally, the excess contribution will be taxed as ordinary income in the year it was made. It’s important to carefully track your contributions to avoid exceeding the limit.

Can I contribute to both a 401(k) and an IRA in 2024?

Yes, you can contribute to both a 401(k) and an IRA in 2024. However, the total amount you contribute to both plans combined may be subject to certain limits. It’s best to consult with a financial advisor to determine the best strategy for your individual situation.

How do I know if I’m eligible for the catch-up contribution limit?

You’re eligible for the catch-up contribution limit if you are 50 years of age or older by the end of the year. This applies to both traditional and Roth 401(k) plans.

What are the tax implications of 401(k) contributions?

Traditional 401(k) contributions are tax-deductible, meaning you can reduce your taxable income by the amount you contribute. However, you will pay taxes on the distributions when you withdraw them in retirement. Roth 401(k) contributions are made with after-tax dollars, but your distributions in retirement are tax-free.

It’s important to consider your individual tax situation when deciding between traditional and Roth 401(k) plans.

If you use your car for business purposes, you’ll need to know the mileage rate for October 2024 to calculate your deductions.

Wondering what the highest tax bracket is in 2024? This article will provide you with the details.

If you’re a trust, you’ll need to fill out a W9 form for tax purposes. This article explains the process and requirements for the October 2024 deadline.

If you’re getting reimbursed for business mileage, you’ll need to know the mileage reimbursement rate for October 2024.

Individuals over 50 have a higher contribution limit for their 401k. This article breaks down the specific limits for 2024.

Several tax changes have impacted the October 2024 deadline. This article highlights some of the key changes to keep in mind.

If you’re a foreign national living in the United States, you’ll need to file your taxes by the October 2024 deadline. This article outlines the specific filing requirements for foreign nationals.

Self-employed individuals have a different tax deadline than those who work for an employer. This article explains the October 2024 deadline for self-employed individuals.

While you can’t deduct mileage for driving to work, you might be able to deduct it for other work-related travel. This article covers the rules and regulations for mileage deductions.

The Seahawks’ comeback attempt fell short in their Week 5 loss. Read this article for a breakdown of the game and what went wrong.

With the new year comes new tax brackets. This article details the updated tax brackets for 2024.