401k contribution limits 2024 for different income levels are a crucial factor in retirement planning. Understanding these limits can help you maximize your contributions and secure a comfortable future. In 2024, the IRS has set specific contribution limits based on your income, which can significantly impact how much you can save for retirement.

This guide will explore these limits, the advantages of maximizing your contributions, and the implications of exceeding the income thresholds.

We’ll also delve into the catch-up contribution limits available to those aged 50 and over, providing valuable insights into how to accelerate your retirement savings. Additionally, we’ll discuss key factors that influence your contribution decisions, such as age, income, risk tolerance, and retirement goals.

By understanding these factors, you can develop a personalized 401k contribution strategy that aligns with your individual circumstances and helps you achieve your retirement aspirations.

Understanding 401(k) Contribution Limits

Retirement planning is crucial, and a 401(k) plan is a valuable tool to help you save for your golden years. 401(k) contribution limits are the maximum amounts you can contribute to your plan each year. Understanding these limits is essential for maximizing your retirement savings and ensuring you’re taking full advantage of the benefits offered.

Contribution Limits and Their Significance

Contribution limits play a vital role in your retirement planning by dictating the maximum amount you can save annually. The higher the limit, the more you can potentially save for your future. These limits are set by the IRS and are subject to change each year.

Contribution Limits Based on Income Levels

For 2024, the maximum amount you can contribute to your 401(k) plan depends on your income. This is because the IRS has set income thresholds for contribution limits, particularly for those who choose Roth 401(k) plans.

Income Thresholds and Contribution Limits

The IRS has set income thresholds for both traditional and Roth 401(k) plans. These thresholds affect the amount you can contribute each year.

Taking the standard deduction can help you reduce your tax liability. You can find out how to claim the standard deduction on your 2024 taxes to ensure you’re taking advantage of all available deductions.

| Income Level | Traditional 401(k) Contribution Limit | Roth 401(k) Contribution Limit |

|---|---|---|

| Under $153,000 | $22,500 | $22,500 |

$153,000

|

$22,500 | $20,500 |

$160,000

|

$22,500 | $18,500 |

| $169,000

If you’re over 50, you have the advantage of contributing more to your 401k. You can find the 401k contribution limits for 2024 for over 50 to maximize your savings.

|

$22,500 | $16,500 |

$178,000

|

$22,500 | $14,500 |

| $187,000

Even if you’re working part-time, you can still contribute to an IRA. You can find out the IRA contribution limits for 2024 for part-time workers and start saving for your future.

|

$22,500 | $12,500 |

| $196,000

If you’re under 50, you can contribute a certain amount to your 401k. You can find the 401k contribution limit for 2024 for people under 50 and start saving for retirement.

|

$22,500 | $10,500 |

| $205,000

Running a small business? You can use a tax calculator for small businesses to estimate your taxes and plan for the year.

|

$22,500 | $8,500 |

| $214,000 or higher | $22,500 | $6,500 |

Implications of Exceeding Income Thresholds

Exceeding the income thresholds for Roth 401(k) plans can significantly impact your contribution limit. If your modified adjusted gross income (MAGI) exceeds the upper limit, you will not be able to contribute to a Roth 401(k).

This is because the Roth 401(k) plan is designed for those with lower to moderate income levels.

Knowing the tax rates for each bracket can help you understand how much you’ll owe in taxes. You can find the tax rates for each tax bracket in 2024 to plan your finances.

For instance, if your MAGI is $220,000, you will not be able to contribute to a Roth 401(k). This is because the contribution limit for this income bracket is $0.

It is important to note that these income thresholds and contribution limits are subject to change each year. You should consult with a financial advisor or refer to the IRS website for the most up-to-date information.

Catch-Up Contributions for Older Workers

Individuals aged 50 and over in 2024 have the opportunity to contribute an additional amount to their 401(k) accounts, known as catch-up contributions. This extra contribution allowance is designed to help older workers accelerate their retirement savings and potentially reach their financial goals.

Catch-Up Contribution Limits in 2024

Catch-up contributions provide an additional opportunity for older workers to bolster their retirement savings. In 2024, individuals aged 50 and over can contribute an extra $7,500 to their 401(k) accounts on top of the regular contribution limit of $22,500. This means that older workers can contribute up to $30,000 in total to their 401(k) accounts in 2024.

Curious about how much you can contribute to your 401k in 2024? Check out the maximum contribution limits for 2024 and start saving for your retirement.

Benefits of Catch-Up Contributions

Catch-up contributions offer several advantages for older workers looking to maximize their retirement savings:* Accelerated Retirement Savings:Catch-up contributions allow older workers to contribute significantly more to their 401(k) accounts, potentially accelerating their retirement savings growth.

The standard deduction amount can help you save money on your taxes. You can find out the standard deduction amount for the 2024 tax year and see if it benefits you.

Compounding Returns

By contributing more, older workers can take advantage of the power of compounding returns, allowing their investments to grow at an exponential rate over time.

Increased Retirement Security

Catch-up contributions can help older workers build a larger nest egg, increasing their financial security in retirement.

It’s always a good idea to check if you can take the standard deduction on your taxes. You can find out if you can claim the standard deduction in 2024 and how much you can deduct. This can help you save money on your taxes.

Examples of Catch-Up Contribution Impact, 401k contribution limits 2024 for different income levels

Consider two individuals, both aged 55, with the same salary and starting 401(k) balances. One individual utilizes catch-up contributions, while the other does not. Assuming a 7% average annual return, the individual utilizing catch-up contributions could potentially have a significantly larger retirement nest egg by the time they reach age 65.

Example:Individual A contributes $22,500 annually, while Individual B contributes $30,000 annually. Over a 10-year period, Individual B could accumulate a retirement balance that is significantly larger than Individual A’s, illustrating the potential impact of catch-up contributions.

Planning for retirement? It’s never too early to start. You can find the 401k contribution limits for 2024 by age to see how much you can contribute based on your age. This can help you plan your savings strategy and maximize your retirement contributions.

Factors Influencing Contribution Decisions

Deciding how much to contribute to your 401(k) is a crucial step in planning for a comfortable retirement. Several factors influence this decision, each with its own implications for your long-term financial well-being.

Wondering about the 401k contribution limits for 2024? You can find the 401k contribution limits for 2024 to help you plan your retirement savings.

Age

Your age plays a significant role in determining your contribution strategy. Younger individuals have a longer time horizon to accumulate wealth, allowing them to take on more risk. They can potentially contribute a higher percentage of their income, aiming for maximum employer matching contributions and maximizing the power of compound interest.

Conversely, older workers with a shorter time horizon may prioritize lower-risk investments and focus on maximizing contributions closer to retirement.

Income

Your income level directly affects your contribution capacity. Higher earners have more disposable income to allocate towards retirement savings. However, even individuals with modest incomes can benefit from contributing regularly, even if it’s a smaller percentage. The key is to prioritize consistent contributions over time.

Risk Tolerance

Risk tolerance reflects your comfort level with the potential for investment losses. Younger individuals with a longer investment timeline may be more comfortable with higher-risk investments, as they have time to recover from potential losses. Older workers with a shorter time horizon may prefer lower-risk investments to protect their savings.

Retirement Goals

Your retirement goals are the foundation of your contribution strategy. Determine your desired lifestyle and expenses in retirement to estimate your financial needs. This information will help you set realistic savings goals and adjust your contribution levels accordingly.

Contribution Strategies and Their Impact

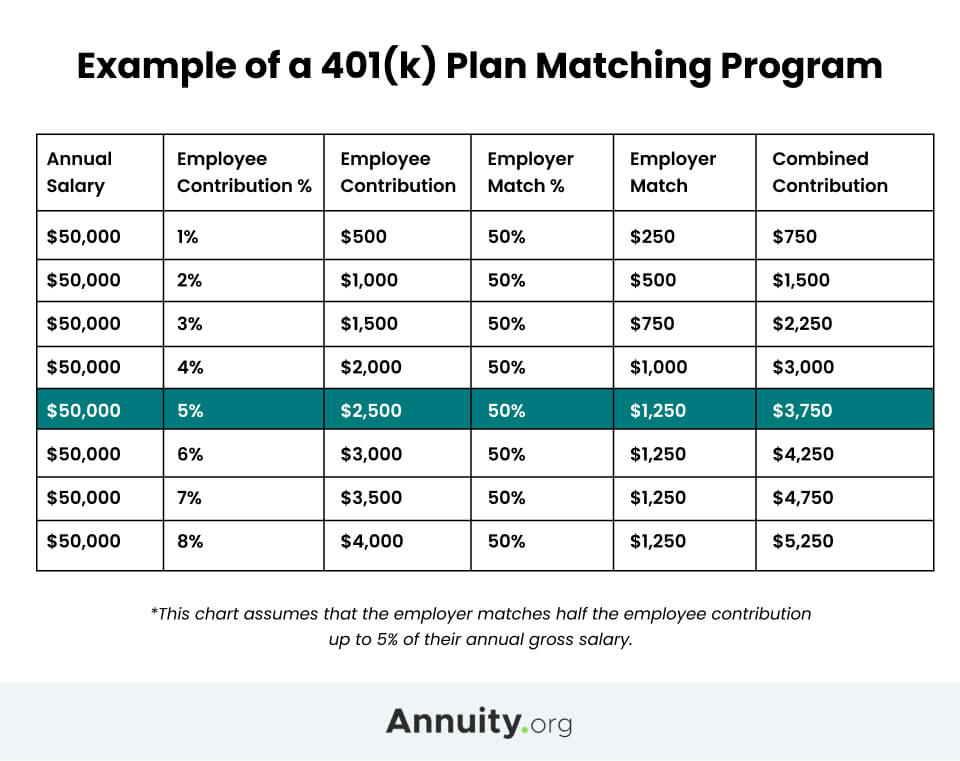

Maximizing Employer Matching

Many employers offer matching contributions, essentially providing free money for retirement savings. Take full advantage of employer matching, as it directly increases your retirement savings.

Dollar-Cost Averaging

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This strategy helps mitigate the impact of market volatility and reduces the risk of buying high and selling low.

Contribution Rate Increases Over Time

Gradually increasing your contribution rate over time can help you reach your retirement goals faster. This approach allows you to adjust your savings to your income growth and changing financial circumstances.

Tax brackets can affect your income, so it’s important to understand how they work. You can find out how tax brackets will affect your 2024 income to make informed financial decisions.

“The earlier you start saving, the more time your money has to grow through compound interest. Even small contributions can make a big difference over the long term.”

401(k) Contribution Strategies

Now that you understand the basics of 401(k) contribution limits, let’s delve into some strategies to maximize your retirement savings.

Dollar-Cost Averaging

Dollar-cost averaging is a strategy that involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This helps to smooth out the impact of volatility and reduce the risk of buying high and selling low. In the context of 401(k) contributions, dollar-cost averaging means contributing the same amount of money to your 401(k) each pay period, regardless of how the market is performing.

Freelancers have unique tax needs. You can use a tax calculator for freelancers to estimate your taxes and plan your financial strategy.

This approach helps to reduce the risk of timing the market, as you’re buying more shares when prices are low and fewer shares when prices are high.

Dollar-cost averaging is a simple yet effective way to invest consistently over time, minimizing the impact of market fluctuations.

Contribution Strategies

There are several different 401(k) contribution strategies, each with its own advantages and disadvantages.

Lump-Sum Contributions

A lump-sum contribution involves investing a large amount of money into your 401(k) all at once. This strategy can be beneficial if you have a large sum of money available and want to take advantage of potential market growth. However, it can also be risky, as you’re essentially betting on the market’s direction.

Regular Contributions

Regular contributions involve making consistent contributions to your 401(k) over time, such as monthly or bi-weekly. This strategy is less risky than a lump-sum contribution, as it helps to smooth out market volatility. Regular contributions also make it easier to budget for retirement savings.

Catch-Up Contributions

Catch-up contributions allow individuals aged 50 and older to contribute more to their 401(k) each year. This can be a valuable strategy for older workers who want to make up for lost time or increase their retirement savings.

Need to know the mileage rate for October 2024? You can find it by checking the IRS website or other reliable sources. This rate is used for business expenses and moving expenses.

Developing a Personalized 401(k) Contribution Strategy

The best 401(k) contribution strategy for you will depend on your individual circumstances, such as your age, income, risk tolerance, and financial goals. Here are some practical tips for developing a personalized strategy:

- Determine your financial goals:How much money do you need to save for retirement? What are your other financial goals, such as buying a house or paying for your children’s education?

- Assess your risk tolerance:How comfortable are you with market volatility? If you’re risk-averse, you may want to consider a more conservative investment strategy.

- Consider your income and expenses:How much can you afford to contribute to your 401(k) each month? How will your contributions impact your overall budget?

- Explore your employer’s matching contributions:Many employers offer matching contributions to their employees’ 401(k) plans. This is essentially free money, so be sure to take advantage of it.

- Review your investment options:Your 401(k) plan will offer a variety of investment options, such as mutual funds, ETFs, and target-date funds. Research the different options and choose investments that align with your risk tolerance and financial goals.

Tax Implications of 401(k) Contributions: 401k Contribution Limits 2024 For Different Income Levels

The tax benefits of contributing to a 401(k) plan are significant and can help you save for retirement. There are two main types of 401(k) plans: traditional and Roth. Each offers different tax advantages, and understanding these differences can help you decide which plan is right for you.

Tax Advantages of Traditional and Roth 401(k) Contributions

The tax treatment of traditional and Roth 401(k) contributions differs significantly. Here’s a breakdown of the key differences:

Traditional 401(k)

- Pre-tax contributions: Your contributions are deducted from your gross income before taxes are calculated, reducing your taxable income and potentially your tax liability.

- Tax-deferred growth: Earnings on your contributions grow tax-deferred, meaning you won’t owe taxes on them until you withdraw the money in retirement.

- Taxable withdrawals in retirement: When you withdraw funds from a traditional 401(k) in retirement, the withdrawals are taxed as ordinary income.

Roth 401(k)

- After-tax contributions: Your contributions are made with money that has already been taxed.

- Tax-free growth: Earnings on your contributions grow tax-free.

- Tax-free withdrawals in retirement: When you withdraw funds from a Roth 401(k) in retirement, both the contributions and earnings are tax-free.

Tax Implications of 401(k) Withdrawals in Retirement

While 401(k) contributions offer tax advantages, there are tax implications to consider when withdrawing funds in retirement.

Traditional 401(k) Withdrawals

- Taxable as ordinary income: All withdrawals from a traditional 401(k) are taxed as ordinary income in the year of withdrawal.

- Early withdrawal penalties: If you withdraw funds before age 59 1/2, you may have to pay a 10% penalty, in addition to the regular income tax.

- Required Minimum Distributions (RMDs): You are required to start taking withdrawals from a traditional 401(k) by age 72. Failure to do so can result in penalties.

Roth 401(k) Withdrawals

- Tax-free withdrawals: Qualified withdrawals from a Roth 401(k) are tax-free, both contributions and earnings.

- No early withdrawal penalties: You can withdraw your contributions from a Roth 401(k) at any time without penalty.

- No RMDs: You are not required to take withdrawals from a Roth 401(k) in retirement.

Moving in October 2024? You can use the October 2024 mileage rate for moving expenses to calculate your deductible moving expenses. This can help you save money on your taxes.

Optimizing 401(k) Contributions for Tax Efficiency

Choosing between a traditional and Roth 401(k) depends on your individual circumstances and tax situation. Here are some factors to consider when making your decision:

Traditional 401(k)

- Lower current income tax liability: If you expect to be in a lower tax bracket in retirement than you are now, a traditional 401(k) may be advantageous.

- Tax deduction in the present: The tax deduction on contributions can reduce your current tax liability.

Roth 401(k)

- Higher current income tax liability: If you expect to be in a higher tax bracket in retirement than you are now, a Roth 401(k) may be more beneficial.

- Tax-free withdrawals in retirement: You’ll avoid paying taxes on your withdrawals in retirement.

Additional Resources and Information

This section provides additional resources and information to further enhance your understanding of 401(k) contribution limits and retirement planning.

Navigating the complexities of retirement planning can be challenging. Fortunately, there are numerous resources available to help you make informed decisions about your financial future.

Reputable Sources for Further Research

Here are some reputable sources for further research on 401(k) contribution limits and retirement planning:

- Internal Revenue Service (IRS):The IRS website is an excellent starting point for information on 401(k) contribution limits, tax deductions, and other retirement-related matters. https://www.irs.gov/

- U.S. Department of Labor:The Department of Labor’s website provides information on retirement plans, including 401(k)s, and employee benefits. https://www.dol.gov/

- Financial Industry Regulatory Authority (FINRA):FINRA’s website offers resources on investing, retirement planning, and consumer protection. https://www.finra.org/

- Securities and Exchange Commission (SEC):The SEC’s website provides information on investing, retirement planning, and investor protection. https://www.sec.gov/

- The National Institute on Retirement Security (NIRS):NIRS is a non-profit organization that advocates for retirement security. Their website provides resources on retirement planning, including information on 401(k)s. https://www.nirs.org/

Contact Information for Financial Advisors

Consulting with a financial advisor can provide personalized guidance and support for your retirement planning. Here are some ways to find a qualified advisor:

- Financial Planning Association (FPA):The FPA is a professional organization for financial planners. Their website allows you to search for certified financial planners in your area. https://www.fpanet.org/

- National Association of Personal Financial Advisors (NAPFA):NAPFA is a professional organization for fee-only financial advisors. Their website allows you to search for advisors in your area. https://www.napfa.org/

- Certified Financial Planner Board of Standards (CFP Board):The CFP Board is a non-profit organization that certifies financial planners. Their website allows you to search for CFP professionals in your area. https://www.cfp.net/

Resource Guide

This resource guide provides links to relevant government websites, financial institutions, and retirement planning organizations:

| Category | Website | Description |

|---|---|---|

| Government | https://www.irs.gov/ | Internal Revenue Service (IRS)

|

| Government | https://www.dol.gov/ | U.S. Department of Labor

|

| Financial Institutions | https://www.fidelity.com/ | Fidelity Investments

|

| Financial Institutions | https://www.schwab.com/ | Charles Schwab

|

| Retirement Planning Organizations | https://www.nirs.org/ | The National Institute on Retirement Security (NIRS)

|

| Retirement Planning Organizations | https://www.aarp.org/ | AARP

|

Concluding Remarks

Navigating the world of 401k contributions can feel overwhelming, but with careful planning and a solid understanding of the limits and strategies involved, you can set yourself up for a secure and comfortable retirement. Remember, it’s never too early or too late to start saving, and every dollar you contribute today can make a significant difference in your future financial well-being.

Consult with a financial advisor to create a personalized retirement plan that meets your unique needs and goals.

Query Resolution

What happens if I exceed the income threshold for 401k contributions?

If your income exceeds the threshold, your contribution limit may be reduced or eliminated. This means you may not be able to contribute the full amount allowed for your age group.

Are there any penalties for exceeding the 401k contribution limit?

Yes, exceeding the limit may result in penalties. You may have to pay taxes and penalties on the excess contributions.

Can I contribute to both a traditional and Roth 401k?

No, you can only contribute to one type of 401k plan at a time. You must choose either a traditional or Roth 401k.

What are the tax implications of withdrawing funds from a 401k account before retirement?

Early withdrawals from a 401k account may be subject to taxes and penalties, depending on your age and the reason for the withdrawal.