401k contribution limit 2024 and Roth IRA limit: these are crucial figures for anyone planning their retirement. Understanding these limits and how they impact your savings strategy is essential. The 2024 contribution limits represent a significant opportunity to boost your retirement nest egg, but navigating the complexities of 401(k) and Roth IRA contributions can be daunting.

This guide will shed light on these limits, explore the key differences between these retirement savings plans, and provide insights to help you make informed decisions about your financial future.

The 401(k) contribution limit for 2024 is the maximum amount you can contribute to your employer-sponsored retirement plan. The Roth IRA contribution limit, on the other hand, sets the maximum amount you can contribute to a Roth IRA, a personal retirement savings account.

While both plans offer tax advantages, they differ in how taxes are applied. Understanding these differences and how they affect your individual circumstances is crucial for maximizing your retirement savings potential.

401(k) Contribution Limits for 2024

The 401(k) contribution limit is the maximum amount of money you can contribute to your 401(k) plan each year. This limit is set by the IRS and is adjusted annually to reflect inflation. The contribution limit is important because it affects how much you can save for retirement each year.

Contribution Limit for 2024

The maximum amount you can contribute to your 401(k) in 2024 is $24,500. This is an increase from the 2023 limit of $22,500.

The IRS mileage rate is used for deducting business expenses related to vehicle use. To find the current mileage rate for October 2024, visit this website here.

Impact of Age on Contribution Limit

If you are 50 years of age or older in 2024, you can contribute an additional $8,000 to your 401(k) on top of the regular contribution limit. This is known as the catch-up contribution. This allows older workers to save more for retirement.

Those over 50 years old have the opportunity to contribute more to their IRAs in 2024. The contribution limits for those over 50 are outlined here.

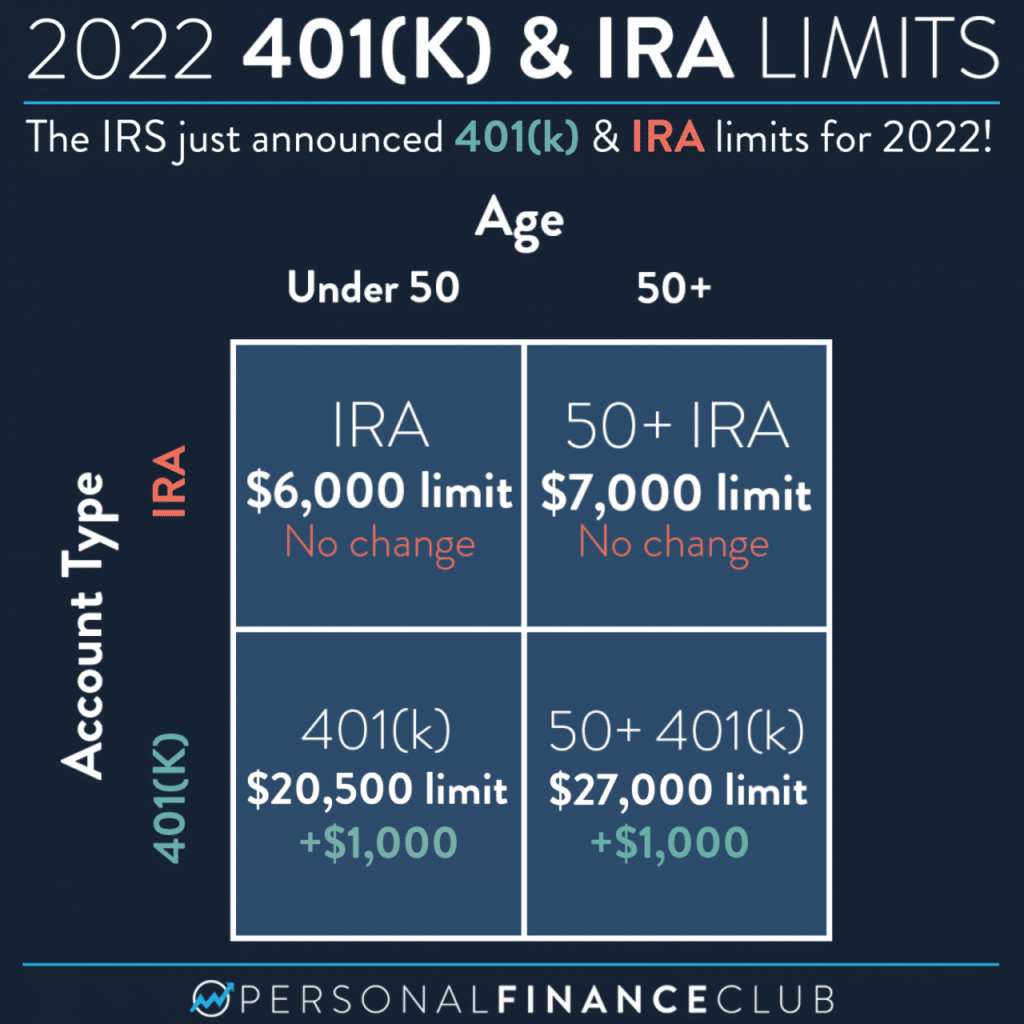

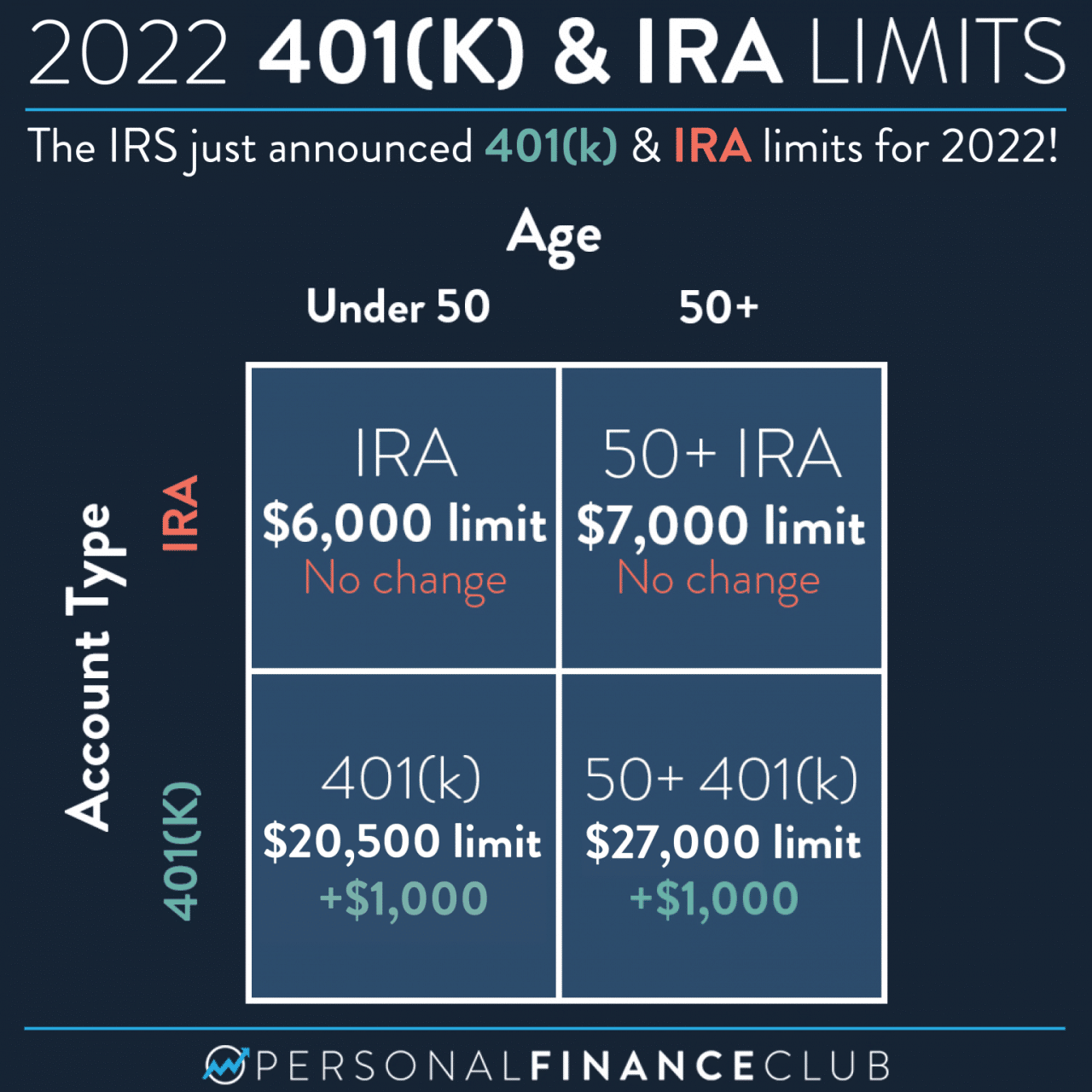

Contribution Limits in Previous Years

The following table shows the 401(k) contribution limits for the past few years:| Year | Contribution Limit | Catch-Up Contribution ||—|—|—|| 2023 | $22,500 | $7,500 || 2022 | $20,500 | $7,000 || 2021 | $19,500 | $6,500 || 2020 | $19,500 | $6,500 |

Roth IRA Contribution Limit for 2024

The Roth IRA is a popular retirement savings option that offers tax-free withdrawals in retirement. For 2024, the contribution limit for Roth IRAs remains the same as in 2023.

Families often have unique tax situations, making it important to use a tax calculator designed for families. You can find a tax calculator specifically for families in October 2024 here.

Contribution Limit

The maximum amount you can contribute to a Roth IRA in 2024 is $6,500. If you are 50 or older, you can contribute an additional $1,000as a catch-up contribution, bringing the total maximum contribution to $7,500.

The standard deduction for head of household in 2024 provides a valuable tax break for single parents or those who support a dependent. You can learn more about this deduction here.

Income Limits

While the Roth IRA offers tax-free withdrawals in retirement, there are income limits that may restrict your ability to contribute. For 2024, the income limits for Roth IRA contributions are as follows:

If your modified adjusted gross income (MAGI) is $153,000 or higheras a single filer, married filing separately, or head of household, you cannot contribute to a Roth IRA.

If your MAGI is $228,000 or higheras a married filing jointly or qualifying widow(er), you cannot contribute to a Roth IRA.

Self-employed individuals have unique 401(k) contribution limits in 2024. You can find more information about these limits here.

Contribution Limits Over Time, 401k contribution limit 2024 and Roth IRA limit

The following table shows the Roth IRA contribution limit for the past few years:| Year | Contribution Limit ||—|—|| 2023 | $6,500 || 2022 | $6,000 || 2021 | $6,000 || 2020 | $6,000 || 2019 | $6,000 |

Choosing Between 401(k) and Roth IRA

Both 401(k)s and Roth IRAs are popular retirement savings plans, but they differ in how they are taxed. Understanding these differences can help you choose the best option for your situation.

Tax Implications of 401(k) and Roth IRA Contributions

The main difference between 401(k)s and Roth IRAs lies in when you pay taxes on your contributions and earnings.

Partnerships have until October 2024 to file their tax returns, giving them extra time to finalize their financial records. You can find more information about this extension here.

- 401(k): Your contributions are made with pre-tax dollars, meaning you don’t pay taxes on them until you withdraw the money in retirement. This can result in significant tax savings during your working years. However, you will pay taxes on your withdrawals in retirement, and your withdrawals will be taxed as ordinary income.

Employees over 50 can contribute more to their 401(k) in 2024, taking advantage of “catch-up” contributions. You can find the contribution limits for employees over 50 here.

- Roth IRA: Your contributions are made with after-tax dollars, meaning you pay taxes on them upfront. However, your withdrawals in retirement are tax-free. This means you won’t have to pay taxes on your distributions, regardless of your tax bracket at that time.

Factors to Consider When Choosing Between a 401(k) and a Roth IRA

There are several factors to consider when choosing between a 401(k) and a Roth IRA, including your current tax bracket, your expected tax bracket in retirement, and your risk tolerance.

Married couples filing separately have unique tax brackets in 2024. To understand these brackets and their implications, check out this resource here.

- Current Tax Bracket: If you are in a high tax bracket now, a 401(k) may be more beneficial, as you will save on taxes immediately. However, if you expect to be in a lower tax bracket in retirement, a Roth IRA may be a better choice, as you will avoid taxes on your withdrawals.

- Expected Tax Bracket in Retirement: If you expect your tax bracket to be higher in retirement, a Roth IRA may be a better choice, as you will avoid taxes on your withdrawals. However, if you expect your tax bracket to be lower in retirement, a 401(k) may be a better choice, as you will save on taxes during your working years.

- Risk Tolerance: Roth IRAs generally offer more flexibility than 401(k)s, as you can withdraw your contributions (but not earnings) at any time without penalty. This can be helpful if you have a low risk tolerance and need access to your savings in the short term.

The maximum 401(k) contribution for 2024 is a significant amount, offering valuable tax benefits for retirement savings. Learn more about this limit here.

Advantages and Disadvantages of 401(k) and Roth IRA

Here are some advantages and disadvantages of each retirement savings plan:

401(k)

Advantages:

- Tax-deferred growth: Your money grows tax-free until you withdraw it in retirement.

- Employer matching contributions: Many employers offer matching contributions, which can significantly boost your retirement savings.

- Potential for higher contribution limits: 401(k) contribution limits are generally higher than Roth IRA limits.

Disadvantages:

The maximum 401(k) contribution for 2024 is subject to change, so it’s important to stay informed. You can find the latest information about this limit here.

- Taxable withdrawals in retirement: You will pay taxes on your withdrawals in retirement.

- Limited investment options: Your investment choices may be limited to the options offered by your employer.

- Potential for early withdrawal penalties: If you withdraw money before age 59 1/2, you may have to pay a 10% penalty, plus taxes on the withdrawal.

Roth IRA

Advantages:

- Tax-free withdrawals in retirement: You won’t have to pay taxes on your withdrawals in retirement, regardless of your tax bracket.

- Greater investment flexibility: You have more investment options with a Roth IRA than with a 401(k).

- Potential for tax-free withdrawals of contributions: You can withdraw your contributions at any time without penalty or taxes.

Disadvantages:

Tax brackets are constantly changing, so it’s essential to stay up-to-date. A tax calculator can help you determine your tax liability in October 2024 based on the latest tax brackets. You can find a helpful tax calculator here.

Key Differences Between 401(k) and Roth IRA

| Feature | 401(k) | Roth IRA ||—|—|—|| Contribution Type | Pre-tax | After-tax || Tax Treatment of Contributions | Tax-deferred | Taxed upfront || Tax Treatment of Withdrawals | Taxable in retirement | Tax-free in retirement || Contribution Limits | Higher | Lower || Investment Options | Limited to employer’s options | More flexible || Early Withdrawal Penalties | Yes | Yes (contributions only) || Eligibility | Generally available to employees | Income limits apply |

Government agencies require the W9 Form for tax reporting purposes. If you’re working with a government agency, be sure to familiarize yourself with the requirements for the W9 Form in October 2024, which you can find here.

Catch-Up Contributions

The catch-up contribution provision allows individuals aged 50 and older to contribute an additional amount to their retirement savings accounts, beyond the regular contribution limit. This provision is designed to help older workers make up for lost time in saving for retirement and potentially accelerate their retirement savings growth.

Capital gains are taxed differently than ordinary income. A tax calculator specifically designed for capital gains can help you understand your tax liability in October 2024. You can find a capital gains tax calculator here.

Catch-Up Contributions for 401(k)s

Individuals aged 50 and older can contribute an additional $7,500 to their 401(k) plans in 2024, on top of the regular contribution limit of $22,500. This means they can contribute up to $30,000 in total. This additional contribution can be a significant boost to retirement savings, especially for those who have not been able to save as much as they would have liked earlier in their careers.

Catch-Up Contributions for Roth IRAs

Similar to 401(k)s, individuals aged 50 and older can contribute an additional $1,000 to their Roth IRAs in 2024, on top of the regular contribution limit of $6,500. This brings their total contribution limit to $7,500.

Estates and trusts also have tax extension deadlines, just like individuals and partnerships. The extension deadline for estates and trusts in October 2024 is available here.

Benefits of Catch-Up Contributions

Catch-up contributions can significantly benefit retirement savings in several ways:

- Accelerated Savings:Catch-up contributions allow individuals to save more quickly, potentially boosting their retirement nest egg.

- Compounding Growth:By contributing more, individuals can take advantage of the power of compounding, allowing their savings to grow exponentially over time.

- Increased Retirement Income:Catch-up contributions can help individuals reach their retirement savings goals, potentially leading to a more comfortable retirement.

Example of Catch-Up Contributions

Consider a 55-year-old individual who has been contributing $10,000 annually to their 401(k) for the past 10 years. With a 7% average annual return, their account balance would be approximately $138,000. However, if they had utilized the catch-up contribution provision for the past five years, contributing an additional $7,500 each year, their account balance would be approximately $183,000, an increase of $45,000.

This illustrates the potential impact of catch-up contributions on retirement savings.

Retirement Planning Strategies

Retirement planning is a crucial aspect of financial well-being, and it involves a combination of strategies to ensure financial security during your post-working years. By combining contributions to both 401(k) and Roth IRA accounts, you can build a robust retirement savings plan.

Retirement Planning Strategies

A well-structured retirement plan incorporates both 401(k) and Roth IRA contributions to maximize your savings potential. This approach offers a blend of tax advantages and flexibility, allowing you to tailor your strategy to your individual circumstances.

IRA contribution limits in 2024 vary based on age. To find the specific limits for your age group, check out this helpful resource here.

Steps to Maximize Retirement Savings

- Determine Your Retirement Goals:Begin by defining your retirement aspirations, such as desired income, lifestyle, and travel plans. This clarity helps you set realistic savings targets.

- Estimate Your Retirement Expenses:Project your future expenses, factoring in housing, healthcare, travel, and leisure activities. This assessment provides a foundation for your savings plan.

- Maximize 401(k) Contributions:Take advantage of employer matching contributions to your 401(k) plan, as this is essentially free money. Aim to contribute at least the amount needed to secure the full match.

- Contribute to a Roth IRA:If eligible, consider contributing to a Roth IRA, which allows for tax-free withdrawals in retirement. Roth IRAs can complement your 401(k) savings.

- Diversify Your Investments:Spread your retirement savings across different asset classes, such as stocks, bonds, and real estate. Diversification helps mitigate risk and enhance potential returns.

- Rebalance Your Portfolio Regularly:Periodically adjust your investment allocation to maintain your desired risk profile. Rebalancing ensures that your portfolio stays aligned with your long-term goals.

- Review and Adjust Your Plan:Regularly assess your retirement plan, considering changes in your financial situation, investment performance, and retirement goals.

Sample Retirement Savings Plan

| Year | Age | Annual Income | 401(k) Contribution (Pre-Tax) | Roth IRA Contribution (After-Tax) | Total Contributions | Estimated Account Value (End of Year) |

|---|---|---|---|---|---|---|

| 2024 | 30 | $70,000 | $10,500 (15%) | $6,500 | $17,000 | $17,000 |

| 2025 | 31 | $75,000 | $11,250 (15%) | $6,500 | $17,750 | $35,825 |

| 2026 | 32 | $80,000 | $12,000 (15%) | $6,500 | $18,500 | $56,031 |

| 2027 | 33 | $85,000 | $12,750 (15%) | $6,500 | $19,250 | $78,044 |

| 2028 | 34 | $90,000 | $13,500 (15%) | $6,500 | $20,000 | $102,196 |

Assumptions:

- Annual investment return: 7% (a conservative estimate)

- No additional contributions after age 34

- No withdrawals before retirement

Calculating Retirement Savings Growth

To estimate the potential growth of your retirement savings over time, you can use the following formula:

Future Value = Present Value x (1 + Rate of Return)^Number of Years

For example, if you invest $10,000 today with an annual return of 7% for 30 years, the future value would be:

Future Value = $10,000 x (1 + 0.07)^30 = $76,122

This calculation demonstrates the power of compound interest over time. Even modest contributions can grow significantly over the long term.

Epilogue

Retirement planning is a journey, not a destination. Understanding the 401k contribution limit 2024 and Roth IRA limit is just one step in this journey. By staying informed about your options, carefully considering your financial situation, and actively managing your retirement savings, you can build a solid foundation for a comfortable and secure future.

Remember, the key to successful retirement planning lies in making informed decisions, taking proactive steps, and seeking professional guidance when needed.

FAQ Compilation: 401k Contribution Limit 2024 And Roth IRA Limit

Can I contribute to both a 401(k) and a Roth IRA in 2024?

Yes, you can contribute to both a 401(k) and a Roth IRA in 2024. However, you may be subject to income limitations for Roth IRA contributions. It’s important to review your income and determine your eligibility.

What happens if I exceed the 401(k) contribution limit for 2024?

If you exceed the 401(k) contribution limit, you may be subject to penalties. The IRS will assess a 10% penalty on the excess contribution, plus any applicable interest. It’s crucial to stay within the contribution limits to avoid penalties.

How do I know if a Roth IRA is right for me?

A Roth IRA may be a good option if you expect to be in a higher tax bracket in retirement than you are today. It allows you to withdraw your contributions and earnings tax-free in retirement. However, if you anticipate being in a lower tax bracket in retirement, a traditional IRA might be more beneficial.

What are the income limits for Roth IRA contributions in 2024?

The income limits for Roth IRA contributions vary based on your filing status. It’s best to check the IRS website for the most up-to-date information on income limitations.

Are there any penalties for withdrawing money from a 401(k) or Roth IRA before retirement?

Yes, there are penalties for withdrawing money from a 401(k) or Roth IRA before age 59 1/2. There are some exceptions, such as for first-time homebuyers, medical expenses, and educational expenses. However, it’s generally best to avoid early withdrawals to avoid penalties and maintain your retirement savings.