30 Year Mortgage sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. A 30-year mortgage is a popular choice for homebuyers, offering a lower monthly payment than shorter-term loans.

However, it also means paying more interest over the life of the loan. This guide will explore the intricacies of 30-year mortgages, delving into its benefits, drawbacks, and everything in between.

From understanding the core principles of loan terms, interest rates, and amortization to navigating the complexities of eligibility criteria and exploring various mortgage options, this guide provides a comprehensive overview. We will also delve into the financial implications of a 30-year mortgage, including interest accumulation and equity building.

Creditninja is a popular online lending platform known for its user-friendly interface and quick approval process. Creditninja can be a convenient option for borrowers seeking short-term loans with flexible repayment terms.

By examining the process of pre-approval and the home buying journey, we aim to equip readers with the knowledge necessary to make informed decisions.

Understanding 30-Year Mortgages

A 30-year mortgage is a type of loan used to finance the purchase of a home, with a repayment term of 30 years. This long-term commitment provides borrowers with lower monthly payments compared to shorter-term mortgages. Let’s delve into the key aspects of 30-year mortgages, including their advantages and disadvantages, and when they might be a suitable option.

Discover also offers a variety of home loan options to fit your needs. Discover Home Loans can help you secure the financing you need to achieve your dream of homeownership.

Core Principles of a 30-Year Mortgage

Understanding the core principles of a 30-year mortgage is crucial for making informed decisions. These principles include:

- Loan Terms:This refers to the agreed-upon repayment period, which in this case is 30 years. This long-term commitment allows borrowers to spread out their payments over a longer duration.

- Interest Rates:The interest rate determines the cost of borrowing. It’s typically expressed as an annual percentage rate (APR) and can vary depending on market conditions and borrower creditworthiness.

- Amortization:This refers to the gradual repayment of the loan principal over time. Each monthly payment includes both principal and interest components, with the interest portion gradually decreasing as the principal balance is paid down.

Advantages and Disadvantages

Like any financial product, 30-year mortgages have both advantages and disadvantages that borrowers should carefully consider:

- Advantages:

- Lower Monthly Payments:Spreading the repayment over 30 years results in significantly lower monthly payments, making homeownership more accessible to a wider range of borrowers.

- Predictable Budget:Fixed-rate mortgages offer predictable monthly payments, allowing borrowers to plan their budgets more effectively.

- Longer Time to Build Equity:While the interest paid over 30 years is substantial, borrowers gradually build equity in their homes as they make payments.

- Disadvantages:

- Higher Total Interest Paid:The longer repayment term means borrowers pay a greater amount of interest over the life of the loan.

- Less Flexibility:The long-term commitment can limit flexibility in the future, as borrowers may face challenges selling or refinancing their homes.

- Risk of Rising Interest Rates:While fixed-rate mortgages offer stability, borrowers with adjustable-rate mortgages may experience higher interest rates over time.

Real-World Scenarios for 30-Year Mortgages

While 30-year mortgages can be suitable for various situations, here are a few real-world scenarios where they might be a good choice:

- First-Time Homebuyers:Lower monthly payments can make homeownership more attainable for first-time buyers with limited savings.

- Budget-Conscious Borrowers:Individuals seeking predictable and manageable monthly expenses may find 30-year mortgages appealing.

- Long-Term Homeowners:Borrowers planning to live in their homes for an extended period might prefer the stability and affordability of a 30-year mortgage.

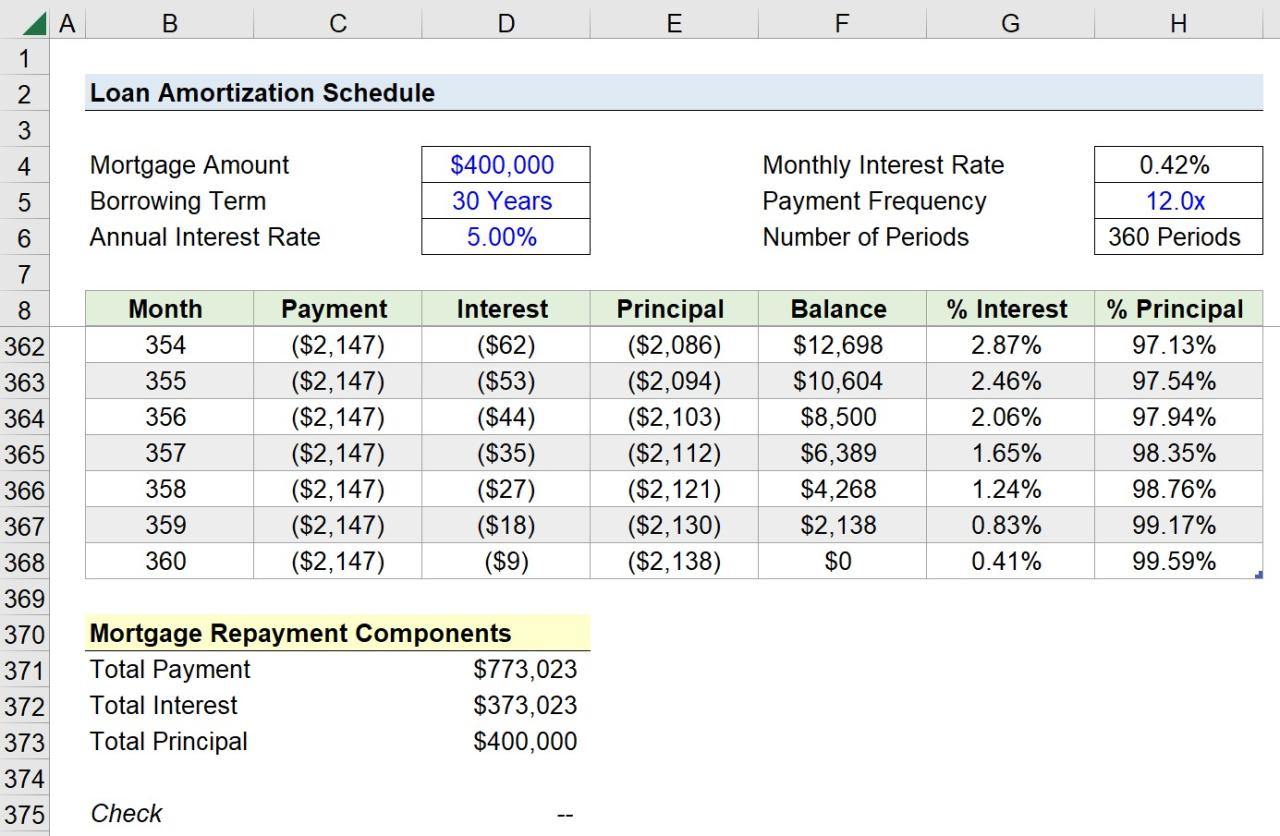

Calculating Mortgage Payments

Understanding how mortgage payments are calculated is essential for making informed decisions about your home financing. This section will guide you through the process of calculating monthly payments using a mortgage calculator and provide a breakdown of the payment components.

Finding a Legit Online Loan can be challenging. Be sure to research lenders thoroughly and understand the terms and conditions before making a decision.

Using a Mortgage Calculator

Mortgage calculators are readily available online and provide a convenient way to estimate monthly payments. To use a mortgage calculator, you’ll typically need to input the following information:

- Loan Amount:The total amount of the mortgage loan.

- Interest Rate:The annual percentage rate (APR) charged on the loan.

- Loan Term:The length of the mortgage, usually 30 years.

Once you’ve entered these details, the calculator will generate an estimated monthly payment amount.

Breakdown of a Typical Mortgage Payment

A typical mortgage payment consists of three main components:

| Component | Description |

|---|---|

| Principal | The portion of the payment that goes towards reducing the loan balance. |

| Interest | The cost of borrowing money, calculated as a percentage of the remaining loan balance. |

| Escrow | This includes payments for property taxes and homeowners insurance, which are often held in escrow by the lender. |

Impact of Interest Rates and Loan Amounts

The monthly payment amount is directly affected by the interest rate and the loan amount. Here’s how:

- Higher Interest Rates:Higher interest rates lead to larger monthly payments. For example, a 5% interest rate will result in higher monthly payments than a 4% interest rate, assuming all other factors remain constant.

- Larger Loan Amounts:Larger loan amounts also lead to higher monthly payments. A mortgage of $300,000 will have higher monthly payments than a mortgage of $250,000, assuming the interest rate and loan term are the same.

Factors Influencing Eligibility

Lenders carefully evaluate potential borrowers to assess their eligibility for a mortgage. This section will explore the key factors that lenders consider when making their decisions.

Credit Score

A strong credit score is a crucial factor in mortgage eligibility. Lenders use credit scores to assess your creditworthiness and risk. A higher credit score typically indicates a lower risk of default, making you a more attractive borrower.

Discover offers a range of financial products, including personal loans. Discover Personal Loans can be a convenient option for borrowers seeking competitive rates and flexible repayment terms.

Debt-to-Income Ratio (DTI)

Your DTI represents the percentage of your monthly income that goes towards debt payments. Lenders prefer borrowers with lower DTIs, as it suggests you have more financial flexibility to handle additional debt obligations.

Need cash quickly? Payday Advance Near Me can help you locate nearby lenders offering short-term loans. Remember to carefully consider the terms and costs before borrowing.

Income Verification

Lenders require proof of income to ensure you can afford the monthly mortgage payments. This typically involves providing documentation such as pay stubs, tax returns, or bank statements.

Square offers business loans to help entrepreneurs grow their ventures. Square Loans can be a convenient option for small business owners seeking quick and easy access to capital.

Down Payment Size and Loan-to-Value (LTV) Ratio

The down payment is the upfront cash contribution you make towards the purchase of a home. A larger down payment generally results in lower monthly payments and can improve your eligibility.

The LTV ratio is calculated by dividing the loan amount by the appraised value of the property. A lower LTV ratio (meaning a larger down payment) often leads to more favorable loan terms.

Understanding current interest rates is crucial when considering a home loan. Current Home Loan Interest Rates provides you with up-to-date information to make informed decisions about your home financing.

Mortgage Loan Programs and Eligibility Requirements

| Loan Program | Eligibility Requirements |

|---|---|

| Conventional Loans | Typically require a credit score of at least 620, a DTI of 43% or less, and a down payment of at least 3%. |

| FHA Loans | Offer more flexible eligibility requirements, including lower credit score requirements (580 for a 3.5% down payment) and DTI limits. |

| VA Loans | Available to eligible veterans, active-duty military personnel, and surviving spouses. These loans often require no down payment and have more lenient credit score requirements. |

Exploring Mortgage Options

The 30-year mortgage landscape offers various options to suit different needs and financial situations. This section will compare and contrast popular mortgage types, highlighting their benefits and drawbacks.

Freedom Plus offers a range of financial products, including personal loans for various purposes. Freedom Plus Loans can be a good option for borrowers seeking competitive rates and flexible repayment terms.

Fixed-Rate Mortgages

Fixed-rate mortgages offer a fixed interest rate for the entire loan term, providing predictable monthly payments and protection against interest rate fluctuations.

USAA is a well-known financial institution offering a variety of services, including auto loans. Usaa Auto Loan can be a good option for members seeking competitive rates and personalized service.

- Benefits:

- Predictable Payments:The fixed interest rate ensures consistent monthly payments, making budgeting easier.

- Protection Against Interest Rate Increases:Borrowers are shielded from rising interest rates, which can be beneficial in a volatile market.

- Drawbacks:

- May Have Higher Initial Interest Rates:Fixed-rate mortgages often have higher initial interest rates compared to adjustable-rate mortgages.

- Limited Flexibility:The fixed interest rate can limit the ability to take advantage of lower interest rates in the future.

Adjustable-Rate Mortgages (ARMs)

ARMs feature an initial fixed interest rate that adjusts periodically based on a predetermined index. This can lead to lower initial payments but carries the risk of higher payments later on.

When you’re in a bind and need cash quickly, I Need Cash Now can help you explore various loan options to get the funds you need.

- Benefits:

- Lower Initial Payments:The initial fixed interest rate is often lower than fixed-rate mortgages, making them attractive for borrowers seeking lower monthly payments.

- Potential for Lower Long-Term Costs:If interest rates decline, the adjusted interest rate may be lower than a fixed-rate mortgage.

- Drawbacks:

- Risk of Interest Rate Increases:If interest rates rise, the adjusted interest rate could lead to significantly higher monthly payments.

- Less Predictability:The fluctuating interest rate makes budgeting less predictable and can create financial uncertainty.

FHA Loans, 30 Year Mortgage

FHA loans are government-insured mortgages that offer more flexible eligibility requirements, including lower down payments and credit score requirements. They are designed to make homeownership more accessible to borrowers with limited resources.

If you’re looking to lower your monthly payments or secure a better interest rate, Refinancing A Car can be a smart financial move. Be sure to compare offers from different lenders to find the best deal for you.

- Benefits:

- Lower Down Payment Requirements:FHA loans allow for lower down payments, often as low as 3.5%, making them attractive to first-time homebuyers.

- More Lenient Credit Score Requirements:FHA loans have more lenient credit score requirements compared to conventional loans.

- Drawbacks:

- Mortgage Insurance Premiums:FHA loans require mortgage insurance premiums, which are added to the monthly payments.

- Stricter Property Requirements:FHA loans have stricter property requirements, which can limit the available housing options.

Key Features and Characteristics of Popular Mortgage Options

| Mortgage Type | Interest Rate | Down Payment | Eligibility Requirements | Benefits | Drawbacks |

|---|---|---|---|---|---|

| Fixed-Rate Mortgage | Fixed for the loan term | Typically 3% or more | Strong credit score, low DTI | Predictable payments, protection against interest rate increases | May have higher initial interest rates, limited flexibility |

| Adjustable-Rate Mortgage (ARM) | Fixed initially, then adjusts periodically | Typically 3% or more | Strong credit score, low DTI | Lower initial payments, potential for lower long-term costs | Risk of interest rate increases, less predictability |

| FHA Loan | Fixed or adjustable | As low as 3.5% | Lower credit score requirements, more lenient DTI | Lower down payment requirements, more accessible to borrowers with limited resources | Mortgage insurance premiums, stricter property requirements |

Final Thoughts

Understanding the intricacies of a 30-year mortgage is crucial for any prospective homebuyer. This guide has provided a comprehensive overview, encompassing key factors such as eligibility, loan options, closing costs, and financial considerations. Armed with this knowledge, you can navigate the home buying process with confidence, making informed decisions that align with your financial goals and aspirations.

Remember, seeking professional advice from a mortgage lender or financial advisor is essential to ensure you choose the right mortgage option for your unique circumstances.

Planning a road trip in an RV? Rv Loan Rates can help you secure the financing you need to hit the open road with your dream RV.

Q&A: 30 Year Mortgage

What are the typical interest rates for a 30-year mortgage?

Interest rates for 30-year mortgages vary depending on factors like market conditions, credit score, and loan amount. It’s best to consult with a lender for current rates.

A Secured Loan is a type of loan backed by an asset, offering potential benefits like lower interest rates and greater approval chances.

How much down payment is required for a 30-year mortgage?

Looking for a way to consolidate debt or cover unexpected expenses? Personal installment loans can provide the financial flexibility you need, offering fixed monthly payments and a clear repayment plan.

The down payment requirement can vary depending on the type of mortgage and lender. Conventional loans typically require a minimum down payment of 20%, while FHA loans may allow for lower down payments.

What are the benefits of refinancing a 30-year mortgage?

Navigating the mortgage market can be daunting, especially with fluctuating interest rates. 30 Year Mortgage Rates can help you stay informed about current market trends and make informed decisions for your home financing.

Refinancing can be beneficial if interest rates have fallen since you took out your original loan. It can also help you lower your monthly payments or shorten the loan term.

What is mortgage insurance and why is it required?

Mortgage insurance protects lenders against losses if a borrower defaults on their loan. It is typically required for borrowers with low down payments, as it mitigates the lender’s risk.

What are some tips for managing debt alongside a 30-year mortgage?

Create a budget, prioritize debt repayment, and consider consolidating high-interest debts. Also, explore strategies like snowball or avalanche methods to manage multiple debts effectively.