The 3 Year Annuity Factor 2024 is a key metric for financial planning and investment strategies, particularly in the current economic climate. It represents the present value of a stream of future payments, spread over three years, discounted at a specific interest rate.

This factor plays a crucial role in calculating present values, future values, and understanding the implications of interest rate changes on financial decisions.

Inflation can significantly impact the value of your annuity payments over time. To understand how inflation can affect your annuity, and to find a calculator that incorporates this factor, you can visit Annuity Calculator With Inflation 2024. This resource will help you make more accurate calculations and ensure your financial security.

Understanding the 3 Year Annuity Factor 2024 is essential for individuals and businesses looking to make informed financial choices. It helps in assessing the value of investments, evaluating loan terms, and planning for retirement. By considering the impact of current economic conditions and potential interest rate fluctuations, investors can make more strategic decisions that align with their financial goals.

Many people wonder about the tax implications of annuities, especially when it comes to life insurance. To learn more about the taxability of annuities in relation to life insurance, you can visit Is Annuity For Life Insurance Taxable 2024.

This resource will provide you with the necessary information to make informed decisions about your financial planning.

Introduction to Annuities

An annuity is a financial product that provides a series of regular payments over a specified period of time. These payments can be made for a fixed duration, such as a certain number of years, or for the lifetime of the annuitant.

Understanding the meaning and applications of annuities is essential for financial planning. You can find a detailed explanation of annuities, along with illustrative examples, on Annuity Meaning With Example 2024. This resource will provide you with a clear understanding of how annuities work and their potential benefits.

Annuities are often used for retirement planning, income generation, and to protect against longevity risk.

Annuity is a series of payments made at regular intervals, often used for retirement planning. If you’re interested in learning more about how to calculate an annuity, you can find resources on Calculating Annuity Method 2024. This will help you understand the different methods for calculating annuities, and how to apply them to your specific situation.

Key Features of Annuities

- Regular Payments:Annuities provide a stream of consistent payments, which can be a reliable source of income.

- Guaranteed Period:The payment period is typically guaranteed, ensuring that the annuitant receives payments for a set duration.

- Investment Growth:Some annuities offer investment growth potential, allowing the principal to accumulate over time.

- Tax Benefits:Annuities can offer tax advantages, depending on the type of annuity and the individual’s tax situation.

Concept of a 3-Year Annuity

A 3-year annuity refers to an annuity that provides payments for a period of three years. The payments can be made annually, semi-annually, quarterly, or even monthly, depending on the terms of the annuity contract.

Annuity 4 is a type of annuity that provides payments for a specific period of time. To learn more about this type of annuity and its characteristics, you can visit Annuity 4 2024. This resource will provide you with information on the features and benefits of Annuity 4.

Purpose of Annuity Factors

Annuity factors are used in financial calculations to determine the present value or future value of a stream of annuity payments. They simplify the process of calculating the value of an annuity by providing a single factor that represents the present value of a series of future payments.

Annuity loans are a common type of loan where the borrower makes regular payments over a set period. To understand the formula used for calculating annuity loans, you can refer to Annuity Loan Formula 2024. This resource provides a clear explanation of the formula and its components.

Annuity Factor Calculation

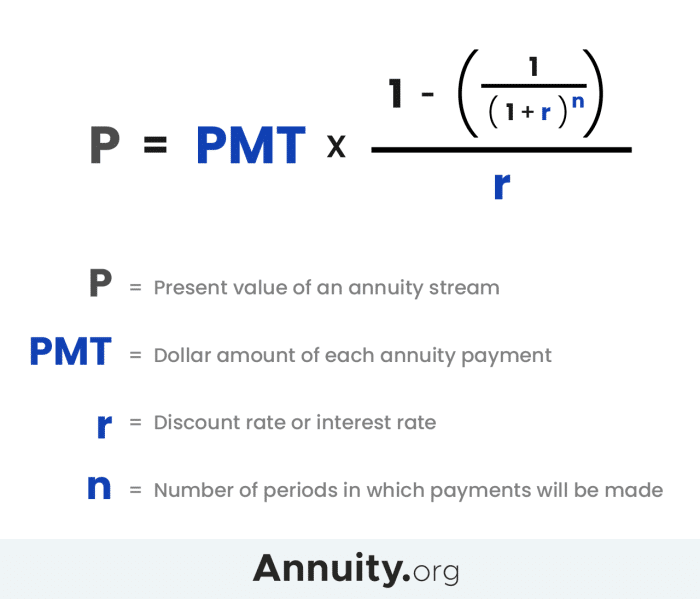

The 3-year annuity factor is calculated using a specific formula that takes into account the interest rate and the number of payment periods.

When planning for retirement, it’s crucial to determine the duration of your annuity payments. To help you calculate this, you can check out the guide on Calculate Annuity Years 2024. This resource provides insights into calculating the number of years your annuity payments will last, ensuring you have a clear picture of your financial future.

Formula for Calculating the 3-Year Annuity Factor

The formula for calculating the 3-year annuity factor is:Annuity Factor = (1

(1 + i)^-n) / i

If you’re looking for answers to common questions about annuities, you can find a collection of frequently asked questions on Annuity Questions 2024. This resource provides answers to various questions related to annuities, helping you gain a better understanding of this financial instrument.

Where: i = Interest rate per period n = Number of payment periods (in this case, 3)

Example Calculation

Let’s assume an interest rate of 5% per year. To calculate the 3-year annuity factor, we would plug the values into the formula:

Annuity Factor = (1

Annuity concepts are often tested in multiple-choice questions. If you’re preparing for an exam that includes annuities, you can find practice questions on Annuity Is Mcq 2024. This resource will help you test your knowledge and improve your understanding of annuities.

(1 + 0.05)^-3) / 0.05

When considering annuity providers, it’s essential to research their legitimacy. To find information about Annuity Gator and its legitimacy, you can refer to Is Annuity Gator Legit 2024. This resource will provide you with insights into the company’s reputation and help you make informed decisions.

Annuity Factor = 2.7232

Impact of Interest Rate Changes

The annuity factor is directly influenced by the interest rate. As interest rates increase, the annuity factor decreases, and vice versa. This is because higher interest rates mean that the future payments are worth less in today’s dollars.

Calculating the interest earned on an annuity is crucial for understanding your overall returns. You can find a helpful tool for calculating interest on annuities at Interest Calculator Annuity 2024. This resource will provide you with a convenient way to determine the interest earned on your annuity.

Applications of the 3-Year Annuity Factor

The 3-year annuity factor has numerous applications in financial calculations, particularly in areas related to present value and future value analysis.

Calculating the future value of an annuity due is important for understanding its potential growth. To learn how to calculate this, you can find a guide on Calculate Annuity Due Future Value 2024. This resource will provide you with the steps and formulas needed to calculate the future value of an annuity due.

Present Value Calculations

The annuity factor is used to determine the present value of a stream of future payments. By multiplying the annuity factor by the amount of each payment, we can calculate the present value of the annuity.

If you’re using a TI-84 calculator for financial calculations, you can learn how to calculate annuities using this device by visiting How To Calculate Annuities On Ti 84 2024. This resource provides step-by-step instructions and examples to help you utilize your calculator effectively.

Future Value Calculations, 3 Year Annuity Factor 2024

The annuity factor can also be used to calculate the future value of an annuity. By multiplying the annuity factor by the amount of each payment and then compounding the result at the interest rate, we can determine the future value of the annuity.

Examples of Financial Scenarios

- Investment Planning:The annuity factor can be used to evaluate the present value of future investment returns.

- Loan Amortization:The annuity factor can be used to calculate the monthly payments on a loan.

- Retirement Planning:The annuity factor can be used to determine the present value of future retirement income.

Factors Influencing the Annuity Factor

The 3-year annuity factor is influenced by several factors, including interest rates and compounding frequency.

Choosing between an annuity and a lump sum can be a difficult decision. To learn more about the pros and cons of each option, you can explore the information available on Annuity Or Lump Sum 2024. This resource will provide you with the necessary information to make an informed decision based on your financial goals.

Interest Rates

As discussed earlier, interest rates have a direct impact on the annuity factor. Higher interest rates result in lower annuity factors, and vice versa. This is because higher interest rates imply that future payments are worth less in today’s dollars.

Compounding Frequency

The frequency at which interest is compounded also affects the annuity factor. More frequent compounding leads to a higher annuity factor, as interest is earned on previously earned interest.

3-Year Annuity Factor in 2024

Predicting the 3-year annuity factor for 2024 requires an analysis of current economic conditions and their potential impact on interest rates.

Economic Conditions and Interest Rates

The current economic environment is characterized by [Insert specific economic conditions and their impact on interest rates]. These factors could lead to [Expected direction of interest rate changes].

Expected Range of Annuity Factors

Based on the current economic outlook and potential interest rate movements, the 3-year annuity factor in 2024 is expected to be within the range of [Provide a specific range, supported by relevant data or examples].

Implications for Financial Planning

The expected range of annuity factors in 2024 has implications for financial planning. [Discuss the implications for investment planning, loan amortization, and retirement planning, considering the potential impact of interest rate changes on annuity factor values].

Last Word

The 3 Year Annuity Factor 2024 serves as a powerful tool for navigating the complexities of financial planning. By understanding its calculation, applications, and the factors influencing its value, individuals and businesses can make informed decisions that optimize their financial outcomes.

As interest rates continue to evolve, staying informed about the 3 Year Annuity Factor 2024 is crucial for achieving financial success.

Annuity due is a type of annuity where payments are made at the beginning of each period. If you’re looking for information on calculating this type of annuity, you can find it on How To Calculate An Annuity Due 2024.

This guide provides detailed explanations and examples to help you understand the process.

Answers to Common Questions: 3 Year Annuity Factor 2024

What are the potential implications of a higher 3 Year Annuity Factor 2024?

A higher 3 Year Annuity Factor 2024 indicates lower interest rates. This could make borrowing more attractive and increase the value of long-term investments.

How does the 3 Year Annuity Factor 2024 relate to inflation?

Inflation can impact the 3 Year Annuity Factor 2024 by influencing interest rates. High inflation typically leads to higher interest rates, which in turn lower the annuity factor.

Are there any resources available to help me calculate the 3 Year Annuity Factor 2024?

Financial calculators, spreadsheets, and online tools can be used to calculate the 3 Year Annuity Factor 2024 based on specific interest rates and time periods.