Navigating the complexities of taxes can be daunting, especially when it comes to understanding the different filing statuses and their implications. “2024 Tax Brackets for Married Filing Separately” delves into the specific tax obligations and benefits for couples who choose to file their taxes separately.

This filing status, while less common, can be advantageous in certain situations, offering a unique set of rules and considerations.

This guide provides a comprehensive overview of the 2024 tax brackets for married couples filing separately, outlining the income ranges and corresponding tax rates. We’ll also explore the standard deduction, personal exemptions, and key tax credits and deductions available to those who choose this filing status.

Understanding these aspects is crucial for making informed decisions about your financial planning and minimizing your tax liability.

Understanding Married Filing Separately

Choosing to file your taxes as “Married Filing Separately” (MFS) can have significant implications for your tax liability. It’s a filing status that allows married couples to file their taxes individually, rather than jointly. While this might seem like a straightforward option, there are various benefits and drawbacks to consider before making this choice.

Benefits of Married Filing Separately

This filing status offers certain advantages, particularly in specific situations.

- Avoiding Joint Liability:Filing separately shields each spouse from the other’s tax liabilities. If one spouse has significant debts or unpaid taxes, the other spouse’s assets are protected. This is especially relevant in situations where one spouse has substantial financial obligations or a history of poor financial management.

Whether you’re planning for retirement or just want to know the maximum you can contribute, the 401k contribution limits for 2024 and 2025 are important to understand.

- Lower Tax Rates:In some cases, filing separately can result in lower overall tax liability. This can occur if one spouse has a significantly higher income than the other. By filing separately, each spouse may qualify for a lower tax bracket, resulting in lower tax payments.

Thinking about contributing to a Roth IRA? It’s a good idea to understand the IRA contribution limits for 2024 and Roth IRA to make sure you’re maximizing your contributions.

- Avoiding Deduction Limitations:Certain deductions, such as the standard deduction, are limited for married couples filing jointly. Filing separately can allow each spouse to claim the full standard deduction, potentially increasing their tax savings.

Drawbacks of Married Filing Separately

While there are benefits, it’s essential to understand the potential drawbacks associated with this filing status.

- Higher Overall Taxes:In most cases, filing jointly results in lower taxes than filing separately. This is because the tax brackets are more favorable for married couples filing jointly. For example, if both spouses have moderate incomes, filing jointly might result in a lower overall tax rate than filing separately.

Foreign nationals have different tax deadlines, and it’s important to be aware of the October 2024 tax deadline for foreign nationals to avoid any penalties.

- Loss of Certain Deductions:Some deductions and credits are only available to married couples filing jointly. For instance, the earned income tax credit (EITC) is not available to married couples filing separately. This can significantly impact tax savings, especially for lower-income households.

- Limited Tax Benefits:The MFS status may limit access to certain tax benefits that are only available to married couples filing jointly. This could include deductions for child tax credits or other credits based on joint income.

Real-World Scenarios, 2024 tax brackets for married filing separately

Several situations might make filing separately advantageous:

- Spouses with Separate Income:If one spouse has significantly higher income than the other, filing separately might result in lower overall taxes due to different tax brackets. This can be especially beneficial if one spouse has a high-income job and the other has a lower-income job or is a stay-at-home parent.

- Marital Discord:If a couple is going through a separation or divorce, filing separately can provide a way to separate their financial obligations and avoid joint liability for each other’s tax burdens. This can help to protect each spouse’s financial interests during a difficult time.

- One Spouse with Significant Debt:If one spouse has substantial debt or unpaid taxes, filing separately can protect the other spouse’s assets from being seized to satisfy those debts. This can be important if one spouse has a history of financial mismanagement or has incurred large debts.

2024 Tax Brackets for Married Filing Separately

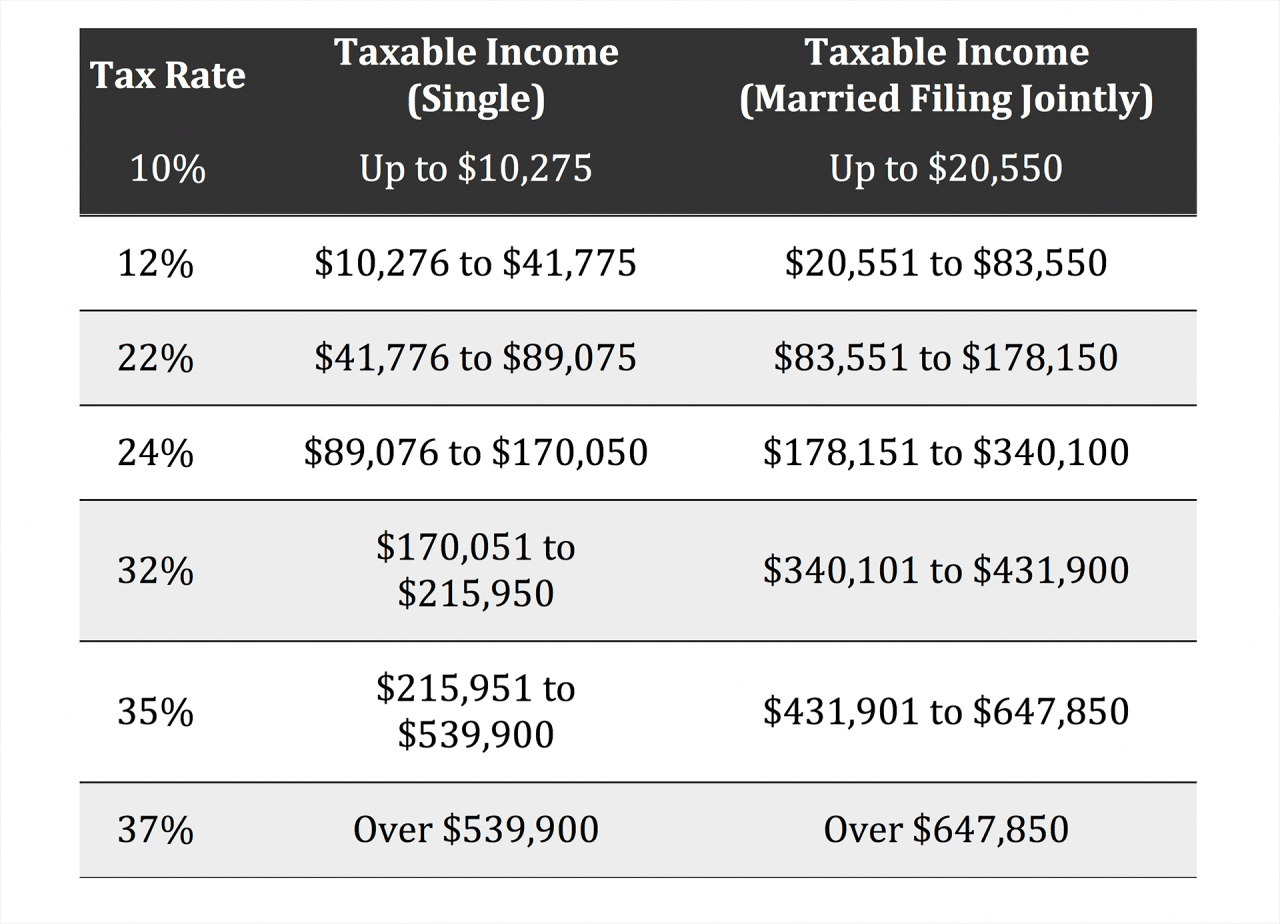

The tax brackets for married individuals filing separately determine the tax rate applied to their taxable income. The higher the income, the higher the tax rate. This method of filing is typically chosen by couples who want to file their taxes separately, perhaps due to differing financial situations or a desire to avoid joint liability for tax debts.

2024 Tax Brackets for Married Filing Separately

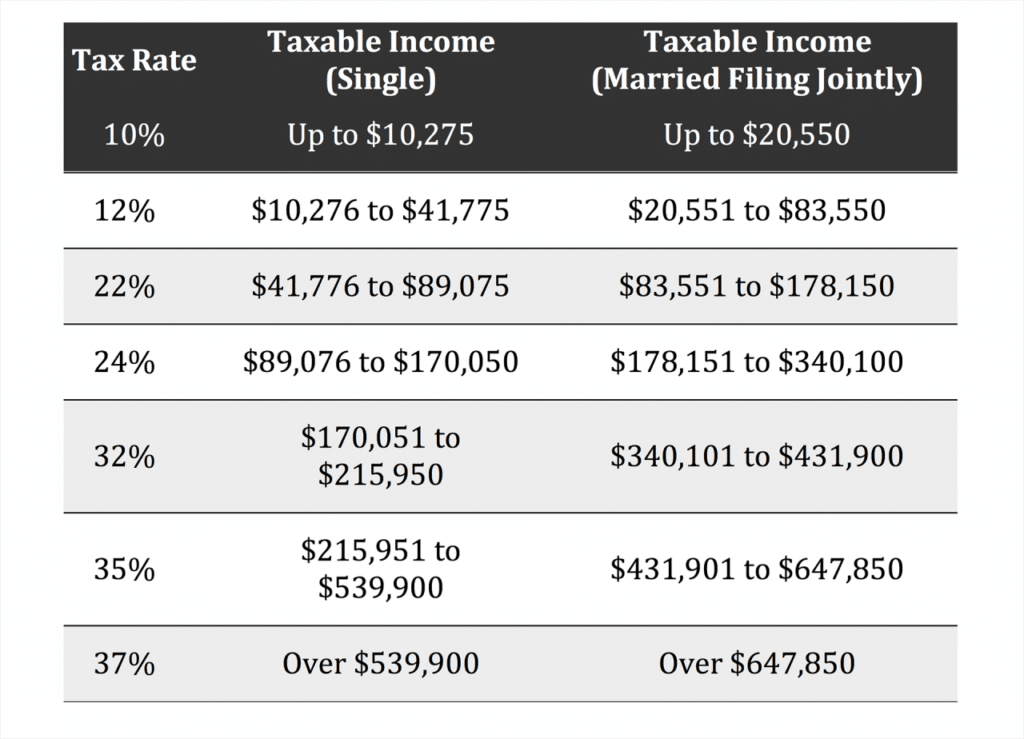

The 2024 tax brackets for married filing separately are:

| Tax Rate | Income Range |

|---|---|

| 10% | $0

If you’re working with government agencies, you’ll need to submit a W9 form. Make sure you’re using the correct version, and you can find information about the W9 Form October 2024 for government agencies here.

|

| 12% | $10,276

|

| 22% | $41,776

Want to make sure you’re taking advantage of all the deductions and credits you’re entitled to? Check out this tax calculator for deductions and credits in October 2024 to see how much you can save.

|

| 24% | $108,426

|

| 32% | $192,151

If you’re driving for work, you might be eligible for mileage reimbursement. You can find the current mileage reimbursement rate for October 2024 here.

|

| 35% | $578,126

|

| 37% | $1,000,001+ |

Standard Deduction and Personal Exemptions

The standard deduction is a fixed amount that taxpayers can subtract from their taxable income, reducing their tax liability. Personal exemptions, on the other hand, are deductions for each individual, including the taxpayer, their spouse, and dependents.

Understanding how tax brackets work can help you plan your finances more effectively. You can find a breakdown of tax brackets for 2024 here.

This section explores the standard deduction and personal exemptions for married individuals filing separately in 2024.

Standard Deduction for Married Filing Separately

The standard deduction for married filing separately in 2024 is $13,850. This means that married individuals who choose to file separately can subtract $13,850 from their taxable income before calculating their tax liability. This deduction helps reduce the amount of income subject to taxation, resulting in lower tax payments.

Personal Exemptions for Married Filing Separately

Personal exemptions are no longer available for federal income tax purposes as of the Tax Cuts and Jobs Act of 2017. This means that married individuals filing separately cannot claim any personal exemptions for themselves or their dependents. However, it is important to note that some states may still offer personal exemptions as part of their state income tax system.

Tax Credits and Deductions

When filing taxes as a married couple filing separately, you can claim various tax credits and deductions to reduce your tax liability. These credits and deductions can be valuable in lowering your overall tax bill.

Tax Credits

Tax credits directly reduce your tax liability dollar-for-dollar. Here are some common tax credits available to married couples filing separately:

- Earned Income Tax Credit (EITC):The EITC is a refundable tax credit for low- to moderate-income working individuals and families. The amount of the credit depends on your income, filing status, and the number of qualifying children you have.

- Child Tax Credit:This credit is available for each qualifying child under the age of 17.

If you’re considering contributing to an IRA, it’s helpful to know the IRA contribution limits for 2024 by age to ensure you’re making the most of your retirement savings.

The amount of the credit is $2,000 per qualifying child.

- American Opportunity Tax Credit:This credit helps pay for the first four years of higher education. The maximum credit is $2,500 per eligible student.

- Premium Tax Credit:If you purchased health insurance through the Health Insurance Marketplace, you may be eligible for a premium tax credit to help pay for your health insurance premiums.

With the new year comes tax changes, and it’s important to stay informed about how these changes might impact your finances. You can check out the tax bracket changes for 2024 to see if your income falls into a different bracket this year.

Tax Deductions

Tax deductions reduce your taxable income, leading to a lower tax liability. Some common deductions for married couples filing separately include:

- Standard Deduction:This deduction is a fixed amount that you can claim instead of itemizing your deductions. The standard deduction amount varies depending on your filing status and age.

- Itemized Deductions:You can itemize your deductions if you have significant expenses in certain categories, such as medical expenses, state and local taxes, home mortgage interest, and charitable contributions.

- Homeownership Deductions:If you own a home, you may be able to deduct mortgage interest and property taxes.

- Student Loan Interest Deduction:You can deduct up to $2,500 in interest paid on student loans.

- Charitable Contributions:You can deduct cash contributions to qualified charities up to 60% of your Adjusted Gross Income (AGI).

Are you planning to contribute to your IRA this year? If so, you’ll want to know the IRA limits for October 2024. These limits are set by the IRS and can vary depending on your age. You can find more information about the IRA contribution limits for 2024 by age here.

Impact on Tax Liability

Let’s look at a couple of examples to illustrate how tax credits and deductions can affect your tax liability:

Example 1: A married couple filing separately has a combined income of $100,000. They have two qualifying children. If they claim the Child Tax Credit, their tax liability will be reduced by $4,000 (2 children x $2,000 per child).

Example 2: A married couple filing separately has a combined income of $80,000. They have a home mortgage and significant medical expenses. By itemizing their deductions, they may be able to reduce their taxable income and, consequently, their tax liability.

The Roth IRA contribution limits for 2024 have been adjusted for inflation, so it’s a good idea to check what the current limits are before making any contributions.

Tax Filing Requirements

When filing taxes as married filing separately, you’ll need to gather specific documents to ensure a smooth and accurate filing process.

Essential Documents for Filing Taxes

To file your taxes as married filing separately, you’ll need to gather several essential documents. These documents provide the IRS with the information necessary to calculate your tax liability accurately.

The standard deduction amount for the 2024 tax year is a key factor in determining your tax liability. Make sure you know what it is to ensure you’re taking advantage of all available deductions.

- Social Security Numbers (SSNs): You’ll need your own SSN and your spouse’s SSN.

- Form W-2: This form summarizes your income and withholdings from your employer. You’ll need both your own Form W-2 and your spouse’s Form W-2.

- Form 1099: This form reports income from sources other than your employer, such as interest, dividends, or freelance work. You’ll need both your own Form 1099 and your spouse’s Form 1099.

- Other Relevant Documents: This can include documentation for any deductions or credits you’re claiming, such as student loan interest, charitable contributions, or medical expenses.

Filing Taxes Electronically or by Mail

You can file your taxes electronically or by mail. Electronic filing is generally faster and more convenient, and it reduces the risk of errors. You can file electronically through a tax preparation software program or through a tax professional. To file by mail, you’ll need to print and complete the necessary tax forms.

You can download these forms from the IRS website. Once you’ve completed the forms, you’ll need to mail them to the address listed on the instructions.

Deadlines for Filing Taxes in 2024

The deadline for filing your taxes in 2024 is April 15, 2024. If April 15 falls on a weekend or holiday, the deadline is extended to the next business day. You may also be eligible for an extension if you meet certain criteria.

Calculating taxes can be a bit of a headache, especially if you’re self-employed. There are tools available to help, and you can find a tax calculator for self-employed individuals in October 2024 here.

Note: It’s important to remember that the deadline for paying your taxes is still April 15, 2024, even if you’re granted an extension to file.

Retirement planning is important, and knowing how much you can contribute to your 401k is crucial. Find out the answer to the question “How much can I contribute to my 401k in 2024?” by clicking here.

Impact on Financial Planning

Filing separately can significantly impact your financial planning, especially when it comes to retirement savings and estate planning. Understanding these implications can help you make informed decisions that align with your financial goals.

Impact on Individual Retirement Accounts (IRAs)

When filing separately, each spouse is treated as an individual for tax purposes, including contributions to and distributions from IRAs. This means that each spouse has their own contribution limits and tax treatment on distributions.

- Contribution Limits:The maximum annual contribution limit for traditional and Roth IRAs in 2024 is $7,000 for individuals under 50 and $7,500 for individuals 50 and older. If you file separately, each spouse can contribute up to the maximum limit, regardless of the other spouse’s income.

- Tax Deductibility:The deductibility of traditional IRA contributions depends on your income and filing status. When filing separately, each spouse’s income is assessed independently, which can impact the deductibility of their contributions. For example, if one spouse has a high income and the other has a low income, the spouse with the higher income may not be able to deduct their contributions.

- Tax Treatment of Distributions:Traditional IRA distributions are taxed as ordinary income, while Roth IRA distributions are tax-free. When filing separately, the tax treatment of distributions is determined on an individual basis.

Impact on Estate Planning

Filing separately can affect estate planning strategies, especially in cases where one spouse has significantly more assets than the other.

- Estate Tax:The federal estate tax applies to estates valued above a certain threshold. In 2024, the threshold is $12.92 million for individuals and $25.84 million for married couples. If you file separately, each spouse’s estate is treated independently for estate tax purposes.

This means that if one spouse’s estate exceeds the threshold, they may be subject to estate tax, even if the combined value of both estates is below the threshold.

- Gift Tax:The annual gift tax exclusion allows individuals to give up to a certain amount of money to others without incurring gift tax. In 2024, the exclusion is $17,000 per person. When filing separately, each spouse has their own gift tax exclusion.

This can be beneficial if one spouse has more assets to give away than the other.

- Beneficiary Designations:It is crucial to review and update beneficiary designations for retirement accounts and other assets when filing separately. This ensures that assets are distributed according to your wishes in case of death.

Seeking Professional Advice

Navigating the complexities of filing separately and its impact on financial planning can be challenging. It is highly recommended to consult with a qualified tax professional and financial advisor to:

- Understand the tax implications of filing separately in your specific situation.

- Develop a financial plan that considers your individual goals and circumstances.

- Review and update estate planning documents to reflect your current situation.

Closing Notes

Filing taxes as “Married Filing Separately” presents a unique set of circumstances that can significantly impact your tax obligations. While this status might be beneficial in specific situations, it’s essential to carefully consider its implications for your financial planning, including retirement accounts and estate planning.

Consulting with a tax professional can provide valuable insights and guidance tailored to your individual circumstances, ensuring you make the most advantageous choices for your tax situation.

FAQ Section

What are the potential benefits of filing separately?

Filing separately can be advantageous if one spouse has significantly higher income or if there are concerns about potential liability for the other spouse’s debts. It can also be beneficial in situations where couples are going through a separation or divorce.

Are there any drawbacks to filing separately?

Filing separately generally results in a higher overall tax liability compared to filing jointly. Additionally, some tax credits and deductions might be limited or unavailable when filing separately.

Can I switch from filing jointly to filing separately after I’ve already filed?

Yes, you can amend your tax return to change your filing status. However, this must be done within the timeframe allowed for filing an amended return. Consult with a tax professional to determine the best course of action.