2024 Mileage Rate is a critical aspect for individuals and businesses seeking to accurately calculate driving expenses for tax purposes. This rate, set by the IRS, determines the amount you can deduct for each mile driven for business, medical, or charitable purposes.

The rate is adjusted annually, reflecting factors like fuel prices, inflation, and government policies.

Understanding how the 2024 Mileage Rate is determined is crucial for maximizing your deductions and ensuring accurate tax reporting. This guide explores the key factors influencing the rate, provides a comprehensive overview of how to calculate mileage expenses, and examines the advantages and disadvantages of using the standard mileage rate versus alternative methods.

Introduction to Mileage Rates

A mileage rate is a fixed amount of money that is paid for each mile driven for business purposes. It is used to reimburse employees or contractors for the expenses associated with using their personal vehicles for work-related travel. Mileage rates are often used by businesses to simplify expense reporting and reduce the need for detailed documentation of travel costs.

Mileage rates are relevant in 2024 because they are subject to change based on factors such as inflation, fuel prices, and vehicle maintenance costs. The Internal Revenue Service (IRS) sets the standard mileage rate for business use, which is used by many businesses and individuals to calculate their mileage reimbursements.

The IRS mileage rate for 2024 is $0.655 per mile for business use.

Secure your future with a solid retirement plan. The Annuity King Sarasota 2024 guide can help you understand the benefits of annuities and how they can provide financial stability in your later years. It’s a valuable resource for anyone looking to make informed decisions about their retirement.

Economic Factors Impacting Mileage Rates

Economic factors can significantly influence mileage rates. Inflation, fuel prices, and vehicle maintenance costs all play a role in determining the appropriate mileage rate. For example, if the price of gasoline increases significantly, the mileage rate may need to be adjusted upward to reflect the higher cost of fuel.

Similarly, if the cost of vehicle maintenance rises, the mileage rate may need to be adjusted to account for these increased expenses.

The standard mileage rate is adjusted annually by the IRS to reflect changes in economic conditions.

2024 Mileage Rate Updates

The standard mileage rates are used to calculate deductible expenses for business and medical use of your vehicle. The Internal Revenue Service (IRS) updates these rates annually, and the 2024 rates are now in effect.

2024 Standard Mileage Rates

The standard mileage rates for 2024 are:

- Business Use:65.5 cents per mile. This rate is used to calculate the deductible expenses for business travel.

- Medical Use:22 cents per mile. This rate is used to calculate the deductible expenses for medical travel, such as trips to and from doctor’s appointments.

The IRS standard mileage rates are subject to change each year. It’s important to consult the latest IRS guidance for the most up-to-date rates.

Factors Influencing Mileage Rates

Mileage rates, a critical component of business expenses, are influenced by a complex interplay of economic, political, and environmental factors. Understanding these factors is essential for businesses and individuals alike, as it allows for accurate budgeting and informed decision-making.

Fuel Price Impact

Fuel prices have a direct and significant impact on mileage rates. The cost of fuel represents a substantial portion of the overall expense associated with driving, and fluctuations in fuel prices directly translate to changes in mileage rates.

- Direct Correlation: The relationship between fuel prices and mileage rates is directly proportional. As fuel prices rise, mileage rates increase proportionally to compensate for the higher fuel costs. Conversely, when fuel prices decline, mileage rates tend to follow suit.

The auto industry is undergoing a major shift with the growing popularity of electric vehicles. The EV tax credits are playing a significant role in this transformation, influencing consumer choices and driving innovation in the sector. It’s an exciting time to see how the auto industry is adapting to this new era.

- Fluctuation Impact: Fluctuations in fuel prices, often driven by global market forces, geopolitical events, and seasonal factors, directly affect mileage rates. Periods of high fuel prices necessitate higher mileage rates to cover fuel costs, while periods of low fuel prices allow for lower mileage rates.

- Real-World Examples: The impact of fuel price increases on mileage rates is evident in real-world scenarios. For example, during the global oil crisis of the 1970s, mileage rates surged significantly to account for the dramatic rise in fuel prices. Similarly, the recent spike in fuel prices due to geopolitical instability has led to an increase in mileage rates across various industries.

Inflation’s Role

Inflation, a persistent increase in the general price level of goods and services, has a significant impact on the cost of vehicle ownership and subsequently, mileage rates.

- Vehicle Maintenance and Repair: Inflation drives up the cost of vehicle maintenance and repair, including parts, labor, and services. This increased cost directly impacts mileage rates, as businesses and individuals need to account for the rising expenses associated with keeping their vehicles operational.

- Overall Cost of Ownership: Inflation also influences the overall cost of vehicle ownership, encompassing factors like depreciation, insurance, and financing. As inflation erodes the purchasing power of money, the cost of owning and operating a vehicle increases, leading to adjustments in mileage rates to reflect these higher expenses.

- Perceived Value of Mileage Rates: Inflation can affect the perceived value of mileage rates. As the cost of living rises due to inflation, individuals and businesses may perceive the current mileage rate as inadequate to cover their expenses, leading to demands for higher rates.

Government Policies and Their Influence

Government policies play a significant role in shaping the landscape of mileage rates, influencing fuel prices, vehicle technology, and infrastructure development.

- Taxation:

- Fuel Taxes: Governments often impose fuel taxes to generate revenue and discourage fuel consumption. These taxes directly impact fuel prices, which in turn influence mileage rates. Higher fuel taxes lead to higher fuel prices and consequently, higher mileage rates.

- Tax Incentives for Fuel-Efficient Vehicles: Governments may offer tax incentives to encourage the adoption of fuel-efficient vehicles. These incentives can lower the cost of purchasing such vehicles, making them more attractive to consumers and businesses. This, in turn, can indirectly influence mileage rates by promoting the use of vehicles that consume less fuel.

- Regulation:

- Emission Standards: Government regulations on vehicle emissions aim to reduce pollution and improve air quality. These regulations often lead to the development of more fuel-efficient vehicles, which can indirectly affect mileage rates. As vehicles become more efficient, the cost of operating them decreases, potentially leading to lower mileage rates.

Wondering about the potential financial boost coming your way? Check out the latest details on the California Stimulus Check in October 2024 , including the amount and payment schedule. This could be a great opportunity to plan ahead and make the most of any extra funds.

- Government Regulations on Vehicle Technology and Efficiency: Government regulations on vehicle technology and efficiency, such as fuel economy standards, can directly impact mileage rates. By setting targets for fuel efficiency, governments incentivize automakers to develop and produce vehicles that consume less fuel. This can lead to lower mileage rates as vehicles become more efficient.

- Emission Standards: Government regulations on vehicle emissions aim to reduce pollution and improve air quality. These regulations often lead to the development of more fuel-efficient vehicles, which can indirectly affect mileage rates. As vehicles become more efficient, the cost of operating them decreases, potentially leading to lower mileage rates.

- Infrastructure:

- Road Conditions and Infrastructure: The condition of roads and infrastructure can significantly impact fuel consumption and, consequently, mileage rates. Well-maintained roads and efficient traffic management systems can reduce fuel consumption and lower mileage rates. Conversely, poor road conditions and congested traffic can increase fuel consumption and necessitate higher mileage rates.

Want to see if you qualify for the California Stimulus Check? The eligibility requirements provide a clear picture of who’s eligible to receive this financial support. Make sure you meet the criteria to potentially receive this helpful benefit.

- Government Investment in Public Transportation: Government investment in public transportation systems can influence mileage rates by providing alternative modes of transportation. As public transportation becomes more accessible and reliable, individuals and businesses may opt for it over private vehicles, leading to a reduction in mileage rates.

- Road Conditions and Infrastructure: The condition of roads and infrastructure can significantly impact fuel consumption and, consequently, mileage rates. Well-maintained roads and efficient traffic management systems can reduce fuel consumption and lower mileage rates. Conversely, poor road conditions and congested traffic can increase fuel consumption and necessitate higher mileage rates.

5. Mileage Rate Comparison

This section will analyze the 2024 standard mileage rate for business use, comparing it to the rates of the past five years. We will also explore the advantages and disadvantages of using this rate, as well as alternative methods for calculating mileage expenses.

Comparison of 2024 Mileage Rate with Previous Years

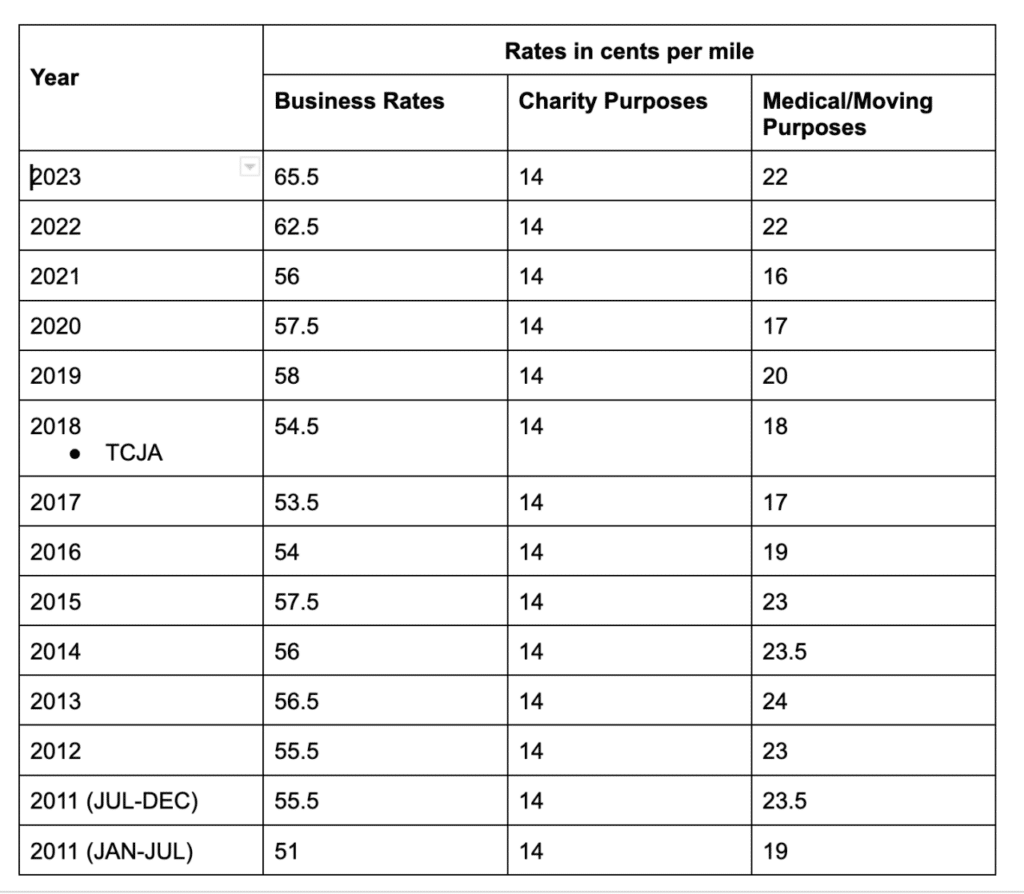

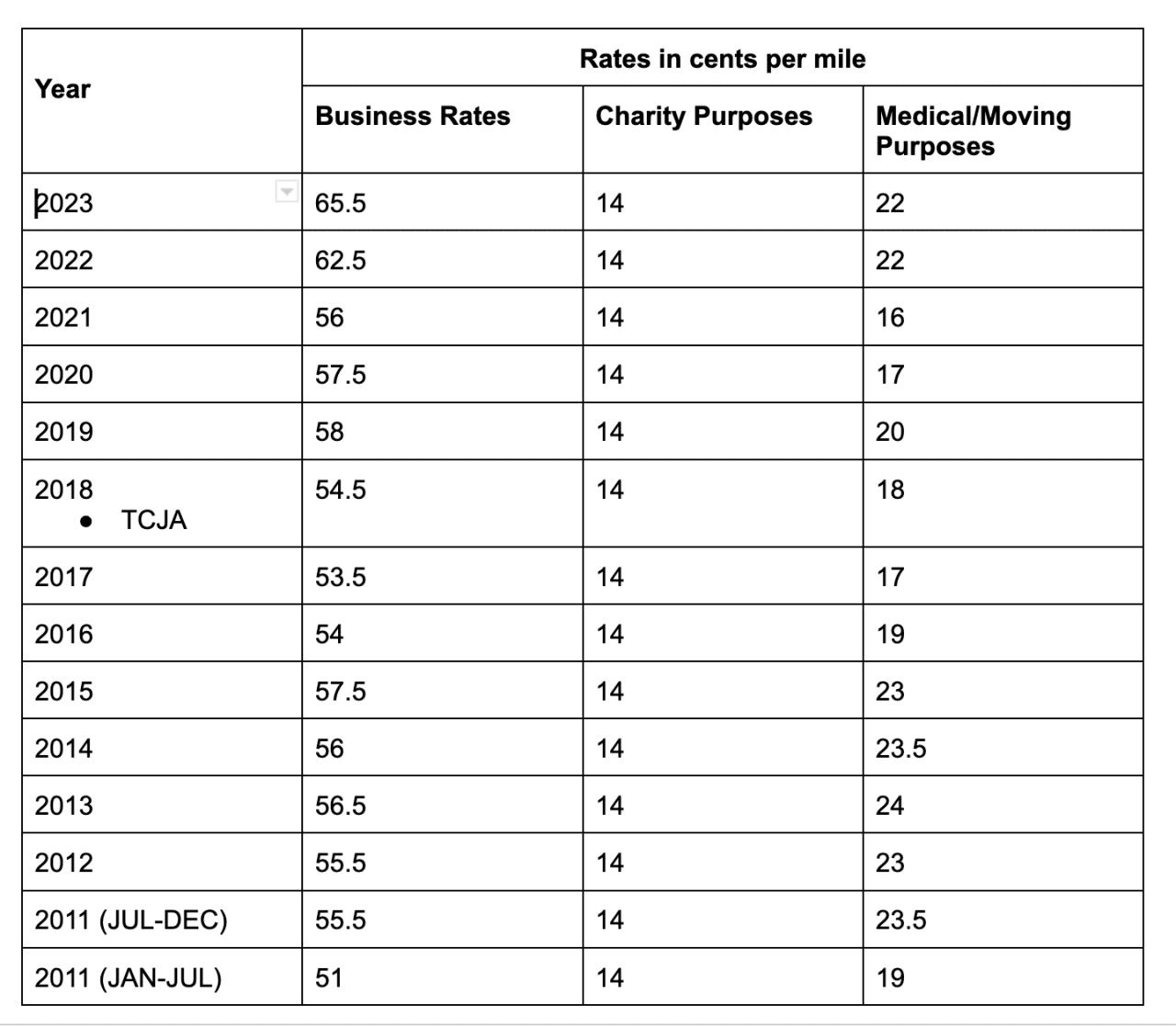

The standard mileage rate for business use is updated annually by the IRS. The following table compares the 2024 rate with the rates for the past five years, highlighting the percentage change from the previous year:

| Year | Mileage Rate per Mile | Percentage Change |

|---|---|---|

| 2024 | $0.655 | – |

| 2023 | $0.625 | 4.8% |

| 2022 | $0.585 | 6.1% |

| 2021 | $0.55 | – |

| 2020 | $0.56 | – |

Advantages of Using the Standard Mileage Rate

The standard mileage rate offers several advantages for taxpayers, including:

- Simplicity:It simplifies the process of calculating mileage expenses, eliminating the need for detailed documentation of fuel costs, repairs, and other vehicle-related expenses. For example, a self-employed individual who drives 10,000 miles for business purposes can simply multiply that number by the standard mileage rate to determine their deduction.

- Convenience:The IRS publishes the standard mileage rate annually, making it readily available to taxpayers. This eliminates the need for individual calculations or estimations, saving time and effort.

- Consistency:The standard mileage rate provides a consistent and fair method for calculating mileage expenses, ensuring that all taxpayers using this method are treated equally.

Disadvantages of Using the Standard Mileage Rate

While the standard mileage rate offers advantages, it also has some drawbacks:

- Potential for Underestimation:The standard mileage rate may not accurately reflect the actual expenses incurred by some taxpayers, potentially leading to an underestimation of their deductions. For example, if a taxpayer drives a vehicle with exceptionally high fuel efficiency or incurs significant maintenance costs, the standard rate might not fully cover their expenses.

- Limited Flexibility:The standard mileage rate does not allow for adjustments based on individual circumstances, such as driving in areas with high fuel prices or having a vehicle with higher maintenance costs. This can be a disadvantage for taxpayers with unique situations.

- Potential for Audit:Using the standard mileage rate can increase the likelihood of an IRS audit, as it is a simplified method that may not provide sufficient documentation to support the claimed deduction.

Alternative Methods for Calculating Mileage Expenses

Besides the standard mileage rate, taxpayers have alternative methods for calculating mileage expenses:

- Actual Expenses:This method involves tracking and documenting all vehicle-related expenses, including fuel, repairs, insurance, and depreciation. Taxpayers can deduct these actual expenses instead of using the standard mileage rate. This method offers greater flexibility and accuracy but requires more detailed record-keeping.

- Hybrid Method:This method combines elements of the standard mileage rate and actual expenses. Taxpayers can use the standard mileage rate for a portion of their mileage and track actual expenses for the remaining portion. This approach provides flexibility while simplifying the documentation process.

| Method | Calculation | Advantages | Disadvantages |

|---|---|---|---|

| Standard Mileage Rate | Mileage x Standard Rate | Simple, Convenient, Consistent | Potential for Underestimation, Limited Flexibility, Potential for Audit |

| Actual Expenses | Sum of all Vehicle-Related Expenses | Accurate, Flexible | Requires Detailed Record-Keeping, Time-Consuming |

| Hybrid Method | Partial Standard Rate + Partial Actual Expenses | Combines Simplicity and Accuracy | Requires Careful Planning and Record-Keeping |

Mileage Rate for Different Industries

Mileage rates are not just a standard deduction for taxpayers; they are also crucial components of various industries, impacting business operations, revenue generation, and cost management. This section explores the role of mileage rates in different industries, highlighting their specific regulations and applications.

Transportation and Logistics

Mileage rates play a pivotal role in the transportation and logistics industry, where vehicles are the backbone of operations. They are used to calculate:

- Cost of delivery:Transportation companies use mileage rates to estimate the cost of delivering goods to customers. This helps determine pricing and ensure profitability.

- Fuel expenses:Mileage rates are directly linked to fuel consumption, making them essential for tracking and managing fuel costs.

- Vehicle maintenance:Mileage rates help estimate the cost of maintenance, repairs, and depreciation associated with vehicles, crucial for budgeting and planning.

For example, a trucking company might use a mileage rate of $0.60 per mile to calculate the cost of transporting goods across state lines. This rate covers fuel, maintenance, and driver wages, allowing the company to set competitive pricing and ensure profitability.

Travel and Hospitality

Mileage rates are integral to the travel and hospitality industry, influencing travel expenses for employees and customers.

- Employee reimbursement:Companies in the travel and hospitality sector reimburse employees for business-related travel using mileage rates. This ensures fair compensation and reduces the burden on employees.

- Customer travel costs:Travel agencies and hotels may use mileage rates to calculate travel costs for customers, especially when offering packages that include transportation.

- Tour operator pricing:Tour operators utilize mileage rates to estimate the cost of transportation for their tours, factoring in fuel, maintenance, and driver expenses.

For instance, a hotel chain might use a mileage rate of $0.55 per mile to reimburse employees for travel to attend conferences or meetings. This rate ensures consistency and fairness across the organization.

Technological Advancements in Mileage Tracking: 2024 Mileage Rate

Technological advancements have revolutionized mileage tracking, making it more efficient and accurate. GPS tracking and mobile apps have become indispensable tools for individuals and businesses alike, streamlining the process of recording and managing mileage. Emerging technologies are also shaping the future of mileage management, promising even greater convenience and insights.

GPS Tracking for Mileage Recording

GPS tracking has significantly simplified mileage recording. Devices or apps equipped with GPS technology can accurately track the distance traveled, time spent on the road, and routes taken. This information can be automatically recorded and stored, eliminating the need for manual logging.

GPS tracking offers a reliable and accurate way to record mileage, reducing the risk of errors and inconsistencies.

Mobile Apps for Mileage Tracking

Mobile apps have further enhanced the convenience of mileage tracking. Many apps are available that allow users to track mileage, categorize trips, and generate reports. These apps can automatically detect trips based on location data and provide insights into driving habits.

Mobile apps have made mileage tracking accessible and user-friendly, enabling individuals and businesses to manage mileage effortlessly.

Emerging Technologies for Mileage Management

Emerging technologies are poised to further transform mileage management. Artificial intelligence (AI) and machine learning (ML) are being incorporated into mileage tracking solutions, offering advanced features such as automated trip classification, expense optimization, and predictive analytics.

AI and ML-powered mileage tracking solutions can provide valuable insights into driving patterns and optimize mileage expenses, leading to greater efficiency and cost savings.

Resources for Mileage Rate Information

Navigating the complexities of mileage rates can feel overwhelming, but accessing the right information is key. Understanding where to find accurate and up-to-date mileage rate information can significantly impact your tax planning and expense management. Here’s a breakdown of reliable resources to help you make informed decisions:

Government Websites

Government agencies are the primary sources for official mileage rates. These websites provide the most accurate and current information, ensuring you’re using the correct rates for your tax filings.

- IRS:The Internal Revenue Service (IRS) sets the standard mileage rates for business, medical, and charitable purposes. You can find the current rates and detailed information on their website: https://www.irs.gov/tax-professionals/standard-mileage-rates

- State Revenue Agencies:While the IRS sets the standard mileage rates, some states may have their own rates for specific purposes. It’s crucial to check your state’s revenue agency website for any adjustments or variations. Many states provide online resources where you can find their specific mileage rate information.

Financial Resources, 2024 Mileage Rate

Financial websites offer valuable insights and tools to help you understand mileage rates and their impact on your finances.

Whether you’re a musician, podcaster, or gamer, improving your audio quality is key. Acoustic foam can significantly enhance your recordings, reducing echoes and improving sound clarity. Check out the latest trends in acoustic foam for your YouTube setup.

- Credit Karma:Credit Karma provides articles and resources that delve into the implications of mileage rates on your taxes. Their website can offer helpful insights into how mileage expenses can affect your overall tax liability. https://www.creditkarma.com/taxes/mileage-deduction

- NerdWallet:NerdWallet offers comprehensive guidance on calculating mileage expenses for tax purposes. Their website provides valuable tips and strategies for accurately tracking and reporting your mileage deductions. https://www.nerdwallet.com/article/taxes/mileage-deduction

Expert Advice

Seeking professional advice from tax experts can ensure you’re maximizing your mileage deductions and understanding the intricacies of mileage rates.

- CPA or Tax Preparer:Consulting a Certified Public Accountant (CPA) or tax preparer is highly recommended. They can provide personalized advice tailored to your specific tax situation, helping you understand the most beneficial approach to claiming mileage deductions.

- Financial Advisor:A financial advisor can offer guidance on managing mileage expenses and incorporating them into your overall financial planning. They can help you understand the impact of mileage deductions on your financial goals and provide strategies for maximizing their benefits.

Conclusive Thoughts

Staying informed about the 2024 Mileage Rate and its impact on your finances is essential. By understanding the factors influencing the rate, utilizing accurate mileage tracking methods, and seeking expert advice when necessary, you can ensure you’re taking advantage of all available deductions and maximizing your tax savings.

Questions Often Asked

How often does the IRS update the mileage rate?

The IRS updates the standard mileage rates annually, typically in January, to reflect changes in fuel prices, inflation, and other economic factors.

Can I use the standard mileage rate for all my driving expenses?

No, the standard mileage rate is only applicable for business, medical, and charitable driving expenses. It’s not applicable for personal driving expenses.

What if my actual driving expenses are higher than the standard mileage rate?

You can choose to use the actual expenses method instead of the standard mileage rate. This method allows you to deduct the actual costs associated with your vehicle, such as gas, repairs, insurance, and depreciation.

Where can I find the most up-to-date mileage rates?

You can find the current standard mileage rates on the official IRS website.