2024 Income Tax Brackets are a crucial aspect of financial planning, determining the amount of taxes you owe based on your earnings. Understanding these brackets is essential for making informed decisions about investments, retirement planning, and even charitable giving.

The Internal Revenue Service (IRS) sets these brackets annually, outlining different tax rates for various income levels. Each bracket corresponds to a specific percentage of income that is taxed, with higher earners facing a greater tax burden. These brackets are designed to create a progressive tax system, where those with higher incomes contribute a larger share of their earnings to support government programs.

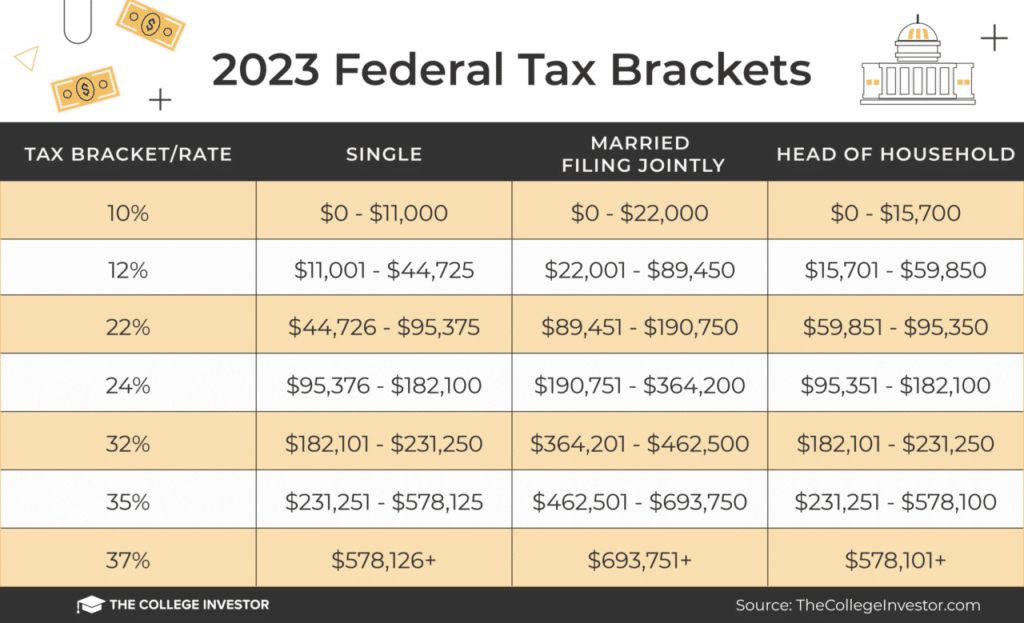

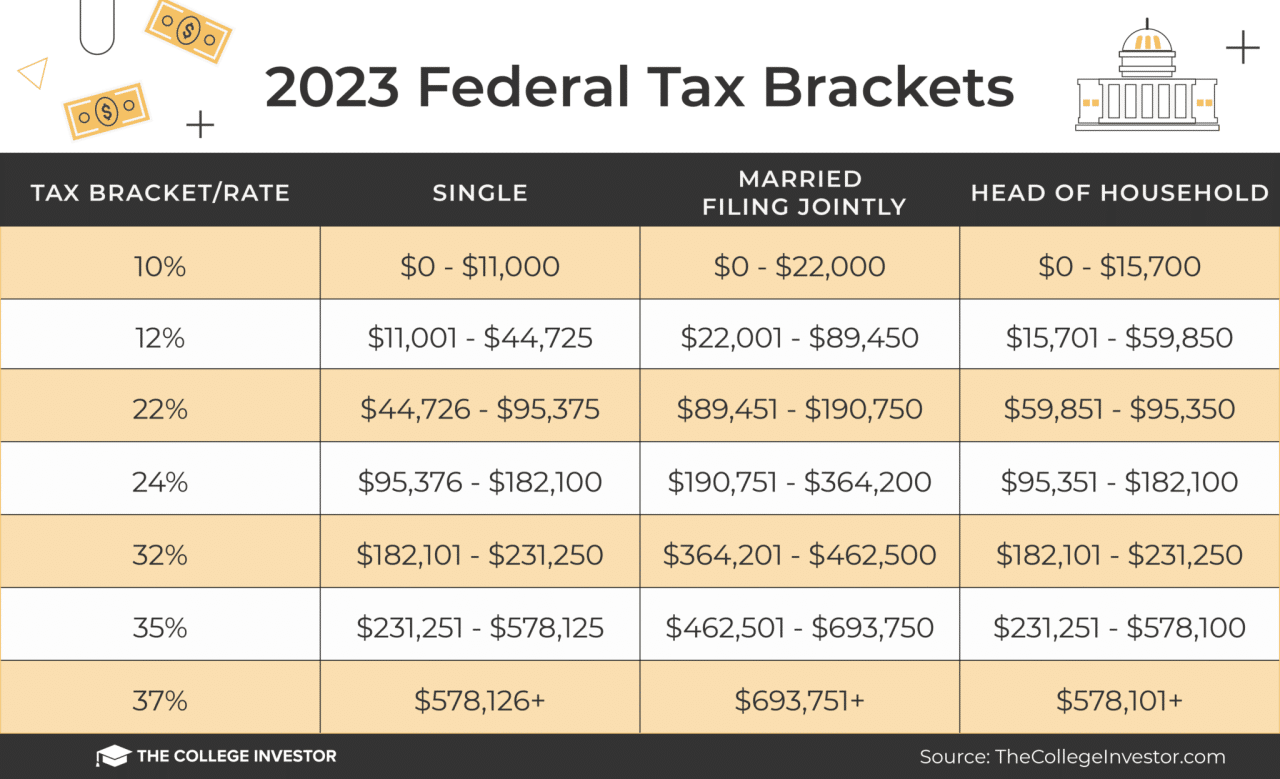

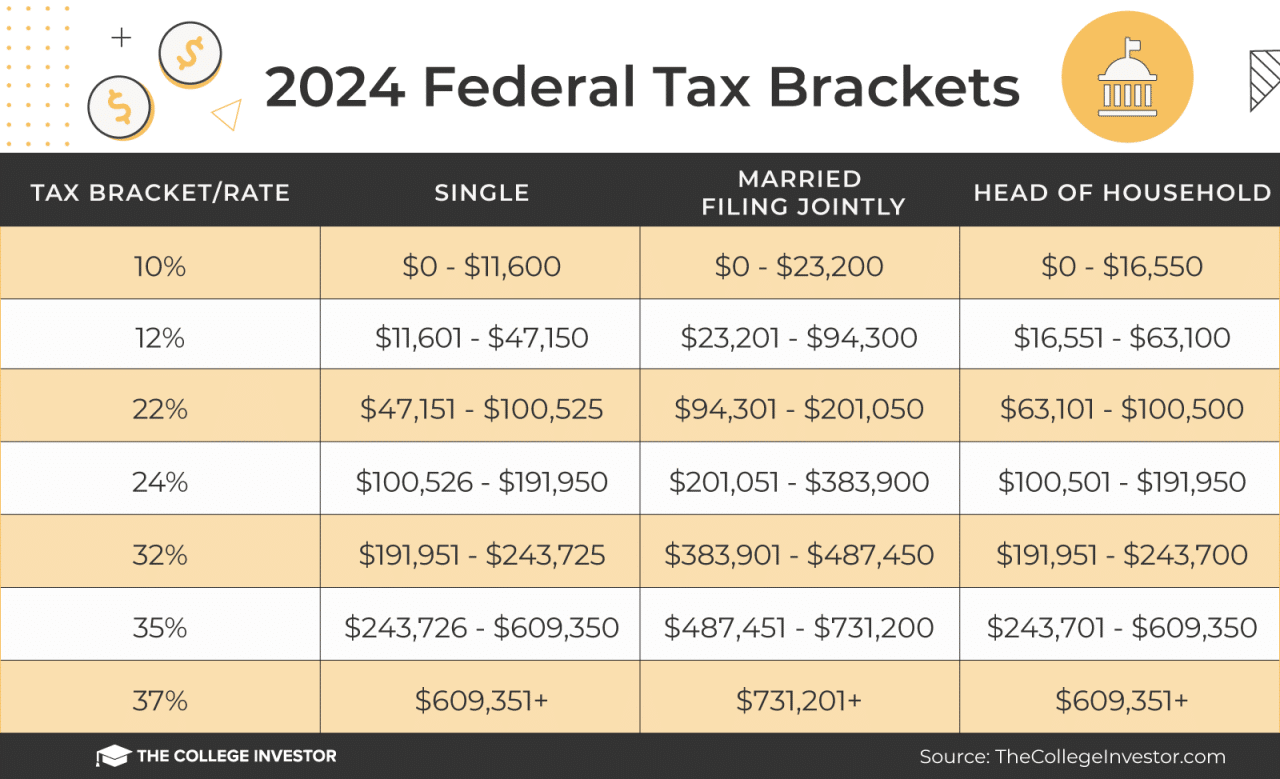

2024 Income Tax Brackets

The 2024 income tax brackets are a crucial factor in determining how much federal income tax you owe. Understanding these brackets is essential for taxpayers to estimate their tax liability and plan their financial strategies accordingly.The tax brackets represent different tax rates applied to different income levels.

The higher your income, the higher the tax rate you pay on a portion of your income.

Tax Brackets for Single Filers

The 2024 income tax brackets for single filers are as follows:

| Tax Bracket | Tax Rate | Income Range |

|---|---|---|

| 10% | 10% | $0

|

| 12% | 12% | $10,276

|

| 22% | 22% | $41,776

|

| 24% | 24% | $89,076

|

| 32% | 32% | $170,051

|

| 35% | 35% | $215,951

|

| 37% | 37% | $539,901+ |

For example, if your taxable income is $50,000, you will pay 10% on the first $10,275, 12% on the income between $10,276 and $41,775, and 22% on the income between $41,776 and $50,000.

Tax Brackets for Married Filing Jointly

The 2024 income tax brackets for married couples filing jointly are as follows:

| Tax Bracket | Tax Rate | Income Range |

|---|---|---|

| 10% | 10% | $0

|

| 12% | 12% | $20,551

|

| 22% | 22% | $83,551

|

| 24% | 24% | $178,151

|

| 32% | 32% | $340,101

|

| 35% | 35% | $431,901

|

| 37% | 37% | $1,079,801+ |

For example, if your taxable income is $100,000, you will pay 10% on the first $20,550, 12% on the income between $20,551 and $83,550, 22% on the income between $83,551 and $178,150, and 24% on the income between $178,151 and $100,000.

The 2024 Tax Deadline is quickly approaching, so make sure you’re prepared. File your taxes on time to avoid penalties and ensure you get all the deductions you’re entitled to. Remember, you can also contribute to your 401(k) and take advantage of the 401k Limits 2024 to save for retirement.

Tax Brackets for Head of Household

The 2024 income tax brackets for head of household filers are as follows:

| Tax Bracket | Tax Rate | Income Range |

|---|---|---|

| 10% | 10% | $0

|

| 12% | 12% | $15,401

|

| 22% | 22% | $62,701

|

| 24% | 24% | $132,201

|

| 32% | 32% | $255,351

|

| 35% | 35% | $321,451

|

| 37% | 37% | $802,801+ |

For example, if your taxable income is $75,000, you will pay 10% on the first $15,400, 12% on the income between $15,401 and $62,700, and 22% on the income between $62,701 and $75,000.

Federal Income Tax Brackets for 2024

The federal income tax brackets for 2024 are based on your filing status and taxable income. These brackets determine the percentage of your income that is taxed at each rate.

Tax Brackets for 2024

The following table Artikels the federal income tax brackets for 2024:| Filing Status | Income Bracket (Minimum

Maximum) | Tax Rate |

|————————–|———————————–|———-|| Single | $0

$10,275 | 10% |

| | $10,275

$41,775 | 12% |

| | $41,775

$89,075 | 22% |

| | $89,075

$170,050 | 24% |

Planning for retirement? Make sure you’re maximizing your contributions! Check out the IRA Contribution Limits 2024 to see how much you can save for your future. And if you’re looking for a way to get a head start, consider contributing to a Roth IRA, which offers tax-free withdrawals in retirement.

You can find the latest Roth IRA Limits 2024 here.

| | $170,050

$215,950 | 32% |

| | $215,950

With tax season approaching, it’s important to know your standard deduction for the year. The Standard Deduction 2024 can help you save on your taxes, so make sure you’re taking advantage of it. Don’t forget to fill out your W9 Form 2024 correctly to ensure you receive all the deductions you’re entitled to.

$539,900 | 35% |

| | $539,900+ | 37% || Married Filing Jointly | $0

$20,550 | 10% |

| | $20,550

$83,550 | 12% |

| | $83,550

$178,150 | 22% |

Looking to save for retirement? Maximize your contributions to your 401(k) plan! Check out the Max 401k Contribution 2024 to see how much you can contribute this year. And if you’re unsure about your contribution limits, the 401k Contribution Limits 2024 will provide you with the latest information.

| | $178,150

$340,100 | 24% |

Understanding the Tax Brackets 2024 is essential for tax planning. Knowing which bracket you fall into can help you make informed financial decisions throughout the year. And to get a better idea of your tax liability, use a Tax Calculator 2024 to estimate your taxes before filing.

| | $340,100

$431,900 | 32% |

| | $431,900

$647,850 | 35% |

| | $647,850+ | 37% || Married Filing Separately | $0

$10,275 | 10% |

| | $10,275

$41,775 | 12% |

| | $41,775

$89,075 | 22% |

| | $89,075

$170,050 | 24% |

| | $170,050

$215,950 | 32% |

| | $215,950

$539,900 | 35% |

| | $539,900+ | 37% || Head of Household | $0

$15,375 | 10% |

| | $15,375

$59,475 | 12% |

| | $59,475

$131,200 | 22% |

| | $131,200

$255,350 | 24% |

Secure your retirement with a well-planned annuity! Learn about the Annuity King Sarasota 2024: Your Guide to Secure Retirement and how it can help you achieve your financial goals. This comprehensive guide provides valuable information on annuities and how they can contribute to a comfortable retirement.

| | $255,350

$323,900 | 32% |

| | $323,900

$539,900 | 35% |

| | $539,900+ | 37% |

Calculating Your Tax Liability

To calculate your tax liability, you need to determine your taxable income, which is your gross income minus deductions and exemptions. Once you know your taxable income, you can use the tax brackets to determine the amount of tax you owe.

For example, if you are single and your taxable income is $50,000, you would owe:

10% on the first $10,275 of your income = $1,027.50

12% on the income between $10,275 and $41,775 = $3,780

22% on the income between $41,775 and $50,000 = $1,815

Your total tax liability would be $1,027.50 + $3,780 + $1,815 = $6,622.50.

3. Standard Deduction and Personal Exemption

The standard deduction and personal exemption are two key components of the federal income tax system that can significantly impact your tax liability. Understanding these deductions can help you minimize your tax burden and maximize your refund.

California residents might be eligible for a stimulus check! The California Stimulus Check October 2024: Amount and Payment Schedule outlines the details of the program. To find out if you qualify, check the California Stimulus Check October 2024 Eligibility Requirements.

Standard Deduction

The standard deduction is a fixed amount that you can subtract from your adjusted gross income (AGI) to reduce your taxable income. It’s a simplified way to account for certain common expenses, such as charitable contributions, medical expenses, and state and local taxes.

The standard deduction amount is determined by your filing status. For 2024, the standard deduction amounts are:* Single:$13,850

Married Filing Jointly

$27,700

Married Filing Separately

$13,850

Head of Household

$20,800

Qualifying Widow(er)

$27,700The standard deduction is designed to provide a basic level of tax relief for all taxpayers, regardless of their individual circumstances. It simplifies the tax filing process by eliminating the need to itemize deductions.

Impact on Taxable Income

The standard deduction directly reduces your taxable income, the portion of your income that is subject to federal income tax. This reduction can result in a lower tax liability and potentially a larger tax refund. For example, let’s say your adjusted gross income is $50,000 and you are filing as single.

Your taxable income would be $36,150 ($50,000

$13,850).

Understanding the Standard Deduction

The standard deduction is a simplified way to account for common expenses you incur throughout the year. It’s a fixed amount that you can subtract from your income to reduce your tax liability. Think of it as a basic tax break for everyone.

Personal Exemption

The personal exemption used to be a fixed amount that you could subtract from your taxable income for yourself, your spouse, and any dependents. However, the Tax Cuts and Jobs Act of 2017 suspended the personal exemption for tax years 2018 through 2025.

Relevance for 2024

The personal exemption is not applicable for 2024. Instead, the standard deduction has been increased to account for the suspended personal exemption.

Implications for Taxpayers

The suspension of the personal exemption means that taxpayers will not be able to claim a separate deduction for themselves or their dependents. However, the increased standard deduction will offset this change, resulting in similar tax benefits.

Comparison of Standard Deduction Amounts

The following table shows the standard deduction amounts for different filing statuses in 2024:| Filing Status | Standard Deduction ||—|—|| Single | $13,850 || Married Filing Jointly | $27,700 || Married Filing Separately | $13,850 || Head of Household | $20,800 || Qualifying Widow(er) | $27,700 |As you can see, the standard deduction amount varies significantly depending on your filing status.

For example, a married couple filing jointly will have a much higher standard deduction than a single individual.

Hypothetical Example

Let’s say a single individual and a married couple filing jointly both have an adjusted gross income of $80,000. * The single individual’s taxable income would be $66,150 ($80,000

- $13,850).

- The married couple’s taxable income would be $52,300 ($80,000

- $27,700).

This example illustrates how the standard deduction can significantly impact taxable income and potentially reduce tax liability.

Taxable Income Calculation

Taxable income is the amount of income that is subject to federal income tax. It is calculated by subtracting deductions and exemptions from your adjusted gross income (AGI). Understanding how taxable income is calculated is crucial for accurate tax filing and ensuring you pay the correct amount of taxes.

Calculating Taxable Income

Taxable income is determined by subtracting deductions and exemptions from your adjusted gross income (AGI). Here are the steps involved in calculating taxable income:

Taxable Income = Adjusted Gross Income (AGI)

- Deductions

- Exemptions

Adjusted Gross Income (AGI)

AGI is your gross income minus certain above-the-line deductions. These deductions are subtracted before calculating your taxable income. Some common above-the-line deductions include:

- Contributions to traditional IRAs

- Student loan interest

- Moving expenses

- Alimony payments

- Certain business expenses

Deductions

Deductions are expenses that can be subtracted from your AGI to reduce your taxable income. There are two main types of deductions:

- Standard Deduction:This is a fixed amount that most taxpayers can claim instead of itemizing their deductions. The standard deduction amount varies based on filing status.

- Itemized Deductions:These are specific expenses that you can deduct if you choose to itemize your deductions instead of taking the standard deduction. Common itemized deductions include:

- Medical expenses exceeding a certain percentage of your AGI

- State and local taxes (SALT) up to a limit

- Home mortgage interest

- Charitable contributions

- Property taxes

Exemptions

Exemptions are deductions for yourself, your spouse, and any dependents you claim. They are a fixed amount that reduces your taxable income. The amount of the exemption varies based on your filing status.

Example of Taxable Income Calculation

Let’s assume a single taxpayer has an AGI of $60,They choose to take the standard deduction of $13,850 and have no dependents. Their taxable income would be calculated as follows:

Taxable Income = $60,000 (AGI)

- $13,850 (Standard Deduction)

- $0 (Exemptions) = $46,150

In this example, the taxpayer’s taxable income is $46,150. This is the amount of income that will be subject to federal income tax.

Tax Liability Calculation

Once you know your taxable income, you can calculate your tax liability. This is the amount of income tax you owe to the government.

Tax Liability Calculation Method

Tax liability is calculated using the progressive tax system. This means that as your income increases, the tax rate you pay also increases. You don’t pay the highest tax rate on your entire income; you pay different rates on different portions of your income.To calculate your tax liability, you need to:

- Determine the tax bracket your taxable income falls into.

- Calculate the tax owed on each portion of your income based on the corresponding tax rate.

- Sum up the tax owed for each portion of your income to determine your total tax liability.

Examples of Tax Liability Calculation

Let’s look at some examples to illustrate how tax liability is calculated:

Example 1: Single Filer with Taxable Income of $50,000

- Tax Bracket:12% bracket (taxable income between $10,950 and $46,275)

- Tax Calculation:

- First $10,950: $0 (tax-free)

- Next $35,325 ($46,275 – $10,950): $35,325 – 12% = $4,239

- Remaining $4,675 ($50,000 – $46,275): $4,675 – 22% = $1,028.50

- Total Tax Liability:$4,239 + $1,028.50 = $5,267.50

Example 2: Married Filing Jointly with Taxable Income of $150,000

- Tax Bracket:22% bracket (taxable income between $84,200 and $172,750)

- Tax Calculation:

- First $20,800: $0 (tax-free)

- Next $63,400 ($84,200 – $20,800): $63,400 – 12% = $7,608

- Next $68,550 ($150,000 – $84,200): $68,550 – 22% = $15,081

- Total Tax Liability:$7,608 + $15,081 = $22,689

Marginal Tax Rates

The concept of marginal tax rates is crucial to understanding the progressive tax system. Your marginal tax rate is the rate applied to the last dollar you earn. For example, if your taxable income is $50,000, your marginal tax rate is 22% because that’s the rate applied to the last $4,675 you earned.

Impact of Tax Brackets on Financial Planning

Understanding how tax brackets work is crucial for making sound financial decisions. Your tax bracket can significantly influence your investment strategies, retirement planning, and charitable giving. By strategically planning your finances, you can potentially minimize your tax liability and maximize your financial well-being.

Impact of Tax Brackets on Investment Strategies

Tax brackets play a significant role in investment decisions. The tax implications of different investment vehicles can vary depending on your income level and tax bracket. For example, individuals in higher tax brackets may find it more advantageous to invest in tax-advantaged accounts like 401(k)s and IRAs, as contributions to these accounts are typically tax-deductible.

This can reduce your taxable income and, consequently, your tax liability.

Impact of Tax Brackets on Retirement Planning

Tax brackets also influence retirement planning strategies. The tax implications of retirement savings plans, such as traditional and Roth IRAs, can vary depending on your tax bracket and expected tax bracket in retirement. Traditional IRA contributions are tax-deductible, reducing your current tax liability, but distributions in retirement are taxed as ordinary income.

If you’re self-employed or use your vehicle for business, make sure you’re aware of the 2024 Mileage Rate for deducting business expenses. This can help you save money on your taxes. And don’t forget about the Ira Limits 2024 for your retirement planning.

Roth IRA contributions are not tax-deductible, but qualified distributions in retirement are tax-free. Individuals in higher tax brackets may prefer Roth IRAs, as they can potentially avoid paying taxes on their retirement income.

Impact of Tax Brackets on Charitable Giving

Charitable giving can be a strategic way to reduce your tax liability and support worthy causes. Tax deductions for charitable contributions are generally capped at a certain percentage of your adjusted gross income. Individuals in higher tax brackets may find it more advantageous to make charitable donations, as the tax savings can be substantial.

7. Tax Credits and Deductions

Tax credits and deductions are valuable tools that can significantly reduce your tax liability. These benefits are offered by the government to incentivize certain behaviors, such as saving for retirement, investing in energy efficiency, or supporting education. Understanding the available credits and deductions and how they apply to your unique situation can help you maximize your tax savings.

Tax Credits and Deductions for All Taxpayers

Tax credits and deductions can be a valuable tool for reducing your tax liability. Here’s a table outlining some common tax credits and deductions available to all US taxpayers in 2024:

| Credit/Deduction Name | Description | Eligibility Requirements | Maximum Amount | How to Claim |

|---|---|---|---|---|

| Child Tax Credit | A credit for each qualifying child under 17 years old. | Must be claimed for a qualifying child who is a US citizen, national, or resident alien. | $2,000 per qualifying child | Claim on Form 8812, “Credit for Qualified Child Care Expenses.” |

| Earned Income Tax Credit (EITC) | A credit for low- and moderate-income working individuals and families. | Must meet income and other eligibility requirements. | Varies based on filing status and number of qualifying children | Claim on Form 1040, “U.S. Individual Income Tax Return.” |

| American Opportunity Tax Credit | A credit for qualified education expenses for the first four years of higher education. | Must be enrolled at least half-time in a qualified educational institution. | Up to $2,500 per eligible student | Claim on Form 8863, “Education Credits (American Opportunity and Lifetime Learning Credits).” |

| Premium Tax Credit | A credit for qualified health insurance premiums purchased through the Marketplace. | Must have health insurance through the Marketplace. | Varies based on income and household size | Claim on Form 1040, “U.S. Individual Income Tax Return.” |

| Retirement Savings Contributions Credit (Saver’s Credit) | A credit for contributions to eligible retirement accounts. | Must meet income and age requirements. | Up to 50% of contributions, with a maximum credit of $1,000 for single filers and $2,000 for married couples | Claim on Form 8880, “Credit for Qualified Retirement Savings Contributions.” |

| Child and Dependent Care Credit | A credit for expenses for the care of a qualifying child or dependent. | Must pay for care to enable you to work or look for work. | Up to 35% of qualifying expenses, with a maximum credit of $3,000 for one qualifying person and $6,000 for two or more qualifying people | Claim on Form 2441, “Child and Dependent Care Expenses.” |

| Adoption Tax Credit | A credit for qualified adoption expenses. | Must adopt a child who is a US citizen, national, or resident alien. | Up to $14,890 per adoption | Claim on Form 8839, “Qualified Adoption Expenses.” |

| Energy Efficient Home Improvement Credit | A credit for qualified energy-efficient home improvements. | Must be made to a residence located in the United States. | 30% of the cost of qualified improvements, with a maximum credit of $2,000 | Claim on Form 5695, “Residential Energy Credits.” |

| Homebuyer Tax Credit | A credit for first-time homebuyers. | Must meet income and other eligibility requirements. | Up to $8,000 | Claim on Form 5405, “First-Time Homebuyer Credit.” |

| Property Tax Deduction | A deduction for state and local property taxes. | Must pay property taxes to a state or local government. | Limited to $10,000 per household | Claim on Schedule A, “Itemized Deductions.” |

Tax credits directly reduce your tax liability, dollar for dollar. For example, if you qualify for the Child Tax Credit and have one qualifying child, you’ll receive a $2,000 credit, reducing your tax liability by $2,000. Deductions, on the other hand, reduce your taxable income, which in turn lowers your tax liability.

For example, if you itemize your deductions and claim the property tax deduction, you’ll reduce your taxable income by the amount of your property taxes paid, leading to a lower tax bill.

Tax Credits and Deductions for Self-Employed Individuals, 2024 Income Tax Brackets

Self-employed individuals have access to several tax credits and deductions that can help reduce their tax liability. Here are some examples:

- Home Office Deduction:You can deduct a portion of your home expenses, such as rent, utilities, and insurance, if you use part of your home exclusively for business purposes. This deduction can significantly reduce your taxable income.

- Health Insurance Premium Deduction:Self-employed individuals can deduct the cost of health insurance premiums paid for themselves and their families. This can be a valuable deduction, especially for those who don’t have access to employer-sponsored health insurance.

- Retirement Savings Contributions Credit (Saver’s Credit):You can claim this credit if you’re self-employed and contribute to a retirement plan, such as a SEP IRA or Solo 401(k). The credit can offset a portion of your contributions, reducing your tax liability.

- Qualified Business Income Deduction (QBI):This deduction allows you to deduct 20% of your qualified business income, which can be a significant tax savings for many self-employed individuals. The deduction is subject to certain limitations based on your taxable income.

- Self-Employment Tax Deduction:You can deduct half of the self-employment tax you paid on your income. This deduction reduces your taxable income and lowers your overall tax liability.

Example:Let’s say you’re a freelance writer who works from home and uses a dedicated office space. You can deduct a portion of your home expenses, such as rent, utilities, and insurance, as a home office deduction. This deduction will reduce your taxable income, ultimately lowering your tax liability.

Tax Credits and Deductions for Homeowners

Making energy-efficient improvements to your home can not only save you money on your energy bills but also potentially reduce your tax liability. Here are some tax credits and deductions available for homeowners who make energy-efficient improvements:

- Energy Efficient Home Improvement Credit:This credit offers a 30% tax credit for qualified energy-efficient home improvements, such as installing solar panels, wind turbines, geothermal heat pumps, and insulation. The maximum credit is $2,000 per household.

- Residential Clean Energy Credit:This credit offers a 30% tax credit for the cost of installing solar panels, wind turbines, fuel cells, and other renewable energy systems. The credit is subject to certain limitations and is phased out based on the amount of energy produced by the system.

- Property Tax Deduction:While not specifically related to energy efficiency, the property tax deduction can help offset the cost of homeownership, including any expenses related to energy-efficient upgrades.

Example:You decide to install solar panels on your roof to generate clean energy and reduce your electricity bills. You can claim the Residential Clean Energy Credit for 30% of the cost of the solar panel system, reducing your tax liability and making the investment more affordable.

Changes in Tax Law for 2024: 2024 Income Tax Brackets

The 2024 tax year brings a new set of rules and regulations for taxpayers. While the core of the tax code remains largely the same, some significant changes have been implemented, affecting income tax brackets, deductions, credits, and exemptions. This report aims to provide a clear and concise analysis of these changes, highlighting their potential impact on individuals, families, and businesses.

Changes to Tax Brackets

The tax brackets for 2024 have been adjusted to reflect inflation and economic growth. These changes affect the income thresholds at which different tax rates apply, potentially altering the tax burden for various income levels.

- Change:Increased Income Thresholds for Each Tax Bracket.

- Impact:Taxpayers may find themselves in a lower tax bracket for a given income level, resulting in a lower overall tax liability.

- Example:A single filer earning $50,000 in 2023 might have been in the 12% tax bracket.

However, with the increased income thresholds for 2024, they may now fall into the 10% bracket, leading to lower taxes.

Changes to Deductions and Credits

Several deductions and credits have been modified for the 2024 tax year, impacting the amount of taxable income and the tax liability of taxpayers.

- Change:Expansion of the Child Tax Credit.

- Impact:Families with children may receive a larger tax credit, potentially reducing their tax burden.

- Example:The Child Tax Credit for 2024 has been increased to $3,000 per child, providing greater tax relief to families with dependents.

Changes to Exemptions

Exemptions, which reduce taxable income, have also undergone adjustments for 2024.

- Change:Increased Personal Exemption Amount.

- Impact:Taxpayers can deduct a larger amount from their taxable income, leading to a lower tax liability.

- Example:The personal exemption amount for 2024 has been raised to $5,000, allowing individuals to reduce their taxable income by a greater amount.

Implications of Tax Law Changes

The modifications to the tax code for 2024 have far-reaching implications for various taxpayer groups.

- Individuals:The changes in tax brackets and exemptions may result in a lower tax burden for many individuals, especially those in the lower to middle income brackets.

- Families:The expanded Child Tax Credit provides significant financial relief to families with children, potentially easing the burden of raising a family.

- Businesses:The tax law changes may impact business operations, particularly in areas related to deductions and credits.

Staying Informed about Tax Law Changes

Staying updated on tax law changes is crucial for making informed financial decisions. Here are some reputable resources:

- Internal Revenue Service (IRS):The official source for tax legislation and regulations.

- American Institute of Certified Public Accountants (AICPA):Professional organization offering insights and guidance on tax matters.

- The Wall Street Journal:Financial news outlet reporting on tax law developments.

State Income Tax Brackets

State income tax brackets are a crucial aspect of personal finance, influencing the amount of income tax an individual owes to their state government. Understanding how these brackets function and how they vary across different states is essential for making informed financial decisions.

State Income Tax Bracket Variations

State income tax brackets represent different tax rates applied to various income levels. Each state has its own unique set of brackets, which can significantly impact overall tax liability. The table below showcases the income tax brackets for five diverse states:

| State Name | Number of Brackets | Lowest Bracket Rate | Highest Bracket Rate | Top Income Threshold |

|---|---|---|---|---|

| California | 9 | 1% | 13.3% | $1,000,000+ |

| Florida | 0 | N/A | N/A | N/A |

| New York | 7 | 4% | 10.9% | $1,000,000+ |

| Texas | 0 | N/A | N/A | N/A |

| Wyoming | 3 | 3.5% | 5.9% | $150,000+ |

The table highlights substantial differences in tax structures across these states. Florida and Texas, for instance, have no state income tax, making them attractive for individuals seeking lower overall tax burdens. Conversely, states like California and New York have progressive tax systems with multiple brackets and higher top rates, resulting in higher tax liabilities for high-income earners.

Impact on Tax Liability

State income tax brackets directly influence an individual’s tax liability. The concept of marginal tax rates plays a crucial role in this calculation. The marginal tax rate refers to the tax rate applied to the last dollar earned within a specific income bracket.

For example, if an individual falls into the 5% tax bracket, only the income exceeding the threshold of that bracket will be taxed at 5%, while the rest of their income will be taxed at lower rates.

State Income Tax Bracket Examples

California

California’s progressive tax system features nine income brackets, each with a different tax rate. The following table Artikels these brackets and their corresponding tax rates:

| Income Range | Tax Rate |

|---|---|

$0

|

1% |

$8,751

|

2% |

$20,851

|

4% |

$41,701

|

6% |

$83,401

|

8% |

$175,001

|

9.3% |

$262,501

|

10.3% |

$525,001

|

11.3% |

| $1,000,001+ | 13.3% |

Let’s consider a hypothetical individual earning $100,000 in California. Their tax liability would be calculated as follows:

- $8,750 at 1% = $87.50

- $12,099 at 2% = $241.98

- $20,849 at 4% = $833.96

- $41,700 at 6% = $2,502

- $16,599 at 8% = $1,327.92

- $100,000 total income

- $83,400 = $16,600 taxed at 9.3% = $1,543.80

Total California income tax liability: $6,536.16

Wyoming

Wyoming’s tax system is significantly different from California’s. It has only three income brackets, with lower tax rates and a lower top income threshold:

| Income Range | Tax Rate |

|---|---|

$0

|

3.5% |

$10,001

|

4.0% |

| $150,001+ | 5.9% |

Using the same hypothetical individual earning $100,000, their Wyoming income tax liability would be calculated as follows:

- $10,000 at 3.5% = $350

- $90,000 at 4% = $3,600

Total Wyoming income tax liability: $3,950This example demonstrates the significant impact of different state income tax brackets. Even with the same income, an individual residing in California would pay over $2,500 more in state income tax than someone living in Wyoming.

Tax Filing Options

Filing your taxes can seem daunting, but it doesn’t have to be. The Internal Revenue Service (IRS) offers various methods for filing your taxes, each with its own advantages and disadvantages. This section will explore these options, helping you choose the best method for your situation.

Using Tax Software

Tax software is a popular option for many taxpayers. It offers a user-friendly interface, step-by-step guidance, and built-in error checks, making the process easier and more efficient.

- Advantages:

- User-friendly interface and step-by-step guidance.

- Built-in error checks to minimize mistakes.

- Often includes free federal e-filing.

- Access to tax deductions and credits you may be eligible for.

- Affordable options available, including free versions for simple returns.

- Disadvantages:

- May not be suitable for complex tax situations, such as self-employment income or business deductions.

- Limited customer support, especially for free versions.

- Can be overwhelming for users unfamiliar with tax terminology.

- Advantages:

- Personalized guidance and expert advice on tax strategies.

- Can handle complex tax situations, such as business deductions or investment income.

- Access to specialized knowledge and resources.

- Can represent you before the IRS if you face an audit.

- Disadvantages:

- Can be expensive, especially for complex tax situations.

- May require you to gather and organize your tax documents.

- May not be necessary for simple tax returns.

- Advantages:

- Faster processing times compared to paper filing.

- Reduced risk of errors and delays.

- More secure than paper filing.

- Often includes free federal e-filing.

- Disadvantages:

- Requires access to a computer and internet connection.

- May require you to use tax software or hire a tax professional.

- May not be suitable for taxpayers who prefer paper filing.

- IRS website:The IRS website offers information on choosing a tax professional, including a directory of Enrolled Agents.

- State tax agency websites:Many state tax agencies provide information on finding tax professionals in their state.

- Professional organizations:Organizations such as the American Institute of Certified Public Accountants (AICPA) and the National Association of Tax Professionals (NATP) offer resources for finding qualified tax professionals.

- Word-of-mouth:Ask friends, family, and colleagues for recommendations.

- Correspondence Audit:This is the most common type of audit. It involves the IRS requesting additional information or clarification about specific items on your tax return. This is typically done through mail, and you can respond by mail or online.

- Office Audit:In this type of audit, you are invited to meet with an IRS agent at their office to discuss your tax return. You will likely be asked to bring supporting documentation to verify your deductions and income.

- Field Audit:This is the most intrusive type of audit. It involves an IRS agent visiting your home or business to examine your records and financial documents. This type of audit is usually reserved for complex cases or situations where there is suspicion of fraud.

- Initial Contact:The IRS will notify you in writing that your tax return is being audited. This notice will specify the type of audit and the specific items being reviewed.

- Document Requests:The IRS will request supporting documentation to verify the information on your tax return. This may include receipts, bank statements, W-2 forms, and other relevant documents.

- Interview Process:You may be required to meet with an IRS agent to discuss your tax return and provide further information. You have the right to be represented by a tax professional during this interview.

- Final Determination:The IRS will review the information gathered during the audit and issue a final determination. If the IRS finds that you owe additional taxes, they will issue a notice of deficiency. If the IRS finds that you are due a refund, they will issue a refund check.

- Right to Representation:You have the right to be represented by a tax professional during an audit.

- Right to Privacy:The IRS must respect your privacy and only request information that is relevant to the audit.

- Right to Appeal:If you disagree with the IRS’s determination, you have the right to appeal the decision.

- Responsibility to Provide Accurate Information:You are responsible for providing accurate and complete information to the IRS during the audit.

- Responsibility to Keep Records:You are responsible for keeping accurate and complete records for at least three years after filing your tax return.

- Discrepancies Between Reported Income and Spending Patterns:The IRS may audit you if they believe that your reported income does not match your spending patterns. This could be based on information from third-party sources, such as banks or credit card companies.

- Unusual Deductions or Credits Claimed:The IRS may audit you if you claim unusual deductions or credits on your tax return. This could be based on the types of deductions or credits claimed, the amount of the deductions or credits, or the supporting documentation provided.

- Errors in Previous Tax Filings:The IRS may audit you if they find errors in your previous tax filings. This could be based on a review of your past returns or an audit of a related taxpayer.

- Random Selection for Audit:The IRS also selects taxpayers for audits at random. This is done to ensure that the audit process is fair and unbiased.

- Gather and Organize Relevant Documentation:This includes receipts, bank statements, W-2 forms, and any other documents that support the information on your tax return.

- Understand the Specific Issues Being Investigated:The IRS notice will specify the items being reviewed. Make sure you understand what the IRS is looking for.

- Seek Professional Tax Advice:If you are unsure about any aspect of the audit process, it’s a good idea to consult with a qualified tax professional.

- Remain Calm and Professional:It’s important to remain calm and professional during the audit process. This will help you avoid making mistakes or saying anything that could hurt your case.

- Respond to All Requests for Information Promptly and Accurately:The IRS will need supporting documentation to verify the information on your tax return. Respond to all requests for information promptly and accurately.

- Maintain a Clear and Concise Record of All Communication with the IRS:Keep a record of all communication with the IRS, including the date, time, and content of each interaction. This will help you track the progress of the audit and ensure that you are not being misled.

- Know the Appeal Process and Available Options:If the IRS issues an unfavorable determination, you have the right to appeal the decision. It’s important to understand the appeal process and the available options.

- Earned Income Tax Credit (EITC):This refundable tax credit provides a significant tax break to eligible low- and moderate-income working individuals and families. The amount of the credit depends on the taxpayer’s income, filing status, and number of qualifying children. For example, a single parent with two children and an income of $50,000 might be eligible for an EITC of up to $6,935 in 2024.

- Child Tax Credit (CTC):The CTC is a partially refundable tax credit that reduces the tax liability of families with qualifying children. The credit amount is $2,000 per qualifying child under 17 years old. This credit is partially refundable, meaning taxpayers can receive a portion of the credit even if their tax liability is less than the credit amount.

For example, a family with two qualifying children might receive a $4,000 tax credit, even if their tax liability is only $2,000. This would reduce their tax liability to $0 and result in a $2,000 refund.

- Premium Tax Credit (PTC):This tax credit helps individuals and families afford health insurance through the Affordable Care Act (ACA) marketplace. The credit amount depends on income and family size. For example, a family of four with an income of $60,000 might receive a PTC of up to $1,000 per month, reducing their monthly health insurance premiums significantly.

- Tax Counseling for the Elderly (TCE):This program offers free tax assistance to seniors, particularly those with low to moderate income. TCE volunteers are trained to assist with various tax-related matters, including preparing tax returns and understanding complex tax issues.

Hiring a Tax Professional

Hiring a tax professional, such as a Certified Public Accountant (CPA) or an Enrolled Agent (EA), is a good option for individuals with complex tax situations or those who prefer personalized assistance.

Filing Electronically

E-filing is the fastest and most secure way to file your taxes. You can file electronically through tax software, a tax professional, or the IRS Free File program.

Resources for Finding Reliable Tax Filing Services

There are several resources available to help you find reliable tax filing services:

Tax Audits

A tax audit is a review of your tax return by the Internal Revenue Service (IRS) to verify the accuracy of the information reported. While most taxpayers will never experience an audit, it’s important to understand the process and how to prepare in case you are selected.

Understanding the Tax Audit Process

There are three main types of tax audits:

The steps involved in a tax audit can vary depending on the type of audit. However, the general process typically includes:

Rights and Responsibilities During an Audit

As a taxpayer, you have certain rights and responsibilities during a tax audit:

Reasons for a Tax Audit

There are several reasons why the IRS may select a taxpayer for an audit. Some common triggers include:

Preparing for and Handling a Tax Audit

It’s important to be prepared for a potential tax audit. Here are some steps you can take:

Here are some tips for handling a tax audit effectively:

Tax Relief and Assistance

Navigating the complexities of the tax system can be challenging, especially for low-income taxpayers or those facing financial difficulties. Fortunately, various tax relief programs and assistance options are available to help individuals and families manage their tax obligations and access necessary support.

Tax Relief Programs for Low-Income Taxpayers

Tax relief programs aim to ease the tax burden on low-income individuals and families. These programs offer various benefits, including:

Conclusion

Understanding the 2024 income tax brackets is crucial for effective financial planning. These brackets determine the amount of tax you’ll owe on your income, and knowing how they work can help you make informed decisions that minimize your tax liability.The 2024 tax brackets are designed to tax higher earners at a higher rate.

However, the brackets themselves are not the only factor that determines your tax burden. Other considerations include your deductions, credits, and the types of income you receive.

Importance of Understanding Tax Brackets

Knowing the tax brackets can help you make strategic financial decisions. For example, you might consider adjusting your income or deductions to take advantage of lower tax rates. You might also decide to make tax-advantaged contributions to retirement accounts or other savings plans.

Seeking Professional Advice

Navigating the complexities of tax laws can be challenging. If you’re unsure about how the 2024 tax brackets will affect you, or if you’re looking for personalized guidance on tax optimization strategies, it’s highly recommended to seek professional advice from a qualified tax advisor.

They can provide tailored recommendations based on your specific financial situation and help you minimize your tax liability.

Epilogue

Navigating the complexities of 2024 Income Tax Brackets can be challenging, but understanding them is key to managing your finances effectively. By carefully considering your income level and the applicable tax rates, you can make informed decisions that optimize your tax liability and achieve your financial goals.

Remember, seeking professional guidance from a qualified tax advisor can help you navigate these complexities and ensure you’re taking advantage of all available deductions and credits.

Questions and Answers

What is the standard deduction for 2024?

The standard deduction amount varies depending on your filing status. For example, in 2024, the standard deduction for single filers is $13,850, while for married couples filing jointly, it’s $27,700.

How do I calculate my taxable income?

To calculate your taxable income, you start with your adjusted gross income (AGI), then subtract your standard deduction or itemized deductions, and any applicable personal exemptions. The remaining amount is your taxable income, which is used to determine your tax liability.

What are some common tax credits available for 2024?

Some common tax credits include the Earned Income Tax Credit (EITC), the Child Tax Credit, and the American Opportunity Tax Credit. These credits can significantly reduce your tax liability, especially if you meet the eligibility requirements.