2024 401k contribution limits for employees over 50 present a unique opportunity to accelerate retirement savings. These “catch-up” contributions allow those 50 and older to contribute more to their 401(k) accounts, potentially boosting their nest egg significantly. This extra contribution room can make a substantial difference in your long-term financial security.

Understanding the details of these catch-up contributions is essential for maximizing your retirement savings potential. This guide will delve into the specifics of these limits, explore the advantages they offer, and provide practical tips for incorporating them into your retirement planning strategy.

Understanding the 2024 401(k) Contribution Limits

The 2024 401(k) contribution limits are subject to change, and it’s important to stay updated on the latest guidelines. These limits dictate how much you can contribute to your 401(k) plan each year, and understanding them is crucial for maximizing your retirement savings.

Standard Contribution Limit

The standard contribution limit for 401(k) plans in 2024 is the maximum amount you can contribute annually, regardless of your age. This limit applies to both traditional and Roth 401(k) plans.

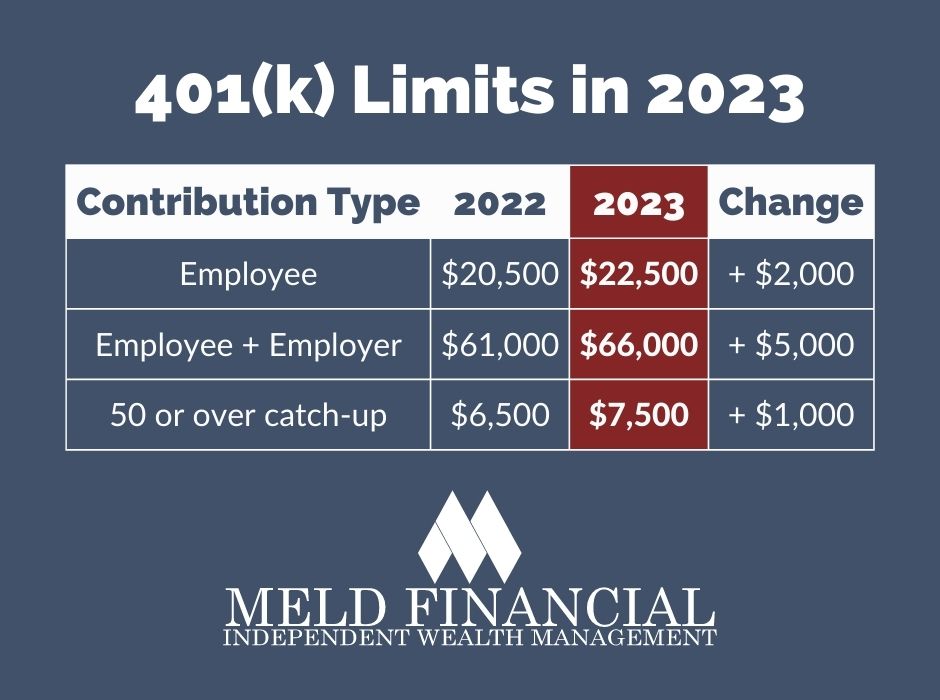

The standard contribution limit for 2024 is $22,500.

Catch-Up Contribution Limit

For employees aged 50 and over, there’s an additional contribution limit called the “catch-up” contribution. This allows older workers to contribute more to their 401(k) plans to make up for lost savings time.

Investment income can have significant tax implications. Use a tax calculator for investments in October 2024 to determine your potential tax liability and plan accordingly.

The catch-up contribution limit for 2024 is $7,500.

Saving for retirement is crucial, and knowing the Roth IRA contribution limits for 2024 for single filers can help you maximize your contributions. These limits are adjusted annually, so it’s essential to stay informed about the latest changes.

Combined Contribution Limit

The combined contribution limit is the total amount you can contribute to your 401(k) plan, including both the standard contribution and the catch-up contribution. This combined limit applies only to employees aged 50 and over.

Tax brackets are adjusted yearly, so you might be curious about what are the new tax brackets for 2024. Understanding these brackets helps you estimate your tax liability and plan accordingly.

The combined contribution limit for 2024 is $30,000.

The W9 form is essential for tax purposes, and non-compliance can result in penalties. Understanding W9 Form October 2024 penalties for non-compliance helps you avoid potential issues and maintain good standing with the IRS.

Benefits of Catch-Up Contributions

Catch-up contributions are a valuable perk for those 50 and older who want to supercharge their retirement savings. This extra contribution room allows you to put away more money each year, potentially boosting your retirement nest egg and securing a more comfortable future.

Increased Retirement Savings and Income, 2024 401k contribution limits for employees over 50

Catch-up contributions can significantly increase your retirement savings, leading to a larger nest egg and potentially a higher retirement income. The extra contributions can compound over time, allowing you to accumulate more wealth than you would with regular contributions alone.

Predicting your tax burden can be helpful for budgeting and financial planning. Check out how much will I pay in taxes in 2024 to get a better understanding of your potential tax liability.

For example, a 50-year-old contributing the maximum amount of $22,500 in 2024, plus the $7,500 catch-up contribution, will have contributed $2,250,000 over 20 years. This amount could grow significantly through investment returns, resulting in a substantial retirement nest egg.

If you’re managing an estate or trust, it’s important to note the tax extension deadline October 2024 for estates and trusts. Filing extensions can provide valuable time for gathering necessary documentation and ensuring accuracy.

Tax Benefits of Catch-Up Contributions

Catch-up contributions offer tax advantages similar to regular 401(k) contributions. They are pre-tax, meaning you won’t pay taxes on the money until you withdraw it in retirement. This can lead to significant tax savings over time, especially if you’re in a higher tax bracket.

For instance, if you are in the 24% tax bracket, contributing $7,500 in catch-up contributions will save you $1,800 in taxes. Over time, these tax savings can add up considerably, further enhancing your retirement savings.

Planning Your Contributions

Planning your 401(k) contributions for 2024 can seem daunting, but it doesn’t have to be. By taking a strategic approach, you can ensure you’re maximizing your retirement savings while maintaining a healthy financial balance.

Married couples have specific Roth IRA contribution limits. Check out Roth IRA contribution limits for 2024 for married couples to make informed decisions about your retirement savings.

Determining Your Contribution Amount

The first step in planning your 401(k) contributions is determining how much you can afford to contribute. This will depend on your income, expenses, and financial goals.

- Start with a budget:Before you start thinking about your 401(k) contributions, it’s essential to create a budget. This will help you understand your income and expenses, giving you a clear picture of how much money you have available for savings.

- Consider your financial goals:Think about your long-term financial goals, such as retirement, buying a home, or paying for your children’s education. These goals will help you determine how much you need to save and how much you can afford to contribute to your 401(k) each year.

While there are limits, it’s possible to contribute more than the standard 401k limit. Learn more about can I contribute more than the 401k limit in 2024 and explore your options for maximizing your retirement savings.

- Factor in your risk tolerance:Your risk tolerance will also play a role in your contribution amount. If you’re comfortable taking on more risk, you may be able to contribute more to your 401(k). However, if you’re risk-averse, you may prefer to contribute less.

Maximizing Your Contributions

Once you’ve determined how much you can afford to contribute, you can start maximizing your contributions. There are several strategies you can use to maximize your savings.

- Take advantage of employer matching:Many employers offer matching contributions to their employees’ 401(k) plans. This means that for every dollar you contribute, your employer will contribute a certain amount, often a percentage of your contribution. This is essentially free money, so it’s crucial to take advantage of it.

For example, if your employer matches 50% of your contributions up to 6% of your salary, you should aim to contribute at least 6% of your salary to maximize this benefit.

- Consider catch-up contributions:If you’re 50 or older, you can contribute an extra $7,500 to your 401(k) in 2024. This can help you catch up on your retirement savings if you’ve fallen behind. However, remember to factor in the potential impact of catch-up contributions on your overall budget and ensure it aligns with your financial goals.

- Increase your contributions gradually:If you’re not comfortable contributing the maximum amount right away, you can increase your contributions gradually over time. Start with a smaller amount and gradually increase it as your income grows. This can make the process less overwhelming and help you adjust to the changes in your budget.

Maintaining a Healthy Financial Balance

While it’s important to maximize your 401(k) contributions, it’s also crucial to maintain a healthy financial balance. This means ensuring you have enough money for your day-to-day expenses, emergency savings, and other financial goals.

Understanding what is the 401k contribution limit for 2024 is crucial for maximizing your retirement savings. This limit is adjusted annually, so staying informed about the latest changes is essential.

- Prioritize your emergency fund:Before contributing to your 401(k), ensure you have a healthy emergency fund. This will help you avoid tapping into your retirement savings if you experience an unexpected financial setback. Aim to have at least 3-6 months of living expenses saved in an emergency fund.

Tax deductions and credits can significantly impact your tax liability. A tax calculator for deductions and credits in October 2024 can help you determine your eligibility and optimize your tax savings.

- Pay off high-interest debt:If you have high-interest debt, such as credit card debt, it’s generally a good idea to pay it off before increasing your 401(k) contributions. This is because high-interest debt can significantly impact your overall financial health.

- Review your budget regularly:It’s essential to review your budget regularly to ensure you’re still on track with your financial goals. This will help you identify any areas where you can cut back or increase your savings.

Impact of 401(k) Contributions on Retirement Planning

The consistent contributions you make to your 401(k) can significantly impact your retirement security. The power of compounding returns over time allows your savings to grow exponentially, building a substantial nest egg for your golden years.

Long-Term Impact of Consistent Contributions

Regular contributions to your 401(k) can lead to substantial wealth accumulation over time. The magic of compounding allows your investment earnings to generate further earnings, creating a snowball effect that accelerates your savings growth.

Looking to maximize your retirement savings? You might be wondering how much can I contribute to my 401k in 2024 after taxes. Knowing the contribution limits and tax implications is essential for making informed financial decisions.

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”

401k contribution limits vary based on your income level. Find out what are the 401k contribution limits for 2024 for different income levels to make the most of your retirement savings plan.

Albert Einstein

Illustrative Table: Potential Growth of Contributions

This table illustrates the potential growth of a $10,000 annual contribution to a 401(k) with an average annual return of 7%:| Years of Contribution | Total Contributions | Account Value ||—|—|—|| 10 | $100,000 | $140,255 || 20 | $200,000 | $408,759 || 30 | $300,000 | $850,746 || 40 | $400,000 | $1,672,741 || 50 | $500,000 | $3,243,398 |As you can see, the longer you contribute, the more significant the impact of compounding becomes.

The mileage rate is frequently adjusted, so you might be wondering is the mileage rate changing in October 2024. Staying up-to-date on these changes ensures you’re using the correct rate for your tax deductions.

Benefits of Starting Contributions Early

Starting your 401(k) contributions early offers a significant advantage due to the power of time. This table demonstrates the impact of starting contributions early versus delaying them:| Scenario | Starting Age | Annual Contribution | Years of Contribution | Account Value at Age 65 ||—|—|—|—|—|| Early Start | 25 | $5,000 | 40 | $1,168,367 || Delayed Start | 35 | $5,000 | 30 | $578,792 |This example highlights the substantial difference in retirement savings potential between starting early and delaying contributions.

The earlier you begin, the more time your investments have to grow and compound.

Married couples have specific IRA contribution limits. Understanding IRA contribution limits for 2024 for married couples helps you maximize your retirement savings as a couple.

Understanding 401(k) Contribution Limits and Other Retirement Savings Options: 2024 401k Contribution Limits For Employees Over 50

Retirement planning is a crucial aspect of financial well-being, and understanding the various options available is essential for maximizing your savings. While 401(k) plans are a popular choice, other retirement savings options exist, each with unique features and tax implications.

If you’re self-employed, it’s crucial to be aware of the October 2024 tax deadline for self-employed individuals. Filing your taxes on time is essential for avoiding penalties and maintaining good standing with the IRS.

This section will delve into the comparison of 401(k) contributions with other retirement savings options like IRAs and Roth IRAs, highlighting the tax implications and guiding you towards choosing the most suitable strategy for your needs.

Comparing 401(k) Contributions with Other Retirement Savings Options

The comparison of 401(k) contributions with other retirement savings options is crucial for determining the most effective strategy for your individual circumstances. Here’s a breakdown of the key differences between 401(k)s, traditional IRAs, and Roth IRAs:

- 401(k): Offered by employers, these plans allow pre-tax contributions, reducing your taxable income. Contributions grow tax-deferred, and withdrawals in retirement are taxed at your ordinary income tax rate.

- Traditional IRA: Individuals can contribute to these plans regardless of employment status. Contributions are tax-deductible, lowering your current tax liability. Withdrawals in retirement are taxed as ordinary income.

- Roth IRA: Contributions are made with after-tax dollars, meaning you don’t receive a tax deduction upfront. However, qualified withdrawals in retirement are tax-free.

Tax Implications for Employees Over 50

Employees over 50 have the advantage of “catch-up” contributions, allowing them to contribute more to their retirement savings. This can be particularly beneficial for those who have started saving later in life or want to accelerate their retirement savings. Here’s how catch-up contributions impact the tax implications of each retirement savings option:

- 401(k): In 2024, individuals over 50 can contribute an additional $7,500 to their 401(k) plan, bringing the total contribution limit to $30,000. These contributions are still pre-tax, reducing your taxable income.

- Traditional IRA: The catch-up contribution limit for traditional IRAs in 2024 is $1,000, bringing the total contribution limit to $7,500. Contributions are tax-deductible, lowering your current tax liability.

- Roth IRA: While there’s no specific catch-up contribution limit for Roth IRAs, individuals over 50 can contribute the same amount as younger individuals, which is $7,500 in 2024. However, contributions are made with after-tax dollars, meaning you don’t receive a tax deduction upfront.

Choosing the Most Suitable Retirement Savings Strategy

Selecting the most suitable retirement savings strategy depends on your individual circumstances, financial goals, and risk tolerance. Here’s a guide to help you make an informed decision:

- Consider your tax bracket: If you’re in a high tax bracket, a traditional IRA or 401(k) might be more advantageous, as contributions are tax-deductible, lowering your current tax liability.

- Anticipate your future tax bracket: If you expect to be in a lower tax bracket in retirement, a Roth IRA might be a better option, as qualified withdrawals are tax-free.

- Evaluate your income: If your income exceeds certain limits, you may not be eligible to contribute to a traditional IRA. However, there are no income limits for contributing to a Roth IRA.

- Assess your risk tolerance: Consider your investment goals and risk appetite. 401(k) plans often offer a wider range of investment options compared to IRAs, providing greater flexibility for managing risk.

- Review your employer’s matching contributions: If your employer offers a matching contribution to your 401(k) plan, it’s highly beneficial to take advantage of this free money.

- Diversify your retirement savings: It’s generally recommended to diversify your retirement savings across multiple accounts. This can help mitigate risk and potentially enhance returns.

Last Point

By taking advantage of the increased 2024 401(k) contribution limits for those over 50, you can significantly enhance your retirement savings. Remember, every dollar you contribute today can grow exponentially over time, creating a more secure and comfortable retirement.

Don’t miss out on this valuable opportunity to boost your financial future.

FAQ Corner

Can I contribute to both my 401(k) and a Roth IRA?

Yes, you can contribute to both a 401(k) and a Roth IRA, provided you meet the income eligibility requirements for the Roth IRA. However, keep in mind that your total contributions to both accounts may be subject to overall contribution limits.

How do catch-up contributions affect my taxes?

Catch-up contributions are treated the same way as regular 401(k) contributions for tax purposes. They are pre-tax contributions, meaning you won’t pay taxes on them until you withdraw the money in retirement.

Can I make catch-up contributions even if I haven’t contributed to my 401(k) in previous years?

Yes, you can make catch-up contributions in any year you turn 50 or older, even if you haven’t contributed to your 401(k) in the past. There’s no requirement to have contributed in previous years to be eligible for catch-up contributions.

What happens to my catch-up contributions if I leave my job before retirement?

Your catch-up contributions remain part of your 401(k) account, even if you leave your job. You can roll them over to an IRA or another qualified retirement plan, or you can leave them in the plan if it allows.